Financial management technology startup DoubleNet Pay scored a partnership with investment services firm T. Rowe Price this week. The Georgia-based company announced on Tuesday it has integrated its online cash flow management tool into T. Rowe Price’s Retire With Confidence Program.

Financial management technology startup DoubleNet Pay scored a partnership with investment services firm T. Rowe Price this week. The Georgia-based company announced on Tuesday it has integrated its online cash flow management tool into T. Rowe Price’s Retire With Confidence Program.

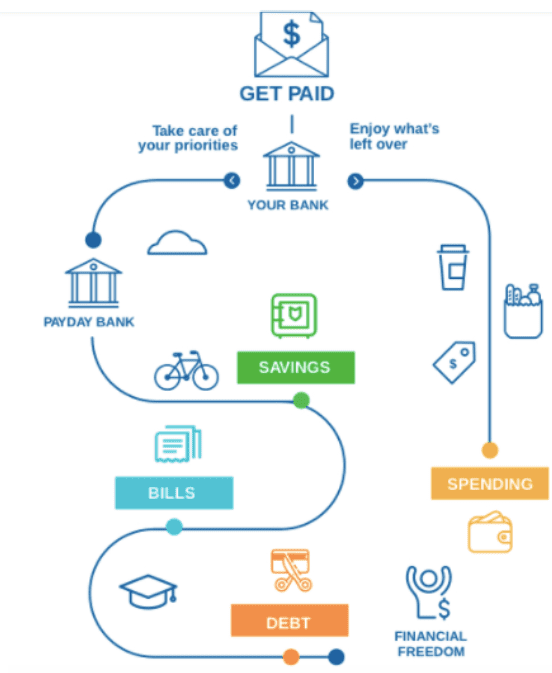

The savings automation tool empowers participants to manage their income by regularly deducting a select amount from their bank account to save towards goals such as emergency savings, bill payment, and debt management. Brian Cosgray, DoubleNet Pay’s founder and chief executive said that the purpose of the tool, which is available on T. Rowe Price’s Workplace Retirement website, is two-fold. It is intended to “help people easily pay their bills on time” and also aims to help users “start a savings fund before spending their money on discretionary items.” Cosgray added, “We hope making financial best practices automatic each pay period will boost positive financial behavior.”

Diana Awed, head of product and marketing for T. Rowe Price Retirement Plan Services said, “We’ve seen the impact automatic services can have on financial behavior, particularly with retirement savings, and believe the addition of DoubleNet Pay to our financial wellness program will encourage employees to get on the right path with their finances, including paying down debt, starting an emergency fund, and saving for retirement.”

Founded in 2013, DoubleNet Pay is based on the principle pay yourself first. In other words, bills need to be paid and savings accounts must be funded before discretionary spending takes place. At FinovateSpring 2015, the company’s cofounders Brian Cosgray and Cody Laird showed off how DoubleNet Pay takes the stress out of personal financial management. Earlier this summer, the company reeled in $4 million in its first round of funding. Last year, DoubleNet Pay earned a spot in Plug&Play’s accelerator program.