Collaboration suite provider unblu understands the value of in-person interactions in banking and the need to deliver a robust experience via digital channels. More importantly, however, the company has figured out how to balance the two by offering the personal touch of an in-person experience through mobile and online channels.

At FinovateEurope 2017, unblu CMO Jens Rabe began the demo saying, “Your customers are already interacting with your online channels everyday. The question is– are you actually taking advantage of those opportunities… driving sales and customer loyalty?” The company’s mobile collaboration solution offers banks an additional channel for live customer consults, using their existing mobile banking apps as the foundation for the interaction.

Company facts:

- Privately funded

- 25+ employees

- Over 80 banks currently using software

- Headquartered in Sarnen, Switzerland

- Founded in 2012

(above) unblu CMO Jens Rabe and CEO Luc Haldimann at FinovateEurope 2017 in London

We spoke with Luc Haldimann (pictured), unblu CEO after the show and followed up with an interview.

We spoke with Luc Haldimann (pictured), unblu CEO after the show and followed up with an interview.

Finovate: What problem does unblu solve?

Haldimann: unblu facilitates an in-person experience, online.

Digital transformation is probably the toughest job in banking today. Banks are not just in the financial business anymore, they’re in the business of enhancing consumer lifestyles and the competition is tough. Fintech newcomers are agile and can respond quickly to changed expectations and deliver cutting-edge digital services to empower customers.In order to differentiate from competition and retain customer loyalty, banks need to support and advise customers through digital channels, in real time and in person. Effectively this means swapping the place of interaction from a high-street branch to a digital branch. We enable our clients to do precisely this, without having to redesign their digital channels or infrastructures.

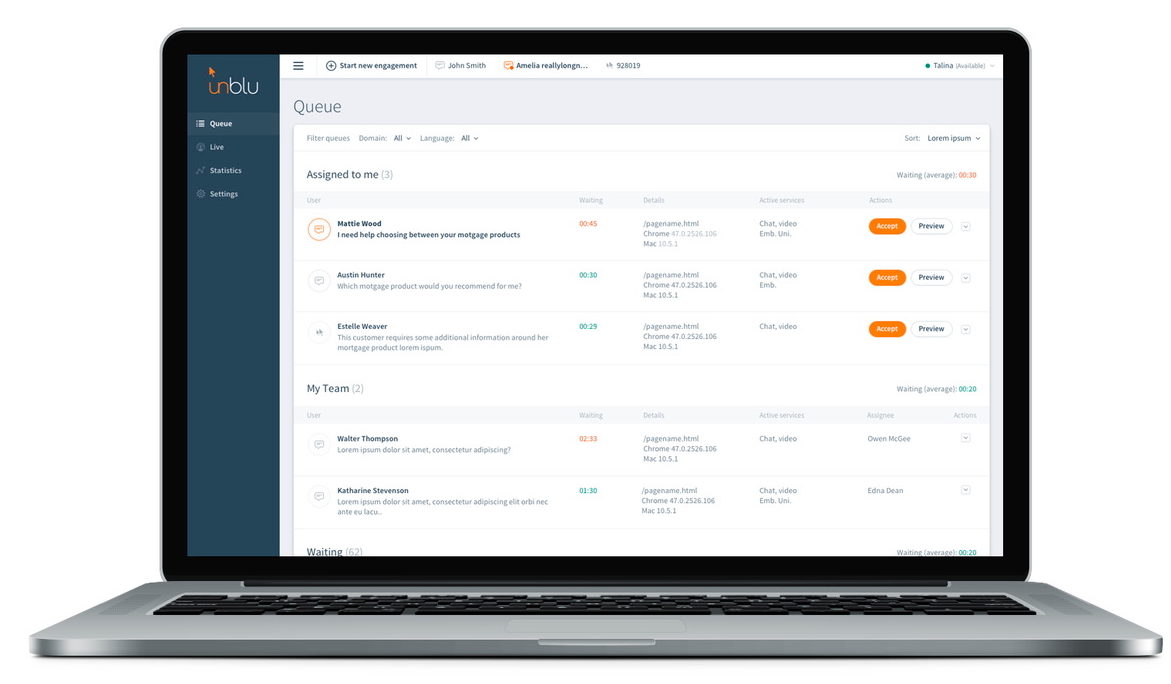

Above: unblu’s administrative screen shows queue of client requests

Finovate: Who are your primary customers?

Haldimann: Over the last few years, we have become specialists for live engagement in the financial sector. Our primary customers are banks who we sell to directly and via leading integrators. These banks are distributed worldwide and include UBS, Intesa SanPaolo, PostFinance, Comdirect, Fineco, Bank Millennium, Societé General and Komerční Banka for example. And of course our partners are invaluable to us. We have fantastic relationships with our many strategic partners, which most notably include over 30% of the technology vendors listed in the leaders’ quadrant of Gartner’s magic quadrant for global retail core banking. Our partners have made and continue to make our offering easily accessible to a myriad of customers around the globe.

Finovate: How does unblu solve the problem better?

