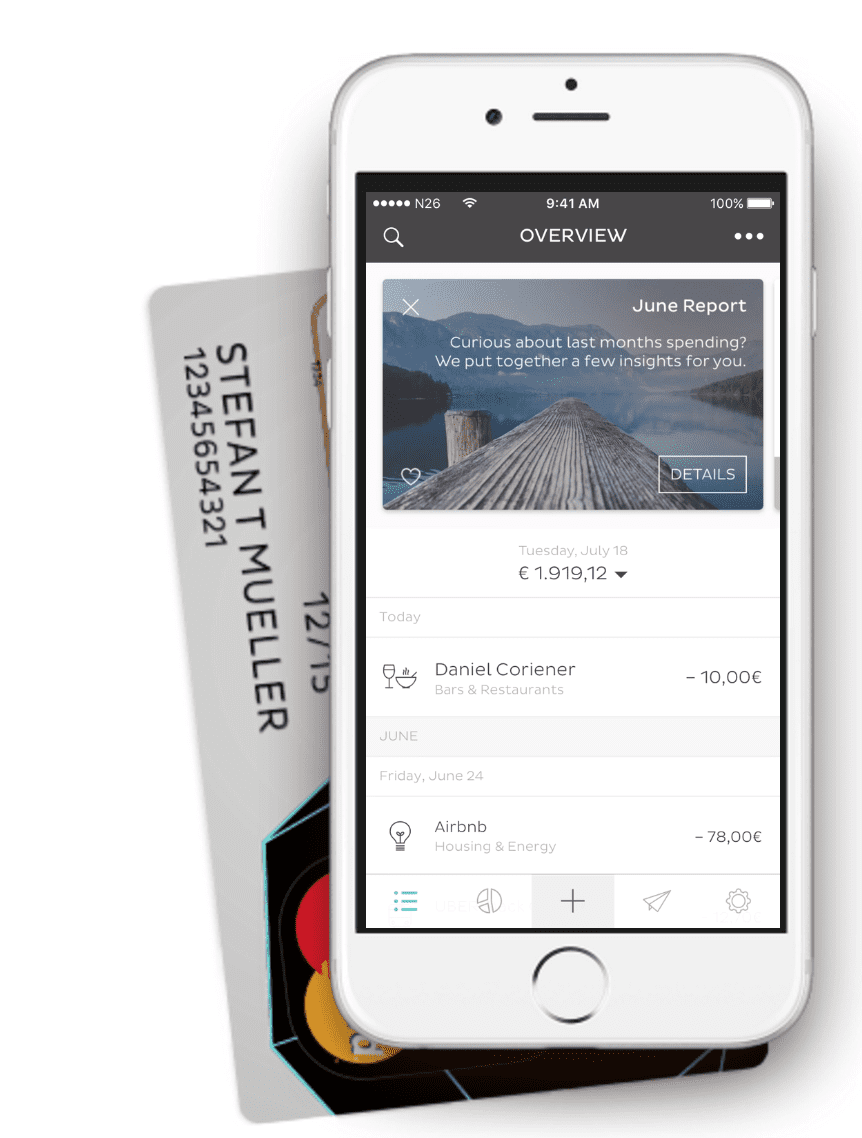

Robo-adviser solutions-provider vaamo teamed up with one of the hottest fintech players in Germany today, neobank N26 (formerly Number26). N26 is using vaamo’s API to offer clients N26 Invest, a co-branded solution that lets users select from three investment strategies depending on their risk tolerance.

Robo-adviser solutions-provider vaamo teamed up with one of the hottest fintech players in Germany today, neobank N26 (formerly Number26). N26 is using vaamo’s API to offer clients N26 Invest, a co-branded solution that lets users select from three investment strategies depending on their risk tolerance.

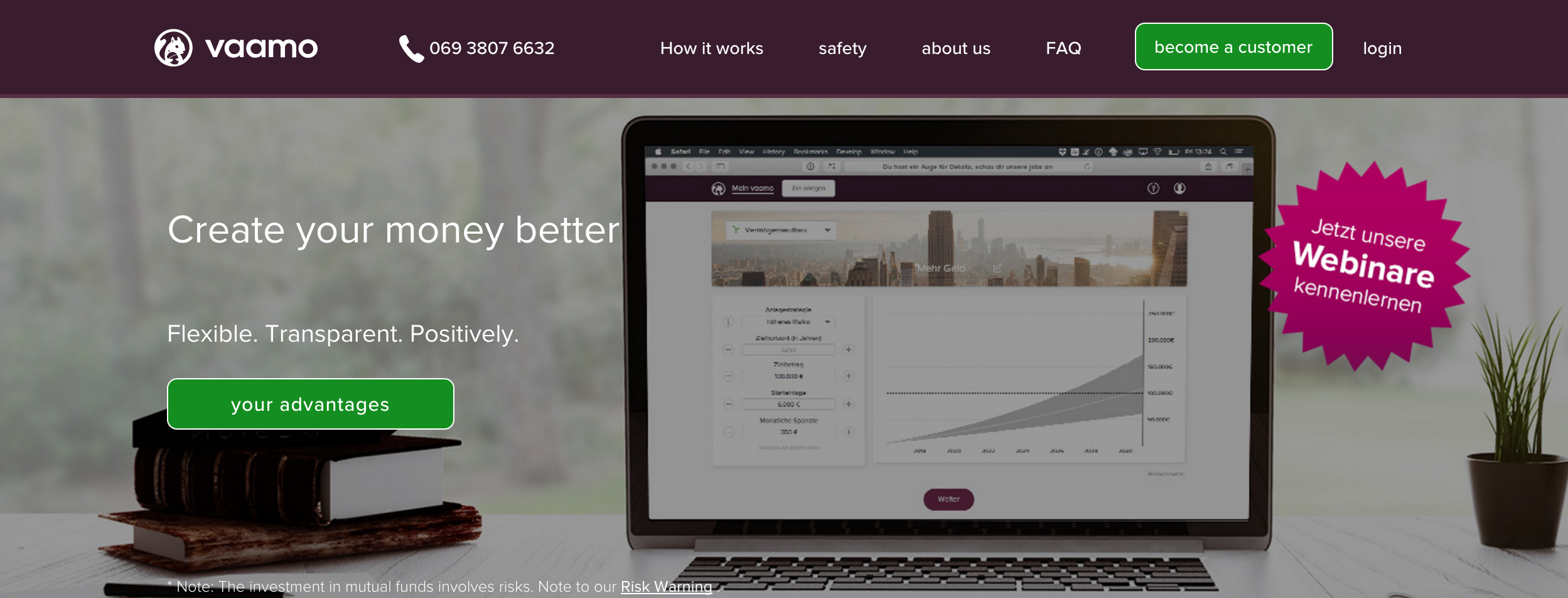

After developing its robo-adviser platform for private investors in Germany, vaamo is seeking to bolster its B2B business model. The company will power an online, automated investment solution for N26. This is the first third-party partner vaamo has signed for its B2B solutions, which can be co-branded or fully white-labeled and are available as a financial intermediary or discretionary portfolio-management solution.

vaamo says its robo-adviser platform addresses younger customers who are “not easily accessible via traditional sales channels” and it helps businesses more profitably serve customers with smaller investment volumes. Maximilian Tayenthal, founder of Number26, said, “vaamo matches perfectly our concept and enables us to provide our customers with an easy and reasonable investment opportunity.”

vaamo launched its goal saving app at FinovateEurope 2014 in London. The company has raised $3.8 million in two rounds from Route 66 Ventures.