A look at the companies demoing at FinovateEurope in London on March 14. Register today and save your spot.

ebankIT enables banks and credit unions to future-proof their digital strategy and to offer a proactive, interactive, and consistent experience through every banking channel.

Features

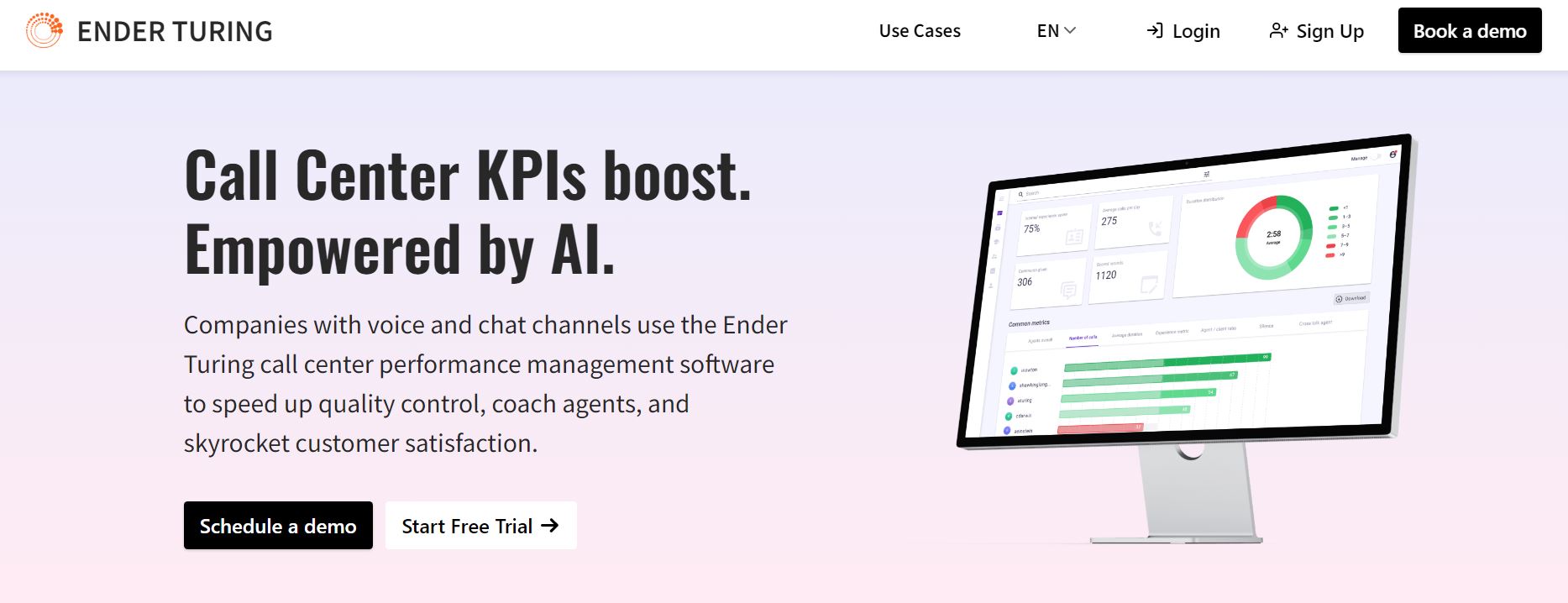

- Includes a new tool to anticipate clients’ needs

- Provides back-office ratings of each user experience

- Uses data so banks know the best way to address each customer

- Alerts clients when a bug is solved and why it happened

Why it’s great

A tool that assesses the banking app performance of each client and uses that data to give customers an experience tailored to their unique needs and past experiences. That’s what ebankIT does.

Presenters

Pete Atkinson, VP of Global Sales

Atkinson has spent much of his career working at the convergent point of technology, business, and consumers. He is VP of Sales at ebankIT and for the last 15 years has helped FIs to digitally transform.

LinkedIn

Joana Lucas, Sales Development Representative

Lucas is a financial industry enthusiast, experienced in Financial Markets, Banking, and Fintech space. Her current mission: Help FIs humanize their digital banking worldwide via ebankIT´s omnichannel capabilities.

LinkedIn