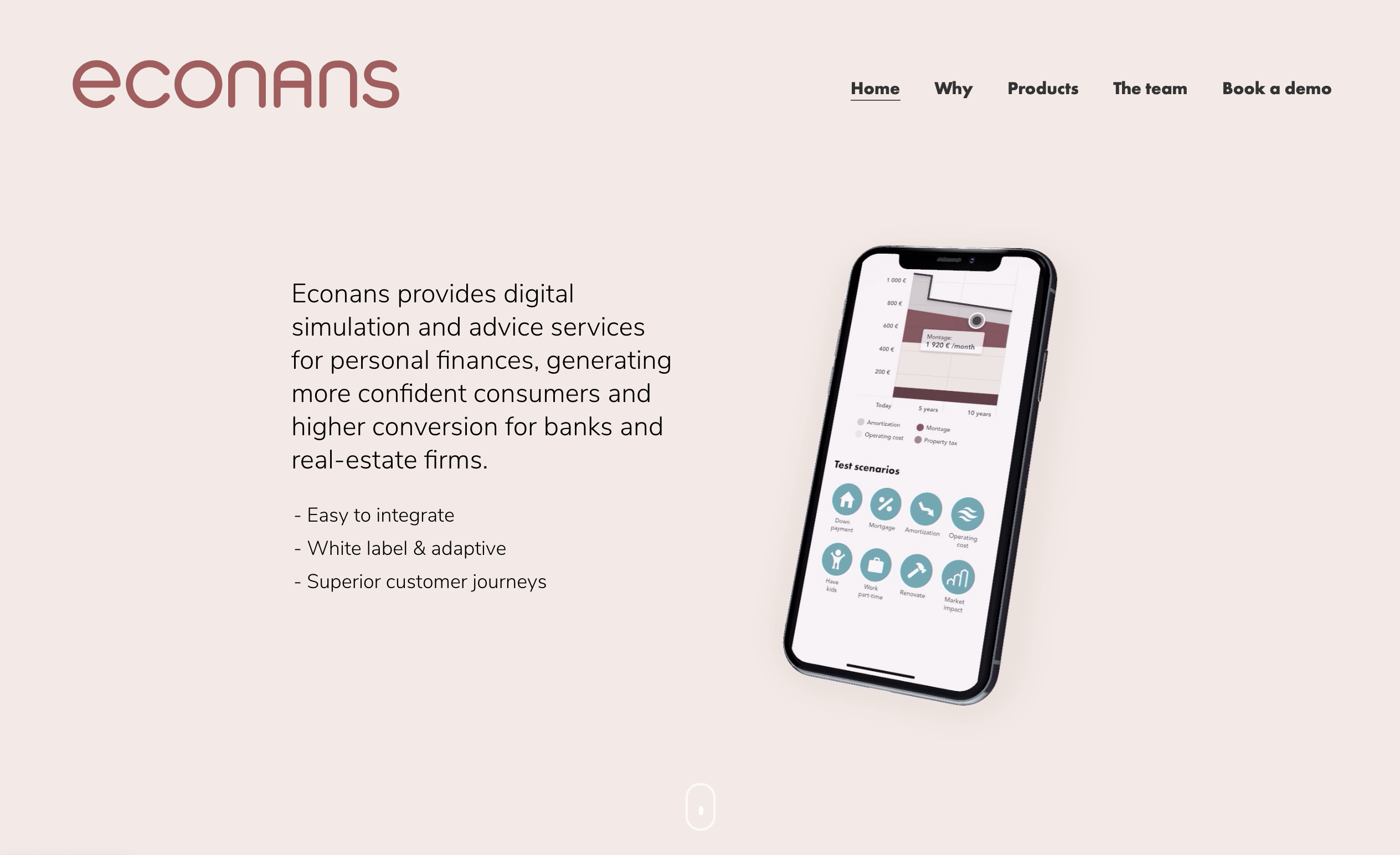

ITSCREDIT‘s innovative solution helps banks’ customers, who are struggling more with their monthly installments due to the Covid-19 crisis, by restructuring their active loans.

Features

- Manage an individual’s financials

- Simply restructure credit

- Restructure loans to avoid arrears

Why it’s great

The Genie Advisor restructures loans to improve a customer’s financial life and helps him or her avoid arrears.

Presenters

Sofia Augusto, Marketing Manager

Augusto has been working in the marketing industry since 2014, and in November 2018, she became ITSCREDIT’s Marketing Manager, developing several projects like branding the company.

LinkedIn

Marco Sousa, International Business Developer

Sousa has been working in the management industry since 2007, and in August 2019, he became ITSCREDIT’s Business Developer, focusing on international business development with clients and partners.

LinkedIn