Here in the U.S., it’s tax season. And even though the IRS has extended the filing deadline by a few weeks, it’s still a stressful time for both individuals and businesses. In an era of changing benefits, everyone is on the lookout to minimize their tax burden.

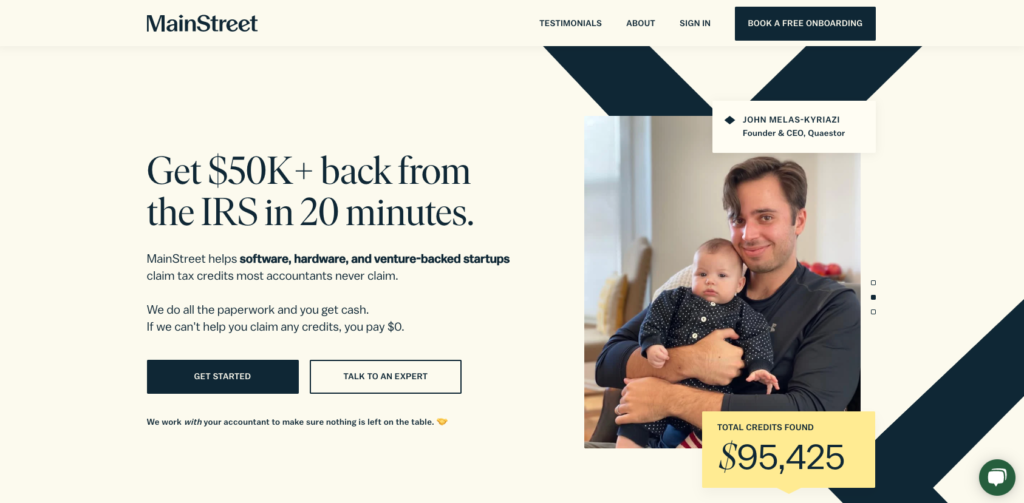

Enter MainStreet, a company founded in 2019 that helps qualify tech startups for tax credits that most accountants don’t check for. The California-based company works with startups’ accountants to check for more than 200 potential unclaimed tax credits.

MainStreet works by integrating the startups’ payroll and scanning the data on a monthly basis for potential federal, state, and local tax credits. If MainStreet finds a tax credit, the company will advance 80% of the credit amount to the startup so that they can use the funds right away instead of waiting on their tax refund. The client is responsible for repaying that amount, with no interest incurred, after they receive their credit from the government.

MainStreet does not charge a fee for this monthly service. Instead, the company keeps the remaining 20% of the startups’ tax credit amount. However, MainStreet only receives payment if it successfully finds a refund for the client.

In the event of an audit, MainStreet offers support through the auditing process. And if MainStreet makes an error with the paperwork or credit claim, the client is insured for up to $1 million.

So far, MainStreet has found more than $80 million for over 1,000 startups. The company’s clients include Rally, Newfront Insurance, LedgerX, Pave, and more.

In the long term, MainStreet plans to expand its operations beyond serving tech startups to include small businesses, as well.

MainStreet has received almost $63 million from investors including Gradient Ventures, Sound Ventures, and Signal Fire.

Photo by Liza Rusalskaya on Unsplash