Today we feature a sponsored post from Celfocus. Henrique Cravo also sits down with Greg Palmer on the Finovate Podcast to talk about intelligent use of data, the importance of tailored experiences, and overcoming barriers left by legacy systems. To get a deeper insight into the topic register for the webinar: Delivering Customer Knowledge Augmentation and Activation here >>

There aren’t many industries where organisations have so much data about customers for such a long period of time. For example, I have had the same bank for the last 25 years which, by the way, is the same as my father’s.

My bank has been my partner when I wanted to go to university or buy my first apartment. It knows how much I make and where I spend it, but I never truly felt they used that knowledge to either enrich my experience or deliver tailored offers. Why is that?

There is a wealth of value to explore in untapped customers’ financial behaviour and banks are in prime position to reap the benefits, but they need to adapt.

The transformation has already begun with banks introducing more channels, learning best practices from digital native banks and fintechs, and even creating new digital business models to test what works, aiming to later integrate those learnings into the core business.

Still, banks are drowning in data and have very little insight on how to transform it into actionable knowledge to better serve customers, personalise offers, and deliver a consistent customer experience.

Furthermore, through segmentation, banks can use their knowledge about current customers to define campaigns and other initiatives to fulfill one of their main objectives, attract new customers. Their continuous appetite for growth steams from delivering unique and innovative value propositions to current but also future customers which today can be, in many situations, hallenging.

From risk takers, tech-savvy, and hungry for innovation customers to techavoiders that value human touch, banks must accommodate different engagement approaches and insights to differentiate customer profiles. This happens not because they don’t have the data, but because they can’t mine it.

It’s clear that very soon ‘Customer intelligence’ will be the most important predictor of revenue growth and profitability. The use of behavioural analytics will be key to identify customer friction points and there will be a surge in building technological capabilities to get more insight on customers’ needs.

A New Engagement Model for the Digital Age

By nature, financial products are complex and both companies and individuals are deeply affected by their financial choices, so there’s a foreseeable need for contact, ensuring a correct understanding of what is at stake.

Bank tellers, financial advisers, and other resources are key in accommodating customers’ requests and providing value-added and timely information. They benefit first-hand from customer insights, which enable them to provide not only a better service, but also to increase the customer value by offering the best solutions.

In addition to assisted channels, there is the emergence of self-service applications aiming to allow customers to engage on their terms, when they want, going as far as allowing customers to configure product features, including pricing. If, in this case, the human factor is eliminated, the need for accuracy is even greater, otherwise, the sale may fail or the inquiry can go unanswered.

Customer expectations have changed mainly due to the experience from other digital native organisations, coming or not, from the financial sector. The easy interactions, the tailored offers, integration between physical and digital channels or the unmatched service, creates a gap between what many financial institutions can deliver and what customers are getting elsewhere.

Responding to the pressure to change, banks must find a balance between opening but guaranteeing trust continues to be paramount, at all levels. Up to this point, the perspectives presented argued for the need for banks to not only gain insights and knowledge from the data they already have, but also the challenge in adjusting to new customers’ demands and how they choose to engage.

However, the biggest challenge is how to orchestrate these two dimensions and provide customers with experiences that leverage the knowledge banks have delivered in a seamless way, using whatever channel customers choose from.

The holy grail of an enhanced experience in the banking sector is to have an holistic and end-to-end perspective of the customer experience.

Introducing Celfocus Customer Knowledge Augmentation and Activation

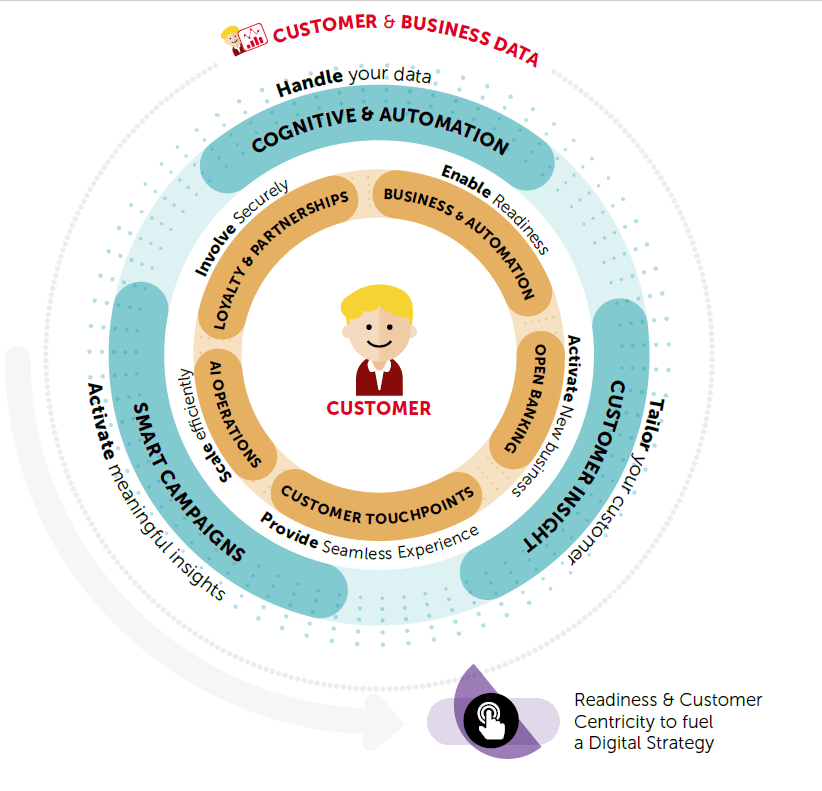

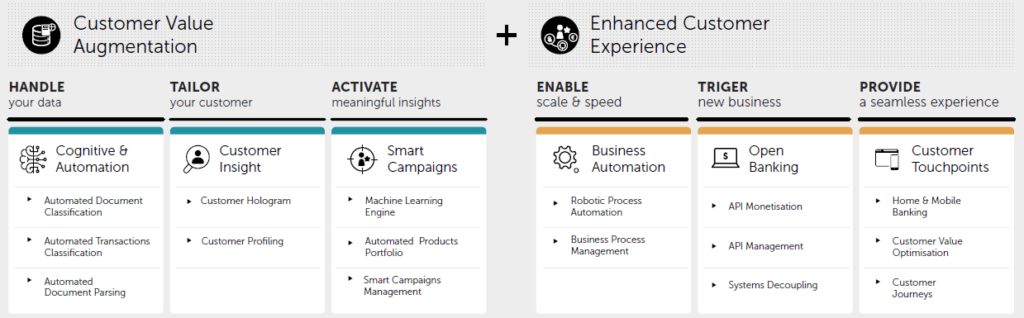

Celfocus Customer Knowledge Augmentation and Activation is a modular and integrated framework tailored to leverage banks’ customer knowledge and deliver tailored services.

This framework is anchored in 2 main modules. The first comprises the tools and technologies to augment customer knowledge by activating every single customer through automated AI and Cognitive data insights, and the second aims at delivering tailored experiences that trigger new targets, portfolios, and customer lock.

By encompassing the Customer Value Augmentation and Enhance Customer Experience modules, the solution provides banks’ full control of the customer journey from planning to execution, focusing on building the technology capabilities to get more intelligence about customers’ needs, and how to best serve them.

Download the full whitepaper from Celfocus, Customer Knowledge

Augmentation and Activation >>