Players in the crowdfunding space have a lot of headaches in order to maintain compliance, especially since the SEC requires that parties who invest in offerings on crowdfunding platforms must be fully accredited. That is, they must meet one of the following two requirements:

1) Have earned $200,000/ year in both of the past two years (or $300,000 with spouse) and expect to earn the same next year

2) Have a net worth of $1 million (excluding primary residence)

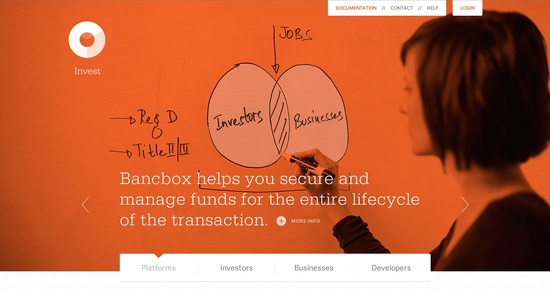

BancBox, a company known for its money-moving APIs, is seeking to remove this barrier for players in the crowdfunding industry with its new API that will verify the accreditation of investors.

The API is a part of the BancBox Invest service. It will enable crowdfunding platforms to determine if their investors are accredited and legally allowed to invest in the platform. In order to comply with the SEC’s 506(c) standard, the new API will:

The API is a part of the BancBox Invest service. It will enable crowdfunding platforms to determine if their investors are accredited and legally allowed to invest in the platform. In order to comply with the SEC’s 506(c) standard, the new API will:

1) Verify income. This includes a review of the investor’s IRS documents (W-2s, 1099s, K-1s, 1040s) for the past two years and an additional confirmation that they expect to qualify in the current year.

2) Have a third party verify income (releasing in April): Third party verification must be received from a CPA, attorney, broker dealer, SEC-registered investment advisor or an equivalent entity.

3) Verify assets (releasing in May): An investor must have a net worth of at least one million dollars, excluding the value of their primary residence.

Combined with other features that the Invest service offers, the API will give private placement and equity/debt-based crowdfunding platform owners a full suite of solutions.![]()

Check out BancBox’s demo from FinovateSpring 2012 where it debuted its payments platform.