Fixed income portfolio platform BondIT has initiated a partnership with FIIG Securities. Through the agreement, FIIG will leverage BondIT’s bond portfolio solution for relationship managers.

Australia-based FIIG offers fixed income services for 6,000 clients, managing more than $7.6 billion (AUD 10 billion) in assets. The company will bring BondIT’s bond portfolio solutions to its core investment management platform, SimCorp Dimension, allowing front office users to leverage the technology for new portfolio construction, investment idea generation, relative value analysis, portfolio monitoring, and portfolio optimization.

In the press release, John Prickett, Chief Operating Officer at FIIG Securities described how more investors are interested in the diversification that corporate bonds can bring to their portfolios and that this spike has increased the demand for fixed income and corporate bonds. He added, “The BondIT software will further enhance our offering, pairing the knowledge of our expert team with the latest technology to identify more fixed income opportunities for our clients and help them maximize their investments.”

In the press release, John Prickett, Chief Operating Officer at FIIG Securities described how more investors are interested in the diversification that corporate bonds can bring to their portfolios and that this spike has increased the demand for fixed income and corporate bonds. He added, “The BondIT software will further enhance our offering, pairing the knowledge of our expert team with the latest technology to identify more fixed income opportunities for our clients and help them maximize their investments.”

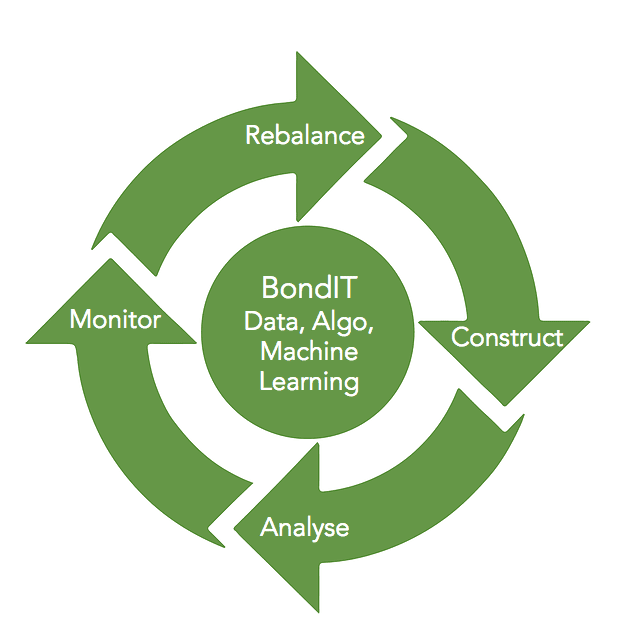

Powered by machine learning algorithms, BondIT’s tools empower advisors to automate the optimization of fixed-income portfolio creation and management. The technology allows individual investors to select 12 different constraint dimensions to personalize their portfolio. BondIT leverages these data points, combined with AI, to create algorithms that offer flexibility in optimizing risk and returns in non-linear, multi-dimensional portfolio selections.

BondIT’s COO Eran Nachshon debuted the technology at FinovateFall 2016 in New York. The company added $4 million to its Series B round last week, bringing its total funding to $18.2 million. BondIT is headquartered in Herzliya, Israel and was founded in 2012.