FinovateEurope 2026 takes place in London on February 10 and 11. Register to attend and save up to £400.

FinovateEurope is returning to London in February, spotlighting the latest in fintech innovation.

The exceptional lineup of 30+ cutting-edge demos and 1,000+ senior-level attendees—including an impressive 600+ from banks and other financial institutions—makes FinovateEurope a must-attend event.

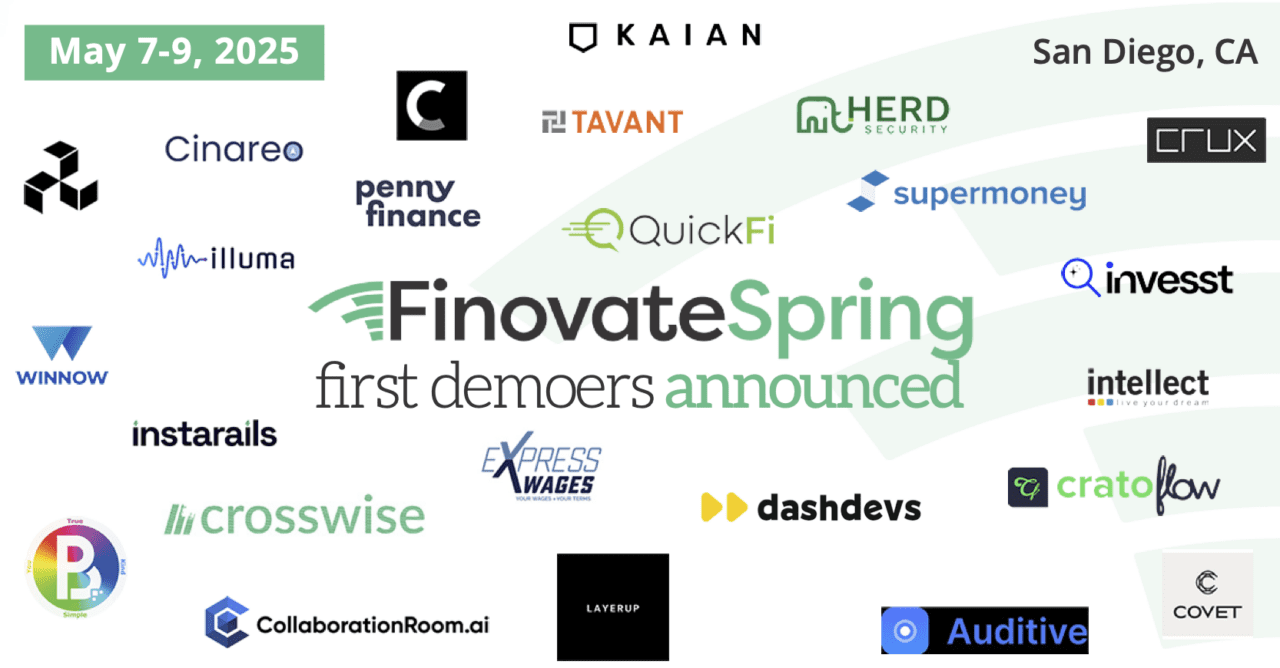

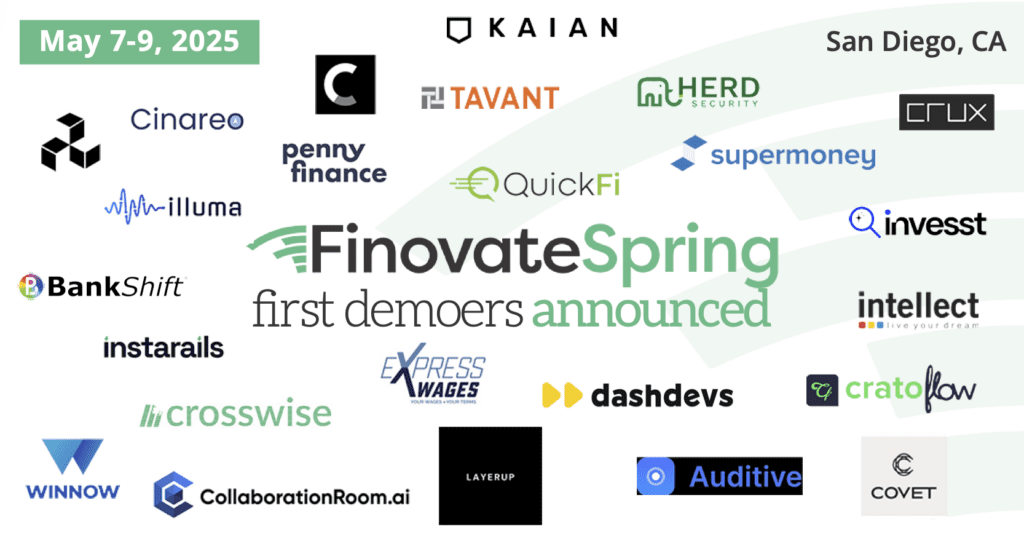

This year’s demo lineup showcases the key trends driving change across the financial services sector and the innovative technologies bringing them to life. Here’s an early look at the first wave of companies taking the stage:

