Eko Founder and CEO Mart Vos doesn’t care if you call his company “echo” or “eco.” But what he does care about is making it easier for community banks and credit unions to offer easy-to-use investment solutions to their customers and members—before they become enamored of the offerings by the new crop of digital investment brokers and platforms.

“I’m from the Netherlands,” Vos said to the FinovateFall 2025 audience last month in New York. “Back in the Netherlands, everybody invests their money with their trusted bank. And maybe it sounds weird. But to me, it’s very normal. If I want to invest my money, I’m going to go with a place that I know and trust. I know my bank. I trust my bank. So where else am I going to go than my trusted bank?”

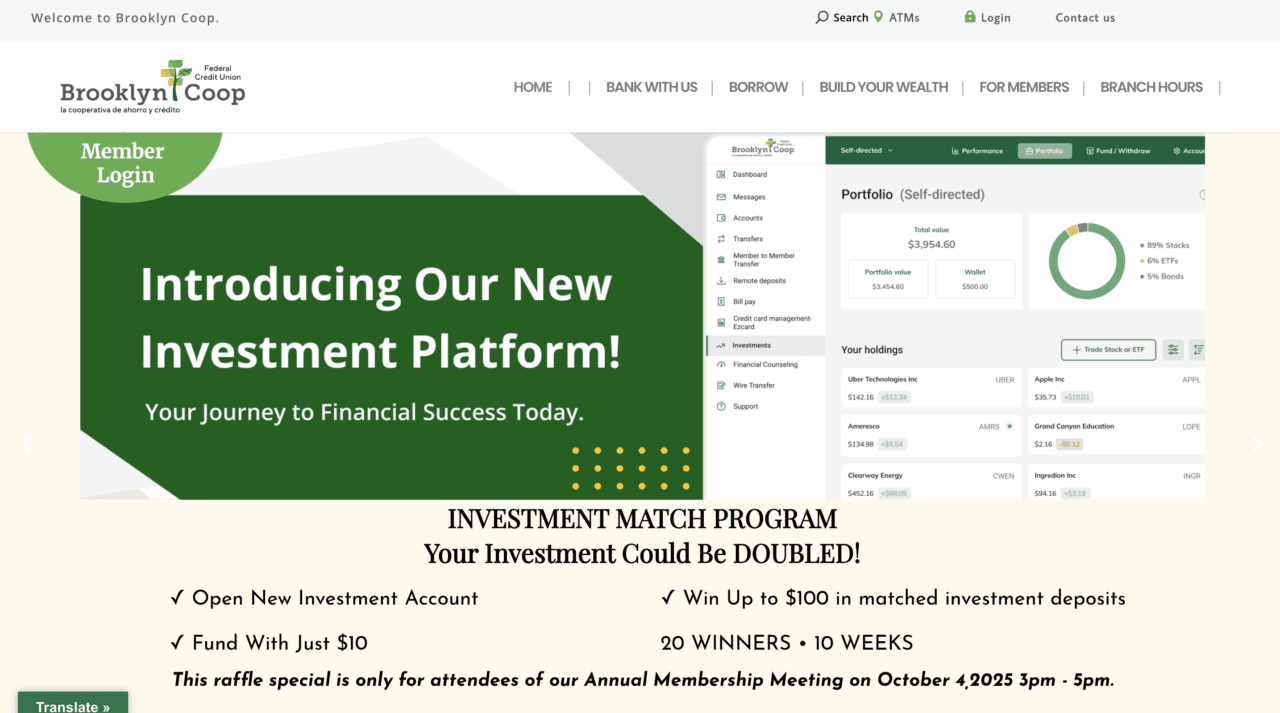

This is the lens through which to view Eko’s latest partnership announcement, teaming up with the Brooklyn Cooperative Federal Credit Union. The partnership, announced last week, will enable Coop members to invest directly from their credit union’s platform. Members can start with as little as $10 and investment services are available in both English and Spanish. A certified CDFI (community development financial institution) and a Minority Depository Institution, Brooklyn FCU began operations in 2001 and serves central and eastern Brooklyn communities such as Bushwick, Bedford-Stuyvesant, and Crown Heights. The credit union is the third largest in its county, despite its relative youth, and currently has more than 7,200 members and $50 million in assets.

In a statement on LinkedIn, Vos noted that the full integration of Eko’s “one-stop investments shop” was completed in three weeks. Coop members will benefit from a seamless, integrated investing experience that sits within their current digital banking portal and/or app, flexible portfolio options including pre-built and hybrid investment pathways, and low barriers to entry with a streamlined onboarding process and the ability to start investing with as little as $10. The partnership news follows Eko’s second consecutive Best of Show win at FinovateFall (the company won its first Best of Show award at FinovateFall 2024), as well as recognition as “Best Fintech” at the Tennessee Credit Union League annual conference.

“This launch feels extra special to me personally: Brooklyn Coop is literally the credit union next door here in New York! Really proud to support Brooklyn Coop in making investing simple, affordable, and accessible for all members,” Vos said.

An embedded investment platform for banks and credit unions, Eko won Best of Show in its Finovate debut at FinovateFall 2024 and won again the following year at FinovateFall 2025. Headquartered in New York and founded in 2021, the company’s white-label solution integrates directly into digital banking infrastructures to enable customers and members to invest in pre-built portfolios, IRAs, cryptocurrencies, and more, as well as engage in hybrid investing and self-directed trading.

In its most recent Finovate appearance, the company demonstrated how its embedded AI assistants support investors by answering financial planning questions, providing investment research, and helping with tasks like setting up recurring deposits and rebalancing portfolios.

Photo by Francesco Gallarotti on Unsplash