A new challenger bank launched this week with the goal of serving the needs of Latin American consumers in the U.S. Built on Galileo’s payment processing platform, Miami, Florida-based Fortú is dedicated to providing culturally-contextual financial and banking services to the country’s growing Latino and Hispanic populations.

Fortú co-founders Charles Yim and Apoio Doca bring a combination of Big Tech savvy and global neobanking experience to the task of better serving the 22% of Hispanic adults who, according to the Federal Reserve, are underbanked. Yim is a former Amazon Web Services and Google executive with a background in business development and partnerships. Doca helped build a pre-smartphone era digital bank based in Brazil called Lemon Bank that was acquired by Banco do Brasil.

The Fortú team features both first and second generation immigrants with family ties to many of the largest Spanish-speaking countries in Latin America. Together they bring this experience to the cause of helping others negotiate the unique challenges many Latinos and Hispanics face when banking in the U.S.

“Compared to other demographics, Latinos in the U.S. are more likely to live in multigenerational and multilingual households, with a significant percentage needing to send regular cross-border remittances, leading to an over-reliance on non-bank financial services,” Doca said. He added that financial barriers for Latinos and Hispanics can range broadly from a lack of non-English language services to more mundane annoyances like the tendency to randomly truncate Latino names – many of which do not fit within the 24-character embossing standard used by most financial institutions.

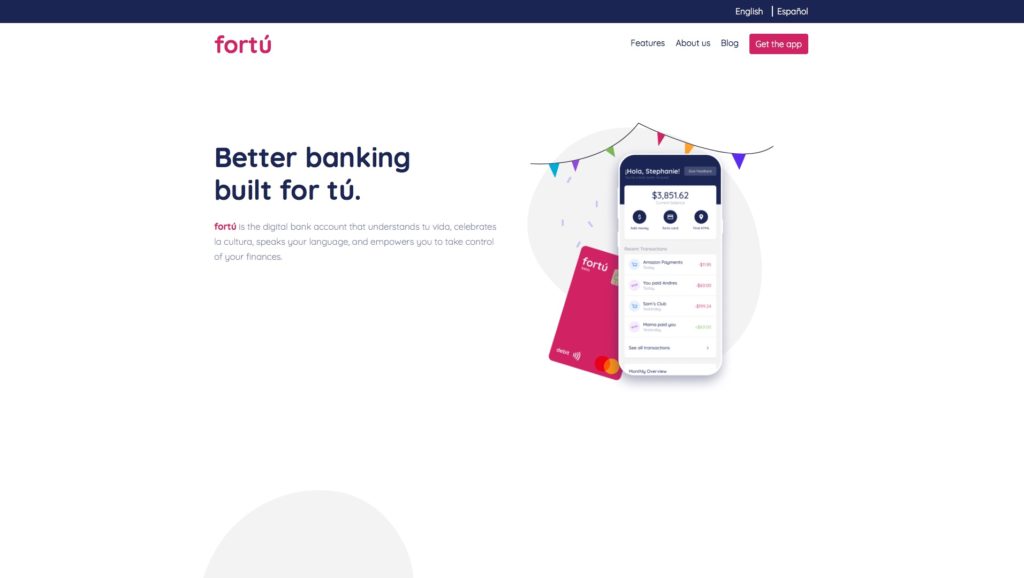

Fortú offers a digital bank account that can be opened without needing a social security number; a Mastercard debit card; fast, no-hidden-fee international transfers (courtesy of a partnership with Finovate alum Wise), as well as the ability to deposit cash at more than 100,000 retail locations like CVS and Walmart, and make free cash withdrawals at more than 55,000 Allpoint ATM locations.

“By creating products to answer the needs of Latinos, who are more likely than the general population to be under- and unbanked, Fortú has set itself apart from other neobanks, while transforming financial wellness for the Latino community,” Galileo CEO Clay Wilkes said.

Fortú has raised $5 million in funding from Valar Ventures and other investors. The fintech’s banking services are provided by LendingClub Bank.

Photo by Sudipta Mondal from Pexels