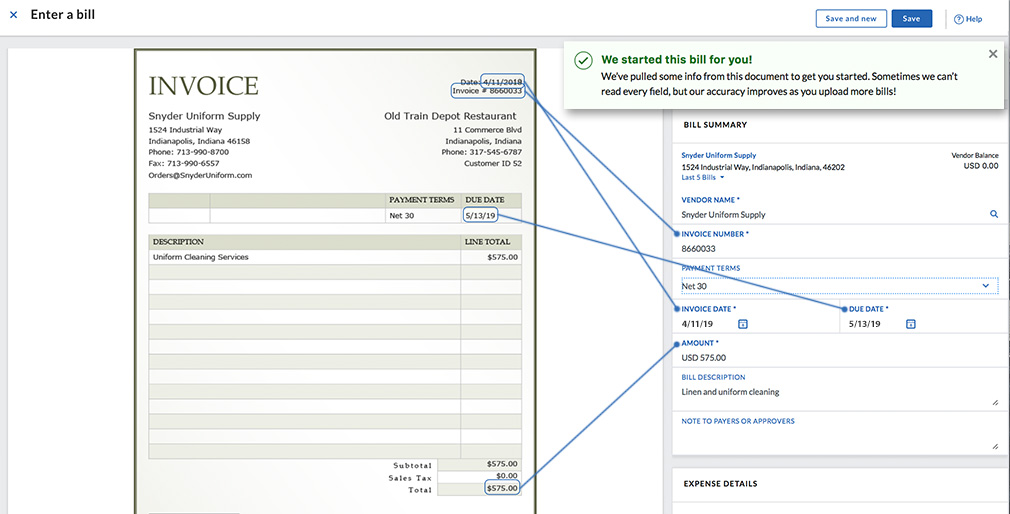

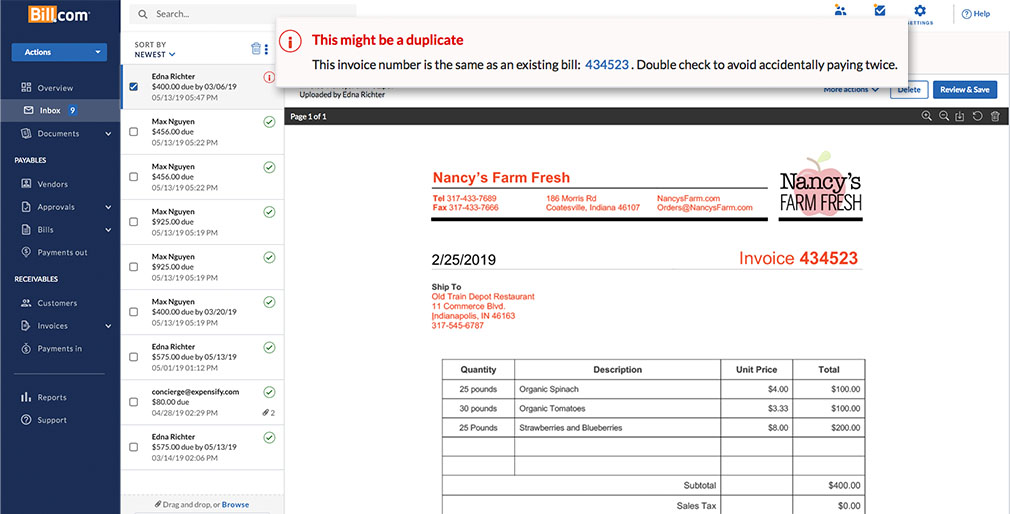

Financial process automation innovator Bill.com has launched its new Intelligent Business Payments platform, a solution that puts AI to work to bring end-to-end automation to financial workflows. The platform leverages its Intelligent Virtual Assistant capacities to automatically capture data from invoices and start the approval process, as well as recognize workflows, and create new business rules.

The new solution also drives payment flexibility, enabling international payments, virtual cards, and other options to accelerate the payment process; and supports auto pay for recurring bills.

“Our new intelligent platform, which is the most significant update to Bill.com since its inception, is built on ten years of experience managing business payments and hundreds of millions of bills and invoices to train the AI,” Bill.com CEO and founder Rene Lacerte said. “Increasing the speed and ease of payments will help businesses get ahead.”

The company said that customers in a recent survey reported averages weekly savings of 5.5 hours, more than 35 business days a year, using Bill.com’s process automation solution. In a statement noting that many companies spend nearly a quarter of the work day managing manual processes, Bill.com suggested there was a growing need for work flow automation technology.

“Bill.com has focused on developing new technologies that help SMBs grow,” Lacerte said. “Automating the back office is a huge industry-wide need.”

The company’s latest announcement comes a little over a month since it picked up $88 million in new funding in a round led by Franklin Templeton. The investment boosted Bill.com’s total capital to $275 million, and puts the company’s valuation above $1 billion. Also this year, Bill.com teamed up with American Express to offer a new AP solution, VendorPay for the firm’s business and corporate cardholders.

Founded in 2006 and headquartered in Palo Alto, California, Bill.com demonstrated its CashView Command and Control system at FinovateSpring 2012. The technology helps businesses better manage their accounts payables and receivables, and provides online billpay, custom invoicing, unlimited document storage, collaboration tools, and mobile access.

With more than $60 billion in payments managed every year and a network of three million members, Bill.com works with 70+ of the top 100 accounting firms, as well as accounting software providers like NetSuite and fellow Finovate alum Xero. The company is also CPA.com’s preferred provider of digital payments.