A look at the companies demoing at FinovateFall in New York on September 12 and 13. Register today and save your spot.

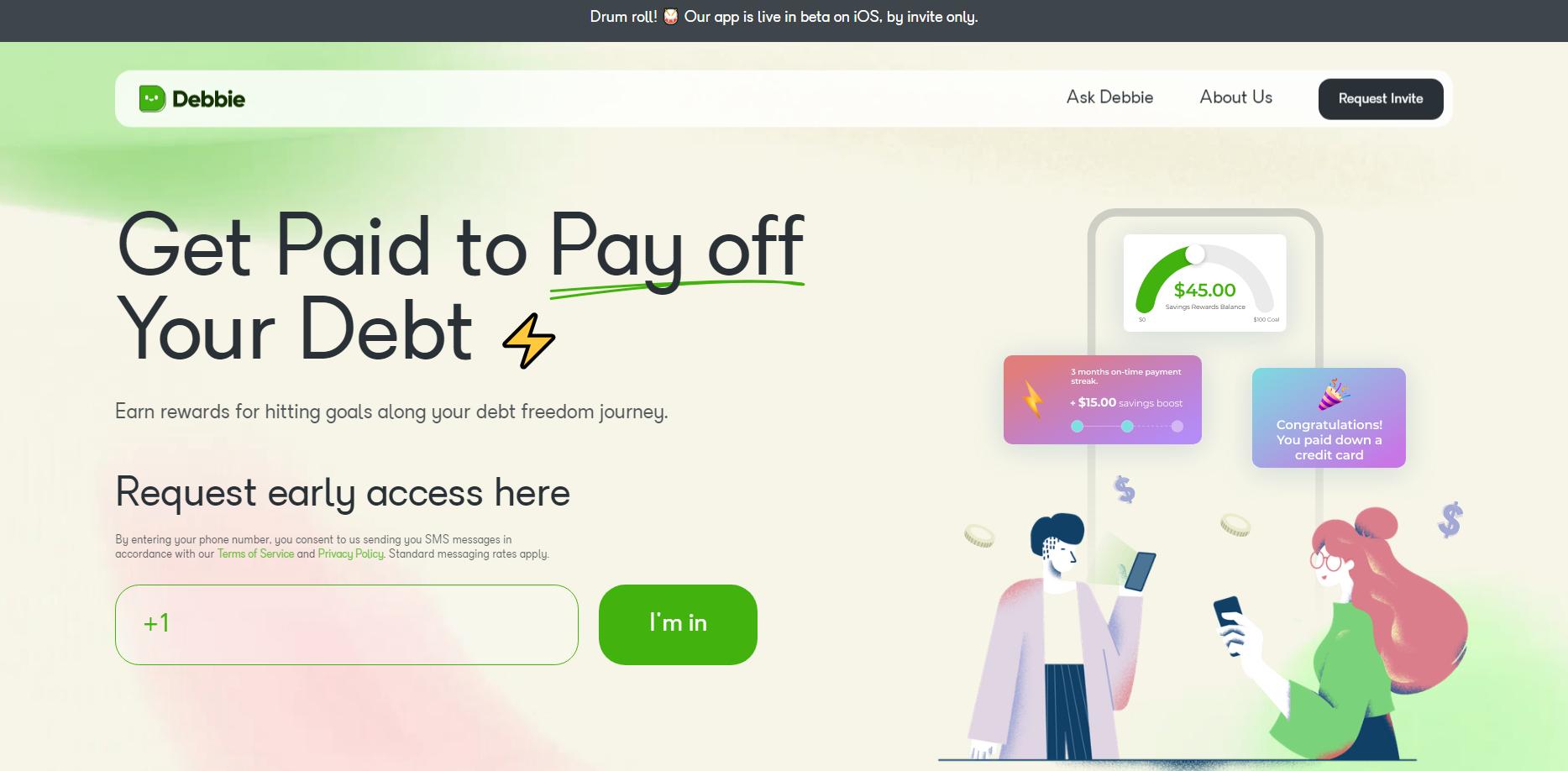

Debbie is the Noom for debt loss, utilizing behavioral psychology and rewards to motivate and incentivize people to crush their debt, for good.

Features

- Utilizes behavioral psychology through a guided debt loss program to help users unwind habits

- Provides time trended credit data to pre-qualify users for refi

- Offers users micro-rewards for improved behavior

Why it’s great

Debbie users pay down on average $450/month of debt, while setting aside savings of $100/month consistently. For folks in $5k-$10k of debt who are making $50k/year, this is significant.

Presenters

Frida Leibowitz, CEO

Ex-Credit Risk at Marcus by Goldman. Immigrant, first-gen student from a single parent home. Passionate about financial security because she’s experienced crushing debt while attending NYU.

LinkedIn

Rachel Lauren, COO

Former VC at BDMI and software equity research analyst at Credit Suisse. Passionate about financial behavior after seeing her family struggle with money management and financial shame.

LinkedIn