Digital check innovator Checkbook.io unveiled Instant Pay today. The new offering streamlines the funds transfer process for businesses that want to send money to individual and business bank accounts.

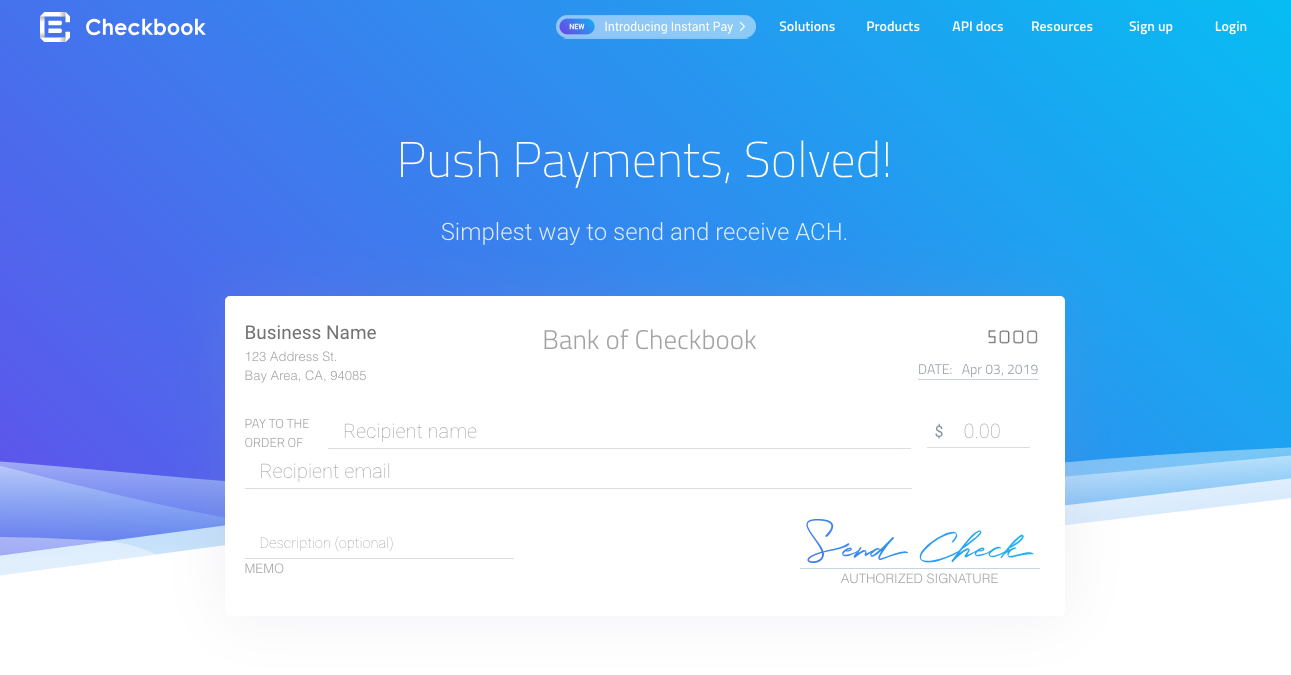

Digital check innovator Checkbook.io unveiled Instant Pay today. The new offering streamlines the funds transfer process for businesses that want to send money to individual and business bank accounts.

Instant Pay works by circumventing the need for payment recipients to go through a sign up process to receive their funds. Instead, Instant Pay requests information directly from the recipient’s Mastercard or Visa branded debit card. This eliminates the requirement of other sensitive information such as their personal details, account number, or routing number.

The technology works because Checkbook.io doesn’t use the antiquated ACH infrastructure, which requires recipient onboarding and takes three to five business days to move funds from one account to another. Instead of running the payment on ACH rails, the funds are transferred using VISA Direct rails, enabling the recipient to see the money in their account within 18 seconds (though the company discloses that the process could take up to 15 minutes).

Businesses can integrate the solution using Checkbook.io’s RESTful API. Along with Checkbook.io’s other tools, the API is publicly available and can easily be integrated into a business’ existing payment process. The company charges a flat, $1 fee per transaction, regardless of the check amount, and allows a maximum of $10,000 per transaction.

Checkbook.io most recently presented at FinovateSpring 2017, where company CEO and founder PJ Gupta showcased the company’s Digital Checks solution. Founded in 2015, Checkbook.io has raised an undisclosed amount of funds from investors such as Tim Draper, AngelList, and more. For more on Checkbook.io, check out our recent feature of the company’s accomplishments.