Consumer-facing credit monitoring site Credit Karma is celebrating Christmas a bit early this year, but the presents its 60 million users will receive won’t be wrapped. The San Francisco-based company launched a new (and free) tax-return preparation offering this week to complement its flagship, free credit-score monitoring, as well as its loan- and credit-card comparison technology.

The new solution is powered by Credit Karma’s recent acquisition of online tax preparation and filing company AFJC Corporation, which sold co-branded and private-label tax services under the names OnePriceTaxes and Tax Preparer Solutions. New and existing users will have access to free tax filing in January 2017, just in time for tax season. According to Forbes, 90% of Americans will be able to file their taxes using the new tax-filing suite. The remaining 10% have complicated taxes for which the typical 1040 form is not suitable.

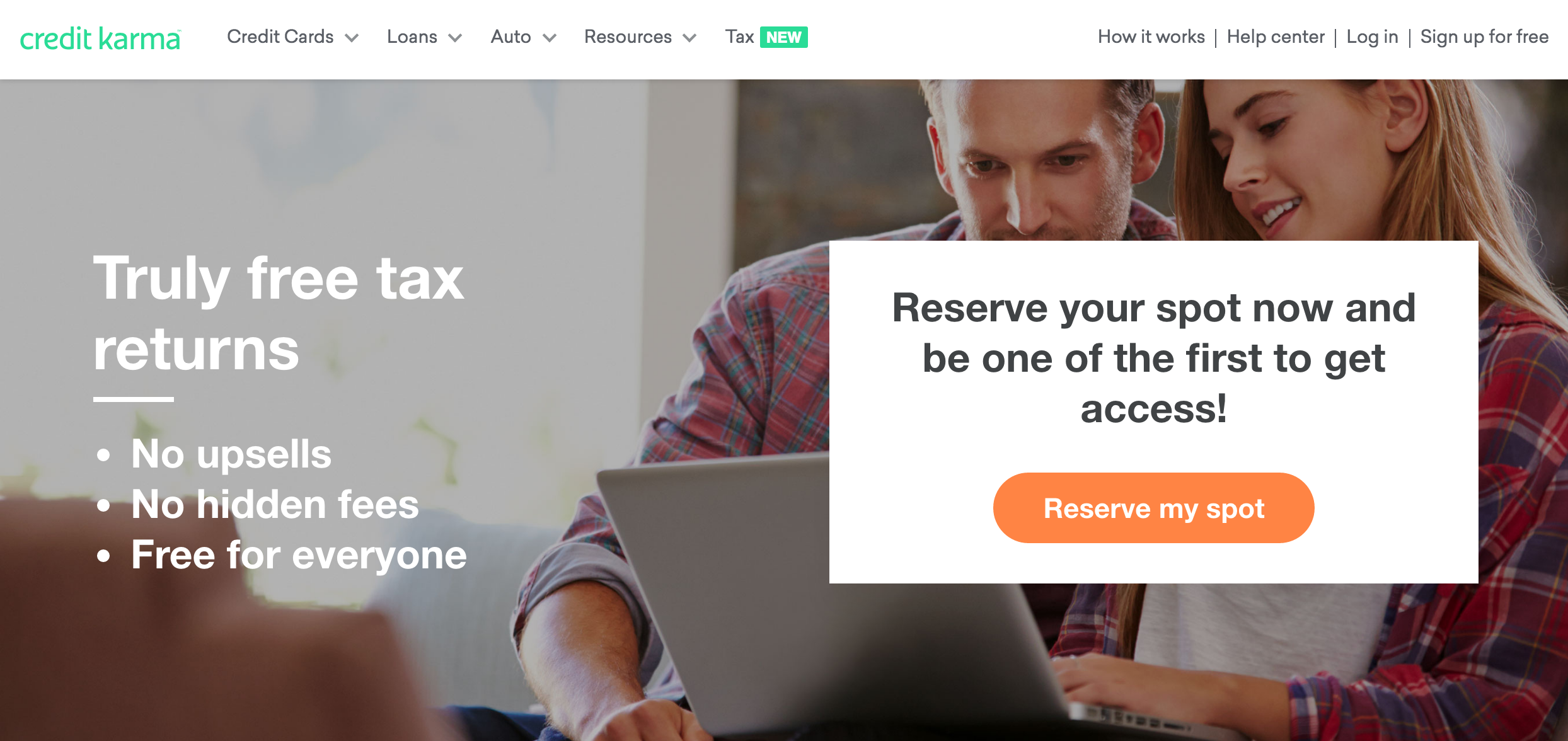

In a blog post announcing the service, Credit Karma CEO Ken Lin was eager to highlight that the service is free. He said, “We don’t have a paid version of our product nor are there confusing packages or versions to trick you into paying. It’s just one simple and truly free solution. And over time, we believe the integrations and insights will make your taxes even easier.”

Credit Karma is seeking to position itself as a financial assistant. As Lin explains, “We can monitor your credit, advise you on how to make good financial decisions and suggest better cards, loans and insurance products for you.” Since Credit Karma gets paid when customers sign up for a third-party’s product on its site, it makes sense for the company to offer another product to entice new users and to get existing users to spend more time on its website.

While the new tax offering doesn’t cost much for Credit Karma to maintain, it did take some time and effort to build. The profit will come in the form of client data. By leveraging income data in users’ tax returns, the company can make better recommendations for credit cards and loans to drive sales for partner companies including Payoff and Upstart for loans and Chase and Barclaycard for credit card offers.

Since launching in 2007, Credit Karma has raised $368.5 million and is valued at $3.5 billion. It offers free credit reports from Equifax and Transunion and seeks to serve as a hub for users to monitor their financial health. Last month, Credit Karma expanded operations to Canada, its first market outside the U.S. The company’s CEO Ken Lin debuted its Debt Manager at FinovateSpring 2009.