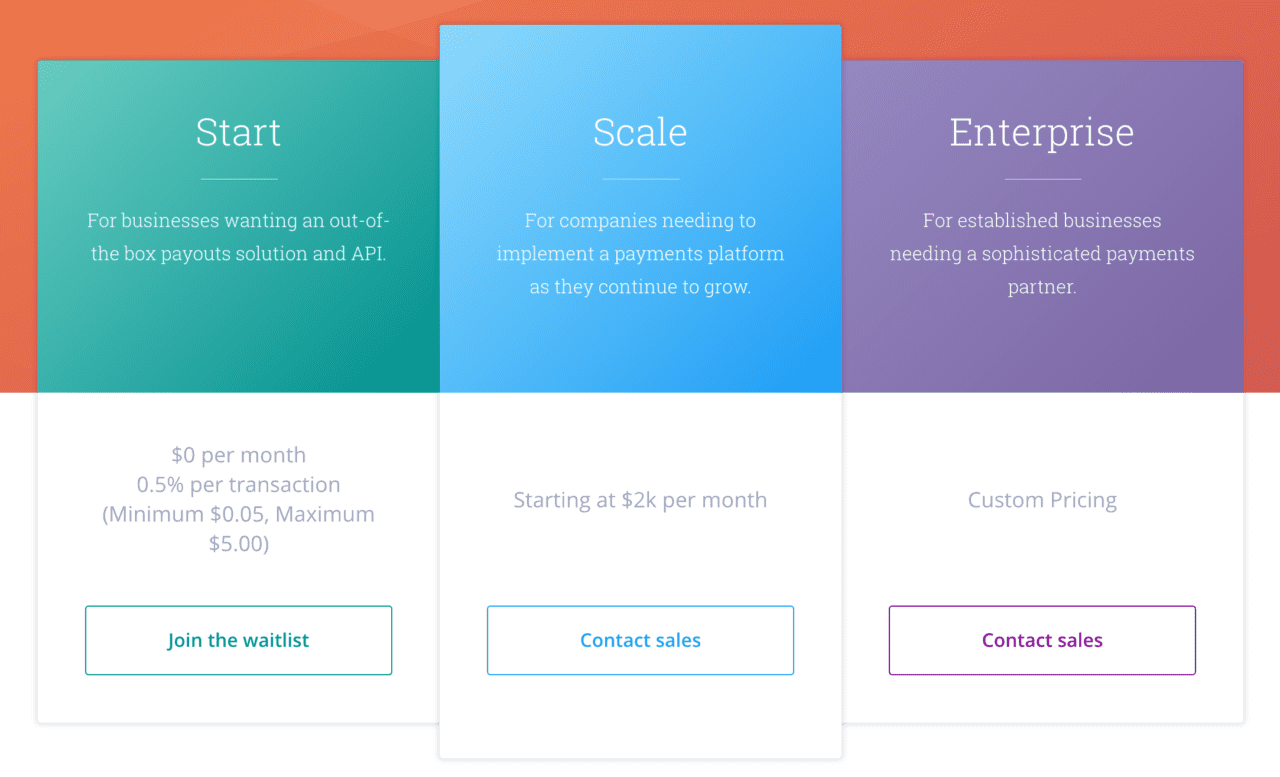

Payments platform Dwolla introduced a new product plan today. It’s called Start, and it offers a white-labeled, out-of-the box way for businesses to send and receive money without a large time or money commitment.

Launching in beta today, Start will complement Dwolla’s other offerings: Scale, which provides a consistent monthly bill with a set number of transactions; and Enterprise, which the company describes as a customizable, “white-glove” approach for complex businesses. Start is differentiated from Scale and Enterprise because it does not lock businesses into contracts, nor does it require monthly minimums. Overall, the new offering helps Dwolla deliver on its commitment of “helping businesses of all sizes start and scale their growth.”

Businesses can integrate their existing app with the Start API or they can use Start’s dashboard, which does not require any coding. After signing up, businesses simply complete AML and KYC checks and can then go live after being contacted by a Dwolla representative.

The beta version of Start is currently being rolled out to select businesses. There is no word on when Dwolla will open the product for a full launch.

Founded in 2008 and headquartered in Des Moines, Iowa, Dwolla offers a white-label payments API that allows firms to credit or debit any U.S. bank account the user has connected. The company integrates with Sift Science to help reduce fraud by leveraging real-time identity verification. And in May of 2017, Dwolla integrated with Plaid to instantly verify and authenticate customers’ bank accounts using tokenization.

The company most recently demoed FiSync at FinovateSpring 2015. Earlier this year, Dwolla closed a $12 million investment led by Foundry Group that brought its total funding up to $51.4 million. Last month, the company partnered with Cryptanite Blockchain Technologies to process their online payments.