A look at the companies demoing at FinovateSpring in San Francisco on May 18 and 19. Register today and save your spot.

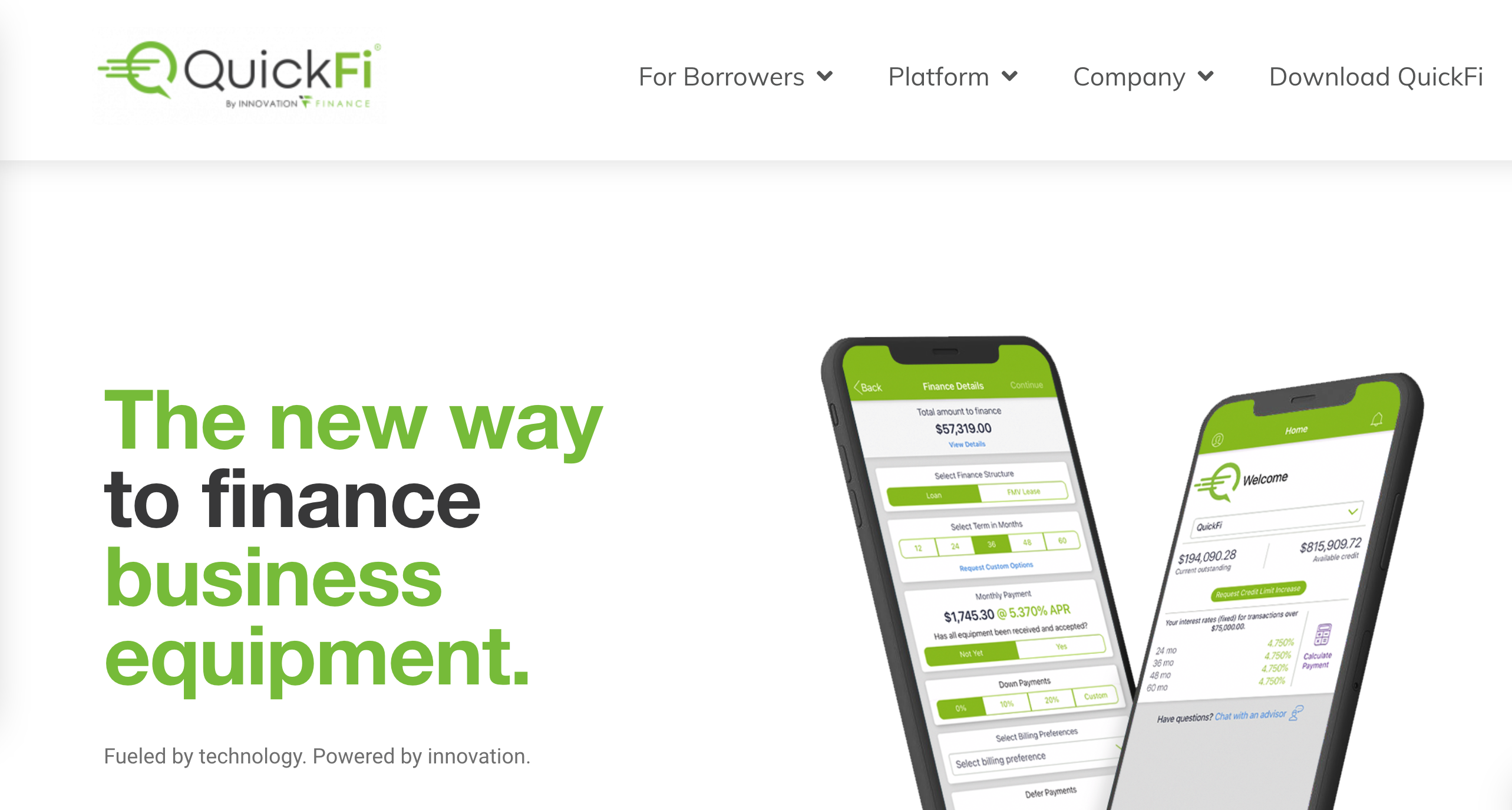

QuickFi is a 100% digital, self-service, mobile equipment financing platform. QuickFi employs facial recognition, drivers’ license authentication, AI/ML, blockchain, and other advanced technologies.

Features

- SPEED: QuickFi allows financing in minutes, not days or weeks.

- COST: QuickFi costs 2/3 less vs. traditional lending.

- TRANSPARENCY: Low, fixed rates without hidden costs.

Why it’s great

QuickFi is available 24/7/365, and QuickFi also offers borrowers live support (via chat or telephone) anytime of the day or night (also 24/7).

Presenters

Nate Gibbons, Chief Operating Officer

Gibbons was a VP of Operations at First American Equipment Finance before becoming one of the founders of QuickFi. He oversees the customer experience strategy at QuickFi.

LinkedIn

Jillian Munson, Technology Product Manager

Munson graduated from Oswego State College with a degree in Computer and Information Science. Prior to joining QuickFi, she was a Systems Analyst at First American Equipment Finance.

LinkedIn