I’ve been following First Tech Federal Credit Union since my days as a Seattle-based banker. They were quite the thorn in our side, attracting all the Microsoft employees despite our integration with Microsoft Money.

Fast-forward two decades and the credit union is still going gangbusters, nearing $10 billion in assets and 425,000 members. Its latest coup was to nab a coveted “Best of” award from MONEY (aka Money Magazine). The publisher named First Tech The Best Credit Union for Everyone in its annual review of the best banks. First Tech was the only credit union mentioned. TD Bank and US Bank tied for Best Big Bank. Chase was named Most Convenient and First Internet Bank received top honors in the Online Bank category with Ally receiving an honorable mention.

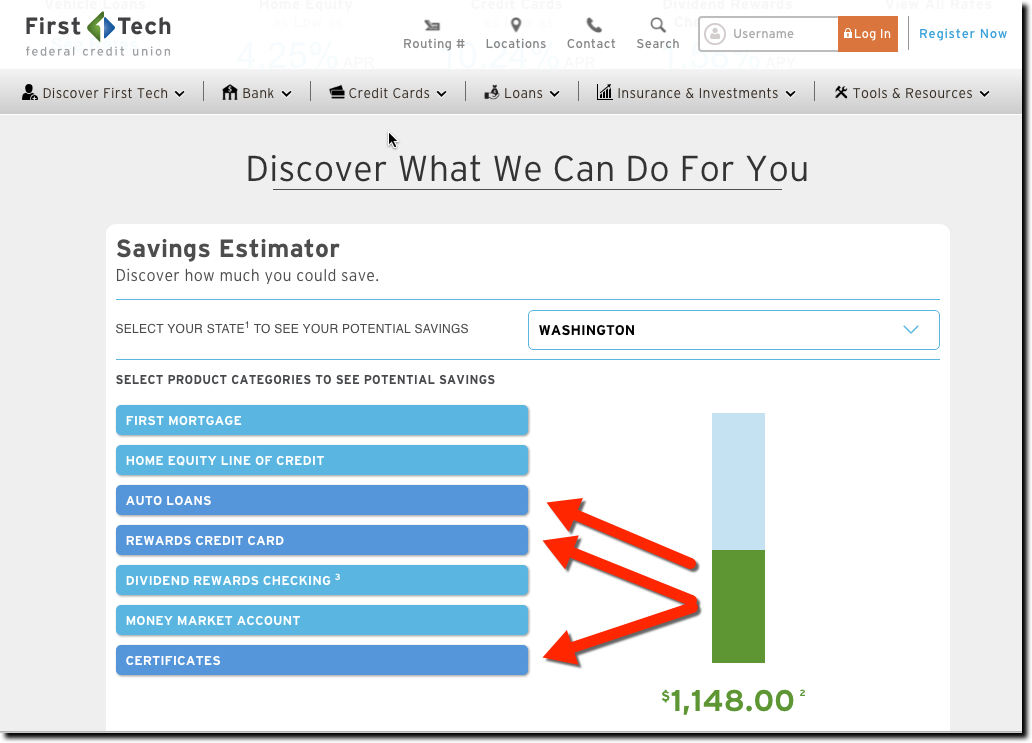

Naturally, I headed over to First Tech to see for myself what had so impressed the Money editors, aside from great pricing. The CU has a bright and modern desktop site (although they still have some work to do on mobile). I especially loved the sales tool on the homepage (see below). The prospective member chooses their products, and the cumulative savings is shown on the right. It’s one of the best sales tools I’ve ever seen, although I would like to see a little more transparency on how the numbers were calculated.

Bottom line: Consumers consistently rate switching banks as one of their least favorite tasks. To get someone to budge, you must get their attention with clear benefits. And if you are a low-cost, high-APY FI, there is no better way to do that than flaunting your money-savings benefits.