Until now, the best way to gauge whether you’re paying too much for auto insurance was to call around to a variety of auto insurance companies. And in order to gain information on your car’s safety recalls, you had to visit the manufacturer’s website. Figuring out what your car is worth was yet another task– usually a visit to KBB.com (or to the library, for luddites).

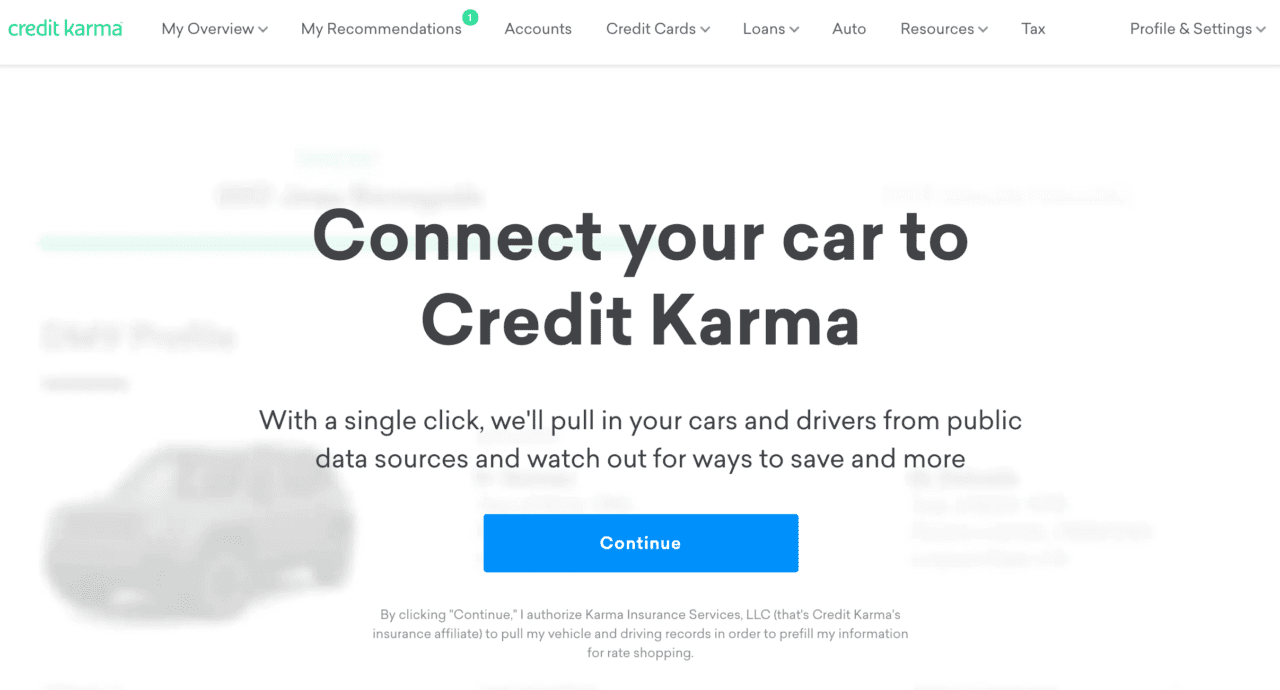

Consumer credit monitoring and financial health startup Credit Karma has launched a new offering today that changes those routines. The company’s new automotive information center is a one-stop shop for helping consumers to manage and organize their vehicle-related finances and information. Included among the capabilities are an overview of the user’s DMV profile, with vehicle and drivers license information, vehicle value estimations, and manufacturer recall notices.

The two most notable capabilities are the auto insurance score and comparison tool and the vehicle refinancing decision tool. The insurance tool offers up information about consumer’s auto insurance score (see image, right) and enables them to shop around for a better deal on car insurance. Highlighting the value of the refinancing feature, Rory Joyce, director of product for CreditKarma told CNBC, “We started to notice that many of our members have auto loans that were effectively mispriced. We found just bringing awareness of what the calculated APR is, versus what we think they deserve, is eye opening.” In order to keep drivers up-to-date, Credit Karma sends alerts to customers when their credit score makes them eligible for a better car insurance or refinancing rate.

Above: the tool offers vehicle value information and recall notices

Earlier this summer, Credit Karma launched Credit Karma Mortgage, a tool that helps homeowners discover savings opportunities available through refinancing. That same month, the company unveiled Unclaimed Money, a feature that monitors government databases in seven states to notify consumers if they are owed money. Founded in 2007, Credit Karma debuted one of its largest product expansions in 2016 when it launched a free tax filing service. The company’s CEO and founder Ken Lin demonstrated Credit Karma’s technology at FinovateSpring 2009.