Haldimann: Put simply we listen carefully to our customers and adapt our solution to fit their requirements. Our focus on banking and its specific challenges enables us to evolve with the industry and adapt to changing needs. This has led to an intricate understanding of the industry’s security, regulatory and technological environment. unblu is uniquely designed to allow banks to rollout a live engagement solution which respects all these constraints.

Of course there are other vendors offering live engagement solutions. Due to our experience we often find

ourselves one step ahead and able to quickly adapt and present a solution regardless of the anomalies relating

to the finance industry. We understand customer centricity in combination with secure environments as the key value proposition in our market segment.

Finovate: Tell us about your favorite implementation of your solution.

Haldimann: My favourite projects are the ones where we’ve succeeded in working closely together with clients to leverage the maximum impact of unblu. It’s incredibly exciting and fulfilling to collaborate with banks who understand the capabilities of unblu and how to utilise it to make an impact within the market. 50% of swiss cantonal banks are already working together with us and share our vision and enthusiasm enough to actually change the way they do business and start building their customer journeys in ways which will allow them to digitally address clients.

These types of clients are savvy and demanding and push us to develop the suite even further in order to

accommodate their needs. Working with customers and helping find solutions that make them happy is what

drives the collaborative spirit at unblu.

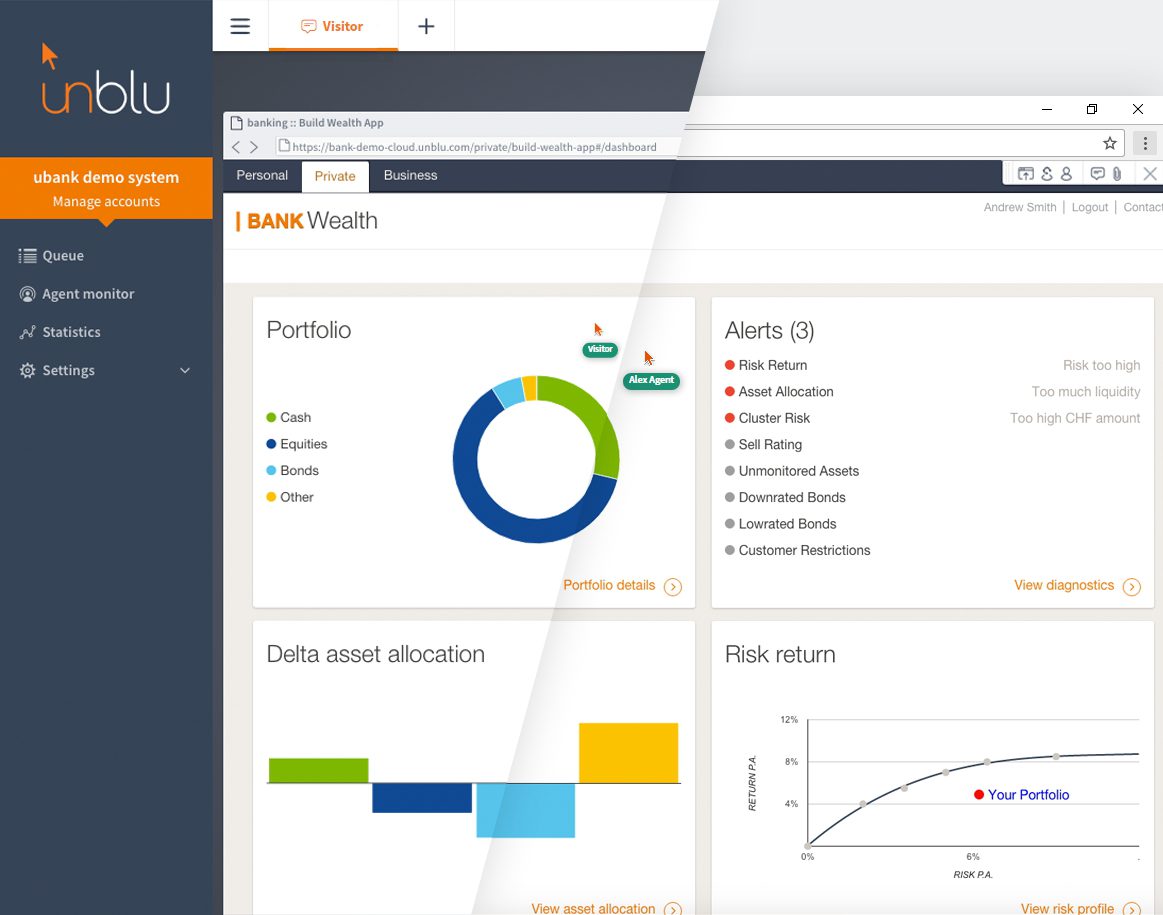

Above: unblu offers co-browsing for an interactive user session

Finovate: What in your background gave you the confidence to tackle this challenge?

