EQ Bank, the digital subsidiary of Canada’s Equitable Bank, has signed a partnership agreement with TransferWise which will see the latter underpin EQ Bank’s international payments, reports Alex Hamilton of Fintech Futures, Finovate’s sister publication.

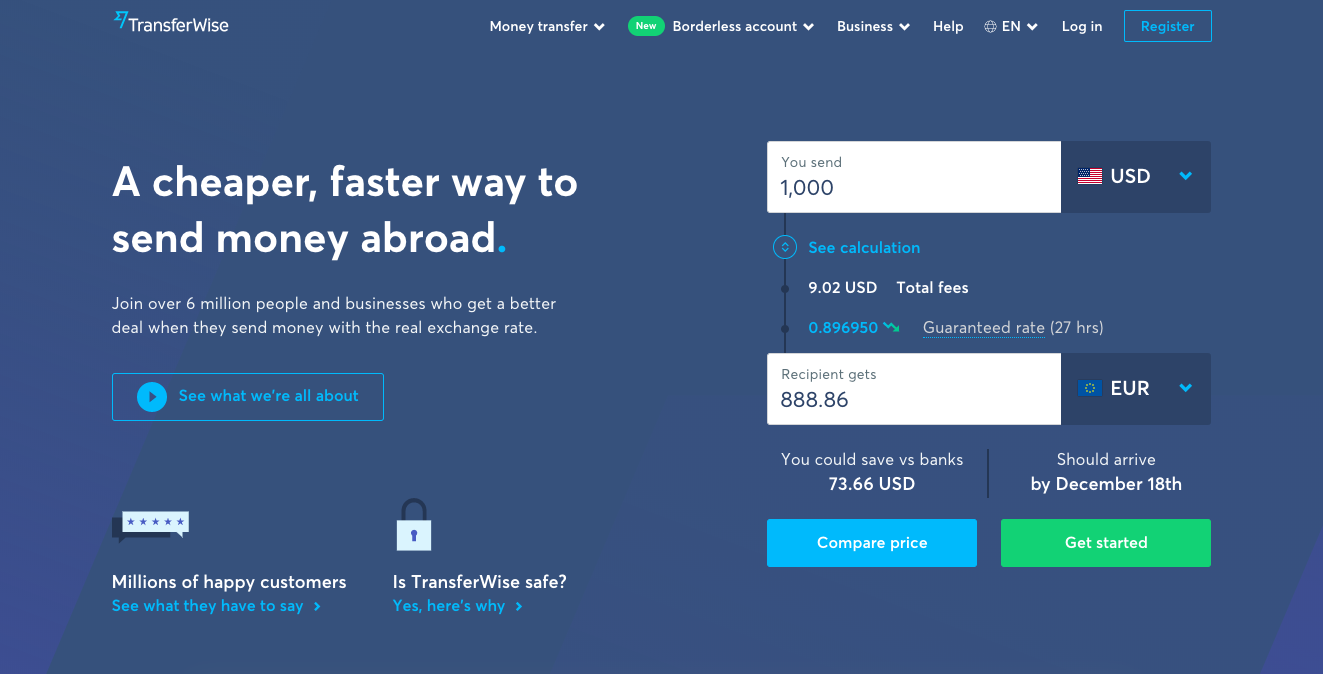

EQ Bank has integrated TransferWise’s API directly into their infrastructure. EQ Bank customers will be able to send money from their Savings Plus account at “the real exchange rate,” paying a “small, transparent TransferWise charge.”

Kristo Käärmann, CEO and co-founder of TransferWise, said that Canadian consumers stand to lose a “staggering” $330 per person to hidden fees when exchanging currencies.

“This needs to stop,” he said. “We ultimately want to ensure that everyone has access to fast, cheap, and transparent international money exchange. We’re thrilled to have found a like-minded partner in EQ Bank.”

EQ Bank recently completed the move of its Temenos core banking system into the cloud. The digital bank utilizes Microsoft’s Azure cloud platform, using software hosted by HP.

“From hidden mark-ups in the exchange rate, to paying multiple fees and lengthy delays, for too long Canadians haven’t been getting the best value for their dollar when sending money abroad,” said Andrew Moor, president and CEO of Equitable Bank.

“At EQ Bank we continually seek ways to remove unnecessary complexities and fees from outdated banking structures to put more money back in the hands of our customers. As TransferWise shares these important values, they are the perfect partner to help us achieve our goal.”

Transferwise, which most recently demoed at FinovateEurope 2013, was founded in 2010 and is headquartered in London. The company has raised more than $770 million.