Banking technology services provider Jack Henry has reached a milestone today, marking more than 100 bank clients using JHA Online Financial Management powered by digital banking company Geezeo.

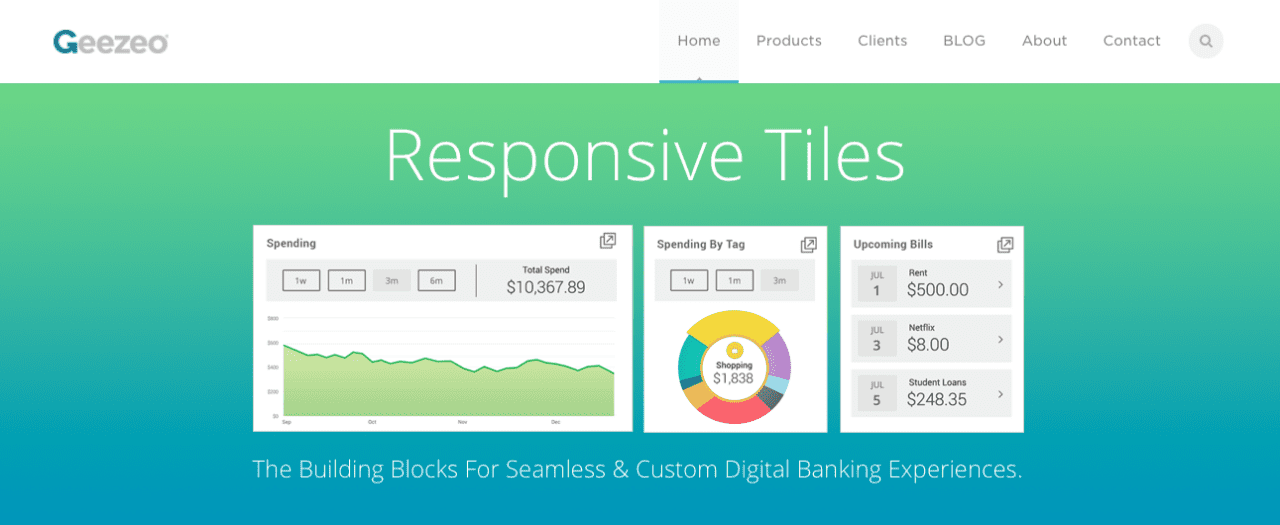

This comes after the two formed a partnership last March in which Jack Henry’s JHA Online Financial Management began integrating the Geezeo platform. Leveraging transaction data from Jack Henry’s core systems, Geezeo presents a seamless user experience through the Missouri-based company’s NetTeller Online Banking, goDough mobile banking, and Banno digital banking solutions (Jack Henry acquired Banno for an undisclosed sum in 2014). Geezeo’s transaction categorization, budgeting, alerts, cash flow calendars, and data aggregation tools help consumers manage their finances.

In the press release, president of Jack Henry Banking Stacey Zengel said, “Creating a rich, rewarding digital experience is paramount for any financial institution’s growth. JHA Online Financial Management offers a modern, engaging experience for the end user while acting as a business driver for the financial institution. It’s that combination of added service and revenue drivers that create compelling industry trends.”

Founded in 2006, Geezeo offers white-label financial management solutions. The company processes and stores billions of transactions to deliver relevant insights that help banks enhance the user experience. The Connecticut-based company demonstrated its business financial management at FinovateFall 2014.

Jack Henry is a division of Jack Henry and Associates, a public company that was founded in 1976. It is one of 49 fintech companies that the NASDAQ tracks on its Fintech Index. Jack Henry and Associates serves more than 9,000 banking clients nationwide. At FinovateFall 2015, the company demonstrated the Banno platform.