Haldimann: Before founding unblu I worked a lot with banks to develop a screen based advisory tool for use in high street branches. This experience taught me a great deal about the in person, face to face advisory processes within banks. Previously to unblu I also helped SAP and HP creating online configurators and developed a fascination for the limits of self service tools. Combining the two ideas seemed very compelling. The true value of the proposition has become apparent since the crisis within the financial sector. The necessary change in mindset and the digitization movement are driving forces in our success story.

Finovate: What are some upcoming initiatives from unblu that we can look forward to over the next few months?

Haldimann: Truly compelling customer service must be intuitive, emotionally rich and also available when needed. We are about to launch our SDK package that will allow unblu to work seamlessly within native mobile phone apps. This means unblu’s collaboration suite will be extended to mobile devices, which is a huge opportunity for financial institutions to create win-win scenarios with their valued customers.

You can also expect to see us expanding both geographically and into new markets throughout the year. We’ve

recently increased our sales coverage in response to demand from global enterprises seeking a solution as

mature as unblu’s, which they haven’t been able to find within their own market. Additionally, we’re beginning to broaden our solid customer base within the fin serv sector itself and have acquired a number of insurance clients including AOK, SwissLife and AON.

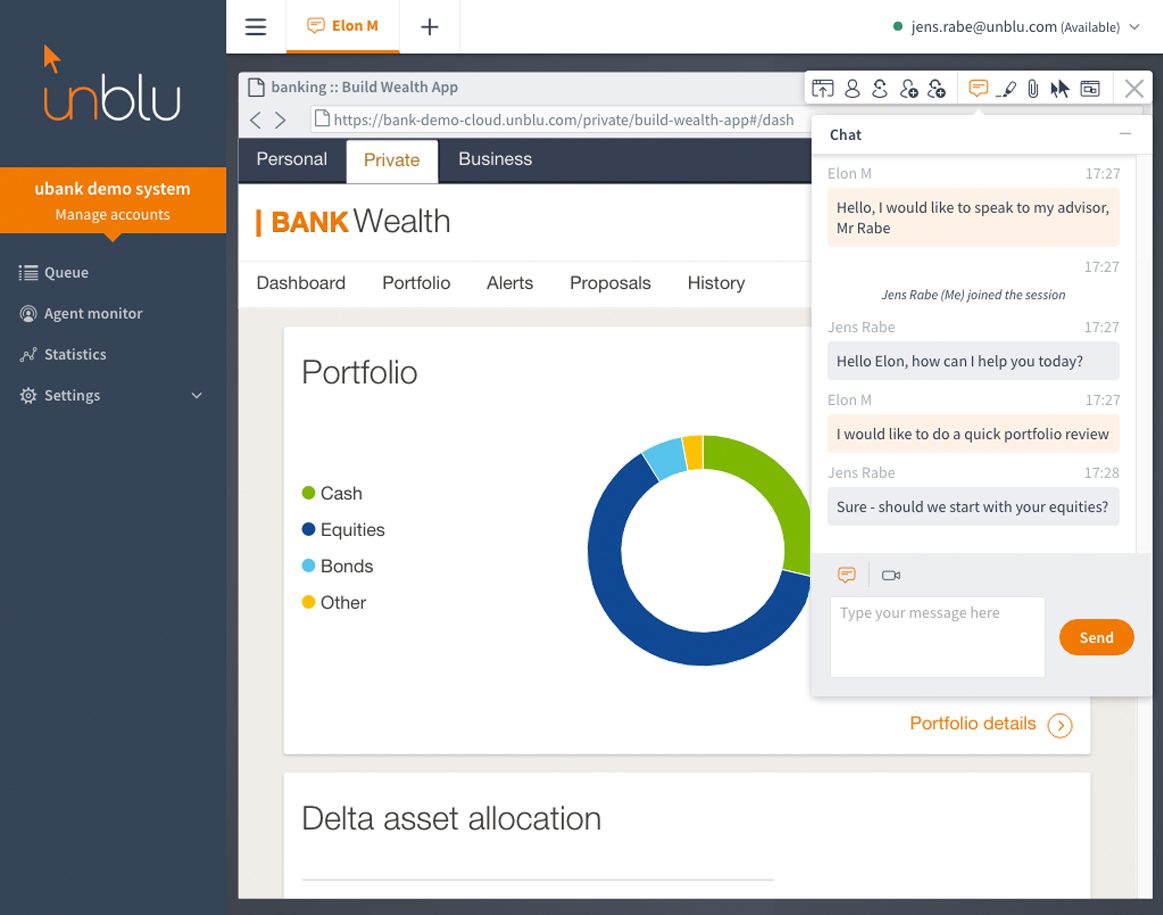

Above: unblu’s interactive chat session

Finovate: Where do you see unblu a year or two from now?

Haldimann: unblu began as a specialized co-browsing solution. In line with market demands we have built out a complete online engagement suite specifically aimed at the financial sector. We are proud of the level of expertise we have achieved and we will continue to develop and maintain our position as market leader for live engagement in the finance sector. There is already a new market segment in the making to enable banks to build effective virtual branches and unblu will be a huge part of that moving forward.

unblu CMO Jens Rabe and CEO Luc Haldimann at FinovateEurope 2017 in London