Digital financial services company Ally Financial announced this week that it will acquire non-prime credit card and consumer financing company CardWorks. The deal, which has been approved by both companies’ boards, is valued at $2.65 billion ($1.35 billion in cash and $1.3 billion in Ally stock).

The acquisition adds a top-20 U.S. credit card platform and a top-15 merchant acquiring business to Ally Financial’s direct bank deposit, auto financing, insurance, and commercial product lines. The combined entity will serve 11+ million customers in 50 states when the transaction is closed in Q3 of this year.

CardWorks founder, chairman, and CEO Don Berman praised Ally Financial as an “ideal partner” for the “people-centric, compliance-focused” and technology-enabled organization he built in 1987. “In leveraging Ally’s commitment to innovation and adaptiveness, the combined company will be well positioned to meet the financial needs of our ever-growing customer base and deliver sustainable growth and performance,” he said. After the deal is closed, Berman will join both Ally Financial’s Board of Directors as well as the company’s executive management team.

Detroit, Michigan-based Ally Financial was founded 101 years ago as the General Motors Acceptance Corporation (GMAC) and retained that name until 2010. The company is one of the largest auto financing firms in the U.S. by volume, and is a top-20 U.S. bank by assets ($180+ billion). Ally Financial trades on the NYSE under the ticker ALLY, and has a market capitalization of $10 billion.

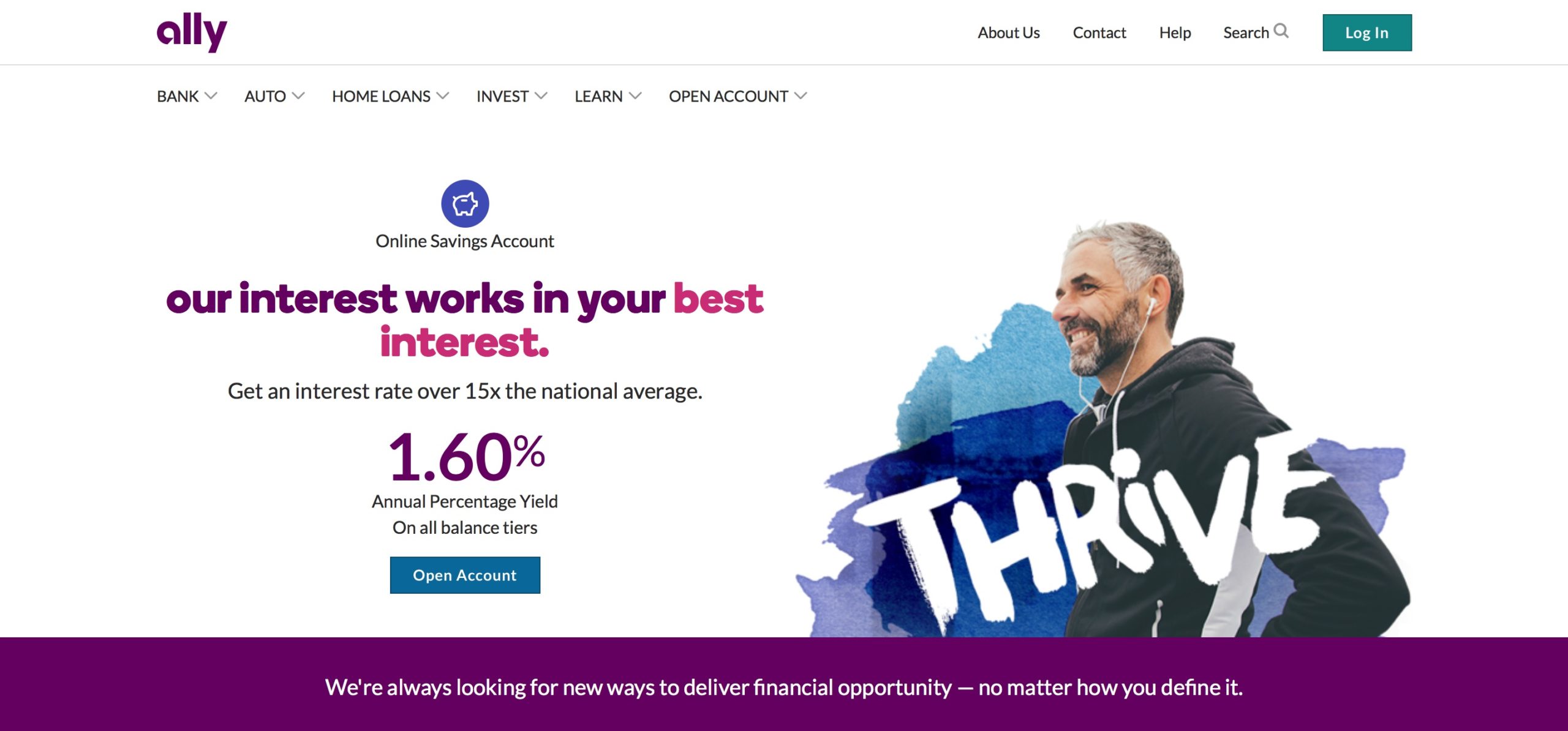

Ally Financial also has an online bank, Ally Bank, which is headquartered in Sandy, Utah, and offers mortgage financing as well as deposit and other banking services. As part of the acquisition, CardWorks subsidiary Merrick Bank will merge into Ally Bank.