In the Quebec-based company’s first round of funding, data management platform TickSmith announced today it has raised $1.6 million ($2 million CAD) from Illuminate Financial.

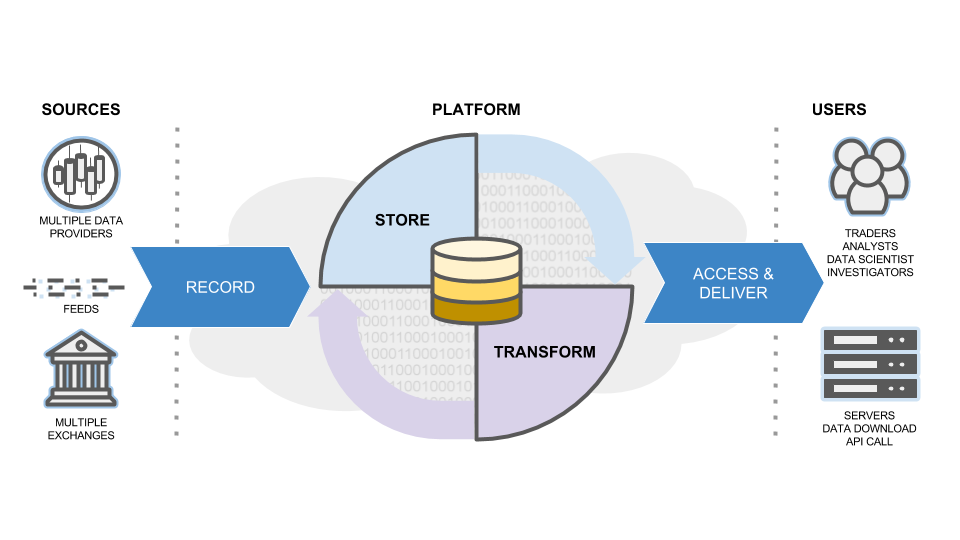

TickSmith will use the funds to further commercialize TickVault, its flagship product that works like a financial data lake for capital markets. Based on Hadoop technology, TickVault records, stores, and transforms structured and unstructured financial data by breaking down trade history, exchange and tick data, back office data, news, events, research, and more. In addition to analysis, the TickVault’s data scrubbing is also useful for compliance and risk management teams.

TickSmith’s TickVault data flow diagram

TickSmith’s TickVault data flow diagram

Francis Wenzel, CEO and co-founder of TickSmith, said, “Market participants recognize the competitive advantage that can be gained from a next generation capital markets data lake, not just in Europe and North America, but increasingly on a global basis.” Wenzel added, “As venture capital specialists within the capital markets technology space, Illuminate Financial are well positioned to help us further develop our flagship product, TickVault, as we continue to build an international client base.”

Founded in 2012, TickSmith presented TickVault and FIXVault at FinovateFall 2014. The company recently introduced a new performance-tracking module, Marketplace Advanced Insights, that gives market participants a better idea of how they are performing and how their peers are behaving. TickSmith partnered with CME Group in October of last year to provide the derivatives marketplace with access to historical data. The company also counts National Bank of Canada as a client.