We reported earlier this year that cloud-based digital banking solutions provider Alkami was heading toward an IPO. Today, the Texas-based company has confirmed rumors.

Alkami will to list on the NASDAQ under the ticker symbol ALKT, launching 6,000,000 shares of common stock. Shares will be priced between $22 and $25. The company believes it will to raise up to $250 million via its IPO, which would value Alkami at $3 billion.

“We currently expect to use the net proceeds from this offering, together with our existing cash and cash equivalents, to finance our growth, develop new or enhanced solutions, and fund capital expenditures,” the company said in a statement.

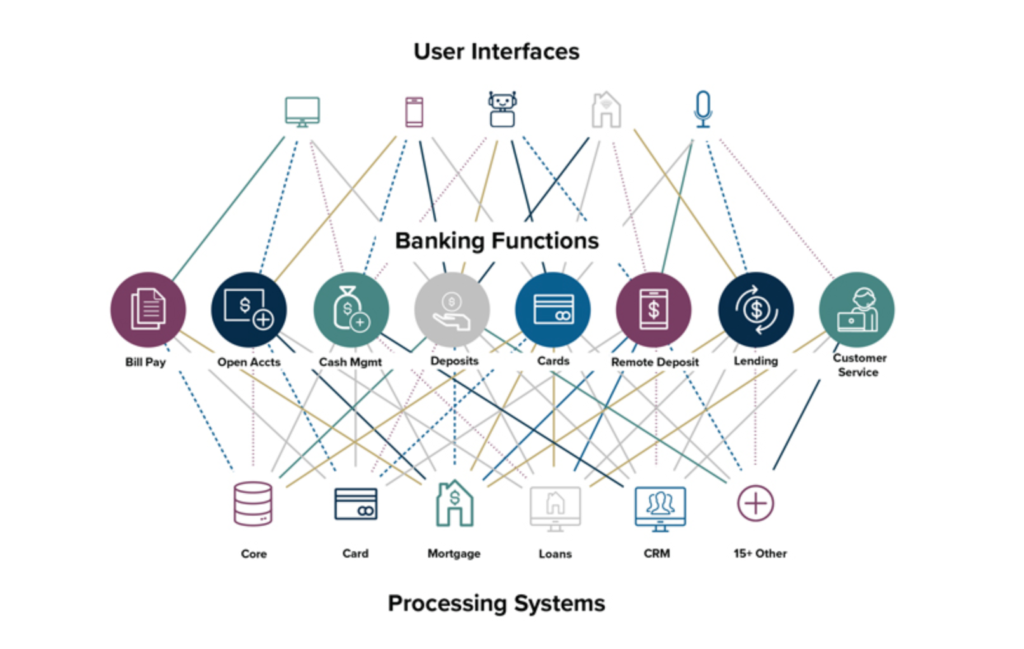

Alkami offers solutions for both retail and business banking. The subscription-based offerings include tools for money transfer capabilities, financial wellness, customer service, security, and more. And because the company is built on an open platform, banks can leverage third party solutions to customize their offerings even further.

According to Alkami’s S-1 document filed with the SEC, the company saw revenues of $112 million last year, representing a 150% increase over 2019 revenues. Alkami has received more than $385 million from nine investors, including Franklin Templeton Investments, Fidelity Management and Research Company, and D1 Capital partners.

Founded in 2009 as iThryv, Alkami counts 151 bank clients representing 9.7 million end users. Mike Hansen is CEO.

Photo by Meriç Dağlı on Unsplash