Earlier this week, BBVA launched its API Market, making eight of its APIs commercially available. The launch comes after the Spanish bank worked for more than a year with developers and businesses to determine the optimal delivery for the APIs.

This not only enables app developers to integrate BBVA customer data into their applications, it also complies with pending PSD2 compliance in the U.K. The early adaption to the upcoming open banking requirement makes BBVA well-positioned to compete in the changing regulatory climate. Shamir Karkal, head of Open APIs at BBVA said, “This is the perfect moment to do this, because there is a whole revolution happening in the financial and the technology space. What the Open Platform does is support that innovation. And, by supporting it, we make that ecosystem move much faster. So, in the end, we enable this whole revolution to happen.” Karkal added, “Sometimes you have to be the change you want to see in the world.”

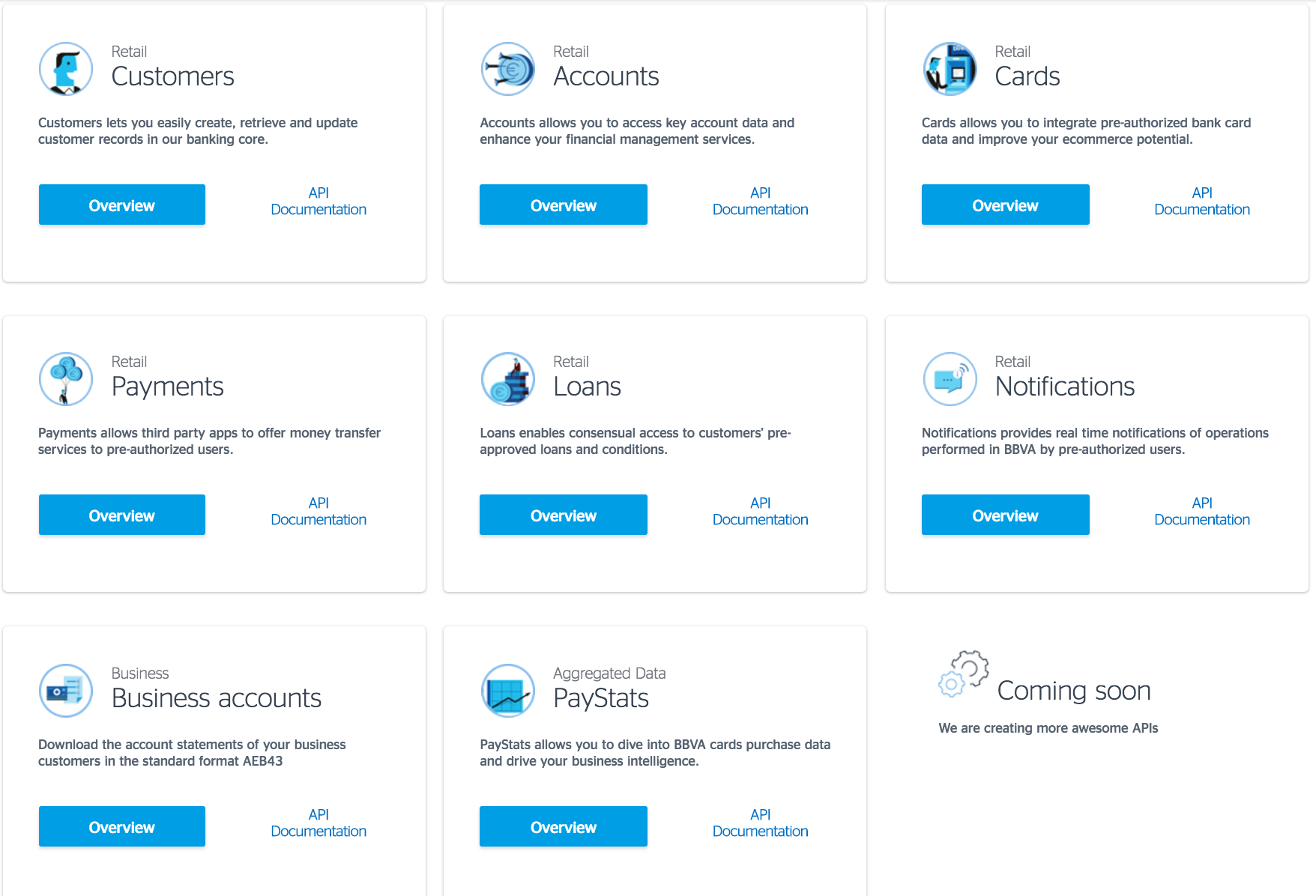

The new APIs allow third parties to use customer data sets (with the customer’s permission) in eight categories, each of which can be broken down into geographical regions:

At FinDEVr Silicon Valley 2016, Karkal launched BBVA’s initial four APIs; accounts, payments, customers, and cards, to the audience of developers. In the presentation, the company’s Diego Blanco, Head of PaaS & Open APIs Platform CTO demonstrated the payments ACH API, showing how the white-labeled API can be used to originate customers and accounts. Check out the full, 15-minute presentation:

https://finovate.wistia.com/medias/yz6rlumk20#

The APIs will be piloted by invitation-only with BBVA clients in Spain and the U.S. The bank plans to roll it out with clients in Turkey, Mexico, Latin America and other regions in the future. Interested in seeing more fintech APIs? Tickets for FinDEVr London are on sale now. Hurry! Prices go up May 27.