Stay tuned for more announcements as we reveal the next wave of innovators in the coming weeks!

Interested in demoing? Applications are still open!

FinovateEurope is the perfect platform for organizations driving innovation in financial services—whether you’re a startup, bank, public entity, or established leader. Demoing offers unparalleled exposure, including:

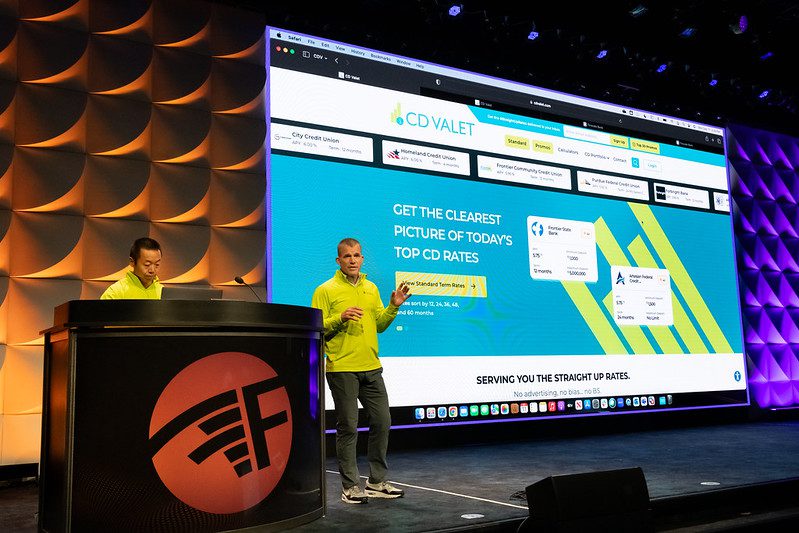

- 7-minute demo slot on the main stage

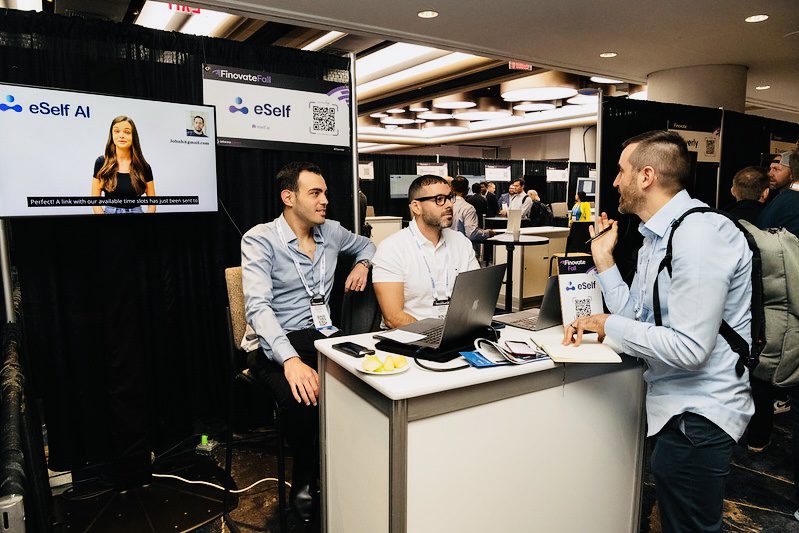

- A plug-and-play exhibit hall stand

- Speaker passes and lead generation reports

- Coaching calls with Finovate’s host and resident expert

- Marketing and media coverage

Don’t miss the chance to kick off 2026 with a strong pipeline of leads and high ROI. Apply now to secure your spot.