By the end of 2017, fintech investments in the Middle East are expected to have grown by 2.7x. As governments and financial leaders diversify away from a petroleum-based economy, the focus is on fintech.

But who will capitalize on this ecosystem of fintech innovation? Foreign brands like Amazon (who acquired Middle Eastern e-commerce firm, Souq.com, earlier this year), local powerhouses like Kingdom Holding Company (who recently led Uber-esque Careem’s Series E funding) or both?

Either way, the message is clear: Look to the Middle East for fintech investment opportunities, acquisitions, partnerships, inspiration and competition. And there’s no better place to start than Finovate in February 2018.

Finovate’s signature 7-minute demos will remain at the core of FinovateMiddleEast with dozens of companies showcasing their latest fintech innovations live on stage. Here’s the first wave of demoing companies to check out. The event will take place February 26 and 27:

CASHOFF — A service for collecting and analyzing consumers’ financial data that gives banks complete knowledge about consumers (online banking, PFM, scoring, sales, loyalty).

Dorsum — A chatbot platform that improves the difficulties of customer acquisition for financial institutions.

ebankIT — An omnichannel banking platform that enhances digital transformation for banks and financial institutions.

Everus Technologies — Offers Everus World, a product that fosters fintech challenges, convenience, and public education and awareness for millennials, traders, and gamers.

Innofis — Provides Bank Virtual Assistant, a platform that uses natural language, artificial intelligence, and analytics to create frictionless interaction and sales efficiency.

Moven — A financial wellness platform targeting declining branch revenue for banks around the world.

Munnypot — An automated online solution providing accessible and affordable investment advice for millions of people in the U.K. and overseas.

NymCard — Offers smart mobile technology providing an alternative to the limited capabilities of digital payment products for the banked and underbanked population in MENA.

Ondot Systems — Provides mobile card services supplying financial institutions, card processors and cardholders with mobile applications for credit and debit card control.

Quisk — A payment network breaking up the exclusivity of current mobile payment technologies for anyone with a mobile phone (not just a smartphone).

RISQ — A financial software platform improving the effectiveness of corporate loan acquisition and customer management for commercial banks.

SwipeStox — A social network for stock trading that cuts through the complexity around financial investing for newbie and professional investors.

Wealth Migrate — A global, direct investment platform remedying the lack of direct investment products for middle class, overseas investors.

W.UP — Offers Sales.UP, a digital banking sales and engagement tool that meets financial institutions’ need of customer insights and personalised automated marketing campaigns.

Additional companies will be announced over the next couple months.

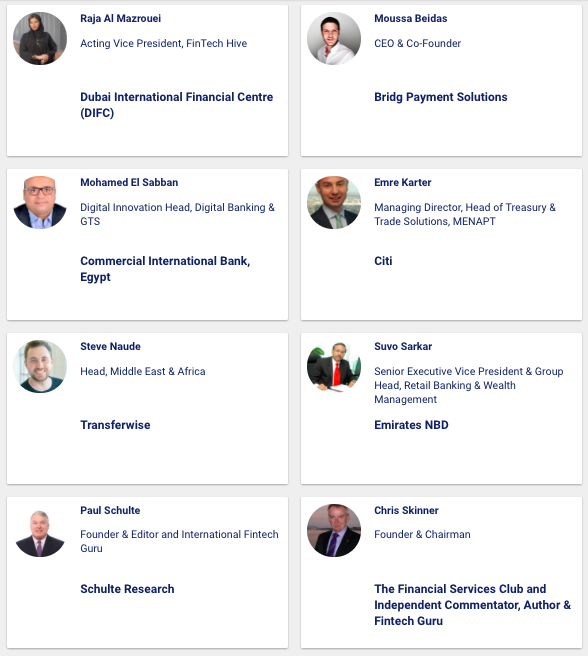

Through the expanded Finovate model, the Dubai debut will also feature fast-paced, short-form discussions from industry leaders. Content-driven panels, regulatory perspectives, and world-class keynotes will address themes and topics relevant to the MENA market and broader economy as well.

See the agenda, and stay tuned — new speakers are added weekly.

Save $200 when you register for FinovateMiddleEast by October 26.

PARTNERS

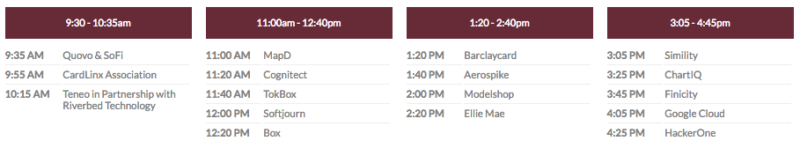

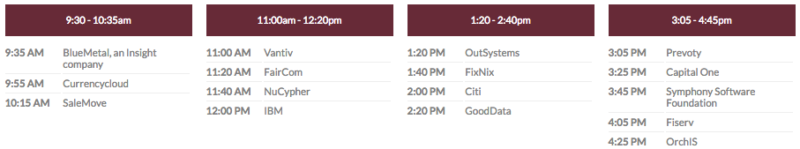

The event kicks off at 9:30AM on both March 21 & 22 (breakfast is available the hour before). 15-minute TED-style presentations with short Q&A sessions run throughout the day, and the longer networking happy hour gives attendees the chance to dive deeper into the content seen on stage.

The event kicks off at 9:30AM on both March 21 & 22 (breakfast is available the hour before). 15-minute TED-style presentations with short Q&A sessions run throughout the day, and the longer networking happy hour gives attendees the chance to dive deeper into the content seen on stage.

Where did you start your career and how did you gain the experience needed to run the tech side of your company?

Where did you start your career and how did you gain the experience needed to run the tech side of your company?

An electrical and computer engineer by training, my first job was at AT&T Bell Labs where I worked on one of the earliest methods for web-based payments. Since then, I have authored over fifteen granted or pending patents in the fields of digital commerce, electronic payments and payments analytics. My work in the business side of payments informed the direction of the technologies I pursued. These leadership positions included my time at ABN AMRO Investment Bank in London, where I was Director and Head of Financial Technology Investment.

An electrical and computer engineer by training, my first job was at AT&T Bell Labs where I worked on one of the earliest methods for web-based payments. Since then, I have authored over fifteen granted or pending patents in the fields of digital commerce, electronic payments and payments analytics. My work in the business side of payments informed the direction of the technologies I pursued. These leadership positions included my time at ABN AMRO Investment Bank in London, where I was Director and Head of Financial Technology Investment. Consumer spending makes up 70% of the US economy. 90% of that spending occurs in stores not online. Card-linking enables companies to link a consumer’s online data with their in-store shopping. We are excited to announce to the fintech industry the first open source card-linking software.

Consumer spending makes up 70% of the US economy. 90% of that spending occurs in stores not online. Card-linking enables companies to link a consumer’s online data with their in-store shopping. We are excited to announce to the fintech industry the first open source card-linking software.

I’m a software engineer at heart but started my career at Morgan Stanley where I advised technology, media, and telecommunications companies on M&A and equity/debt financings. I spent a lot of time covering internet infrastructure

I’m a software engineer at heart but started my career at Morgan Stanley where I advised technology, media, and telecommunications companies on M&A and equity/debt financings. I spent a lot of time covering internet infrastructure From a technologist’s perspective, what’s unique and game-changing about your technology?

From a technologist’s perspective, what’s unique and game-changing about your technology? I began work at

I began work at