Alternative lender Finova Financial introduced a new product this week that will offer non-accredited investors access to regulated public securities offerings.

The new offering is called the JOBS Crypto Offering (JCO) and will allow investors to use cryptocurrency to invest in equity ownership of previously privately-held companies. The JCO is a type of initial coin offering (ICO) in which tokens that represent ownership shares of capital stock are tracked on a blockchain and are sold according to either a registration statement filed under the Securities Act or a transaction that’s exempt from registration under the Securities Act.

“I liked the idea of the ICOs when they were first introduced as they looked like an exciting way for startups to raise funds from small investors, but I had concerns about regulatory compliance practices, especially for tokens that are clearly securities,” said Finova CEO and brainchild of the JCO, Gregory Keough. He said that he created the JCO “to open the doors of opportunity for the small investor.”

Here’s how JCOs work– companies in search of financing issue securities to the general public in exchange for cryptocurrency or other funds. Ownership of these securities is represented by tokens, or blockchain entries. As for what’s next, Keough described his vision for JCOs saying, “I envision the Tokens sold in JCOs being listed on an Alternative Trading System, creating a liquid security and providing companies with an alternative to a traditional initial public offering.”

Currently, there is no word on an expected launch date for the JCO.

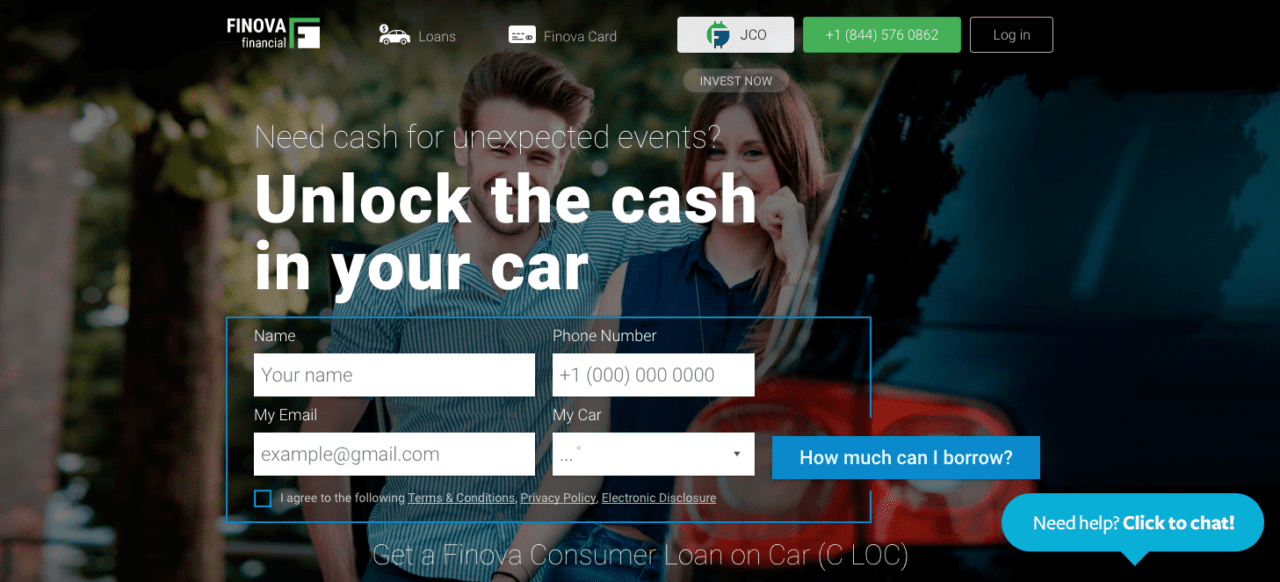

Finova Financial was founded in 2015. At FinovateSpring 2016, Keough debuted Finova’s Car Equity Line of Credit (C-LOC), a product that enables consumers to take loans from the equity in their car. Later that year, the company raised $52.5 million in combined equity and debt.