Currency exchange Kantox launched its API 6 months ago and has since shown early success, announcing that it has processed $100 million.

According to the company’s press release, thousands of transactions have been processed through the API in the 6 months since its beta launch. Philippe Gelis, CEO and co-founder of Kantox, told Finextra, “The huge uptake in our API during the beta launch indicates that Kantox is delivering genuine added value by offering finance departments headache-free automation of currency management and execution of customized FX rate-hedging strategies.”

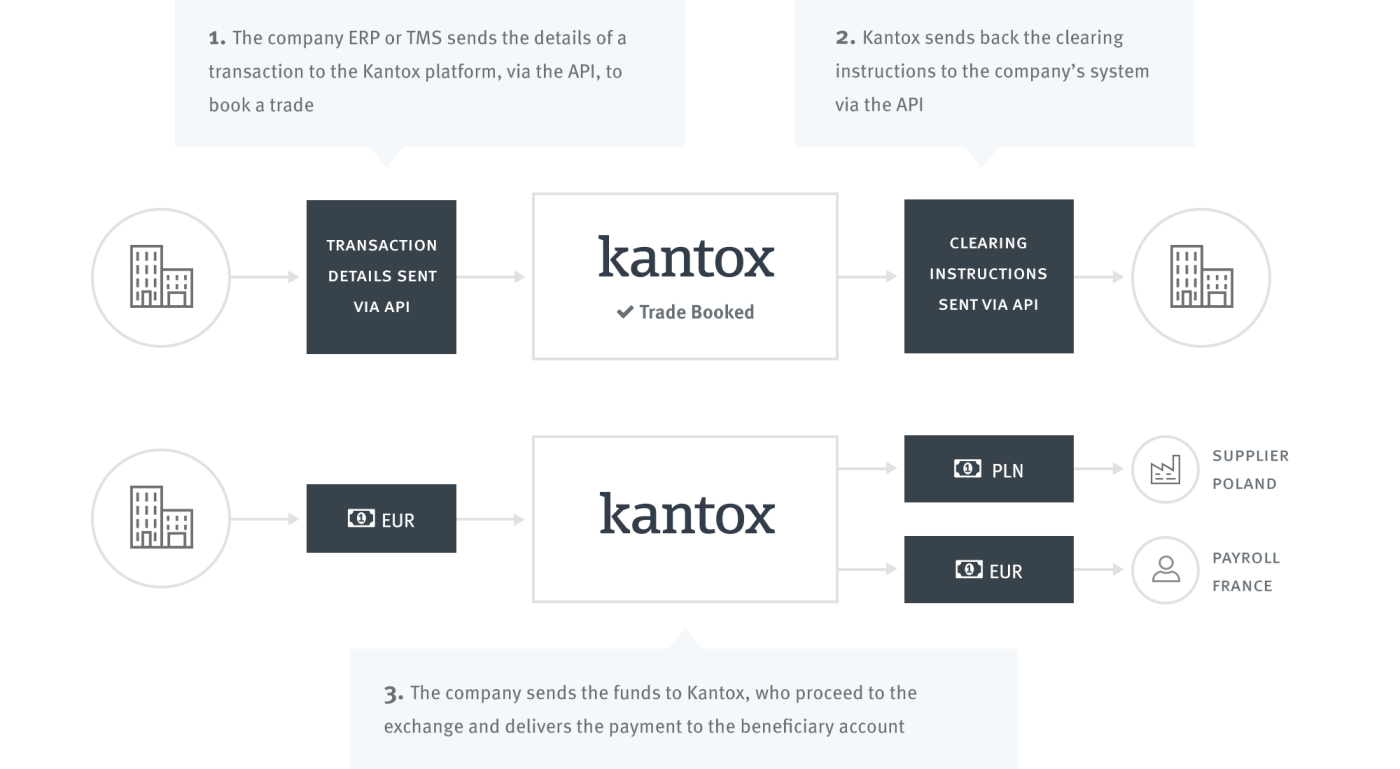

This week the company released the API to 2,000 enterprise customers. It can be integrated with their in-house systems in just a few days. After the integration, clients can access Kantox’s services including:

- Spot trades

- Forwards

- Market orders

- International payments

- Dynamic Hedging

- Payments Hub

The company’s API helps businesses manage frequent FX exposure by connecting directly to their ERP or treasury management system to control all of their FX transactions.

Since it was founded in 2011, Kantox’s 2,000 clients have traded $3+ billion in 103 countries and 34 currencies. At FinovateEurope 2013, Kantox CEO Philippe Gelis debuted Peer FX, a platform that enables companies to directly exchange currencies with one another. The London-based company has raised just over $21 million from 9 investors.

For more developer content, check out FinDEVr Silicon Valley this 18/19 October 2016 in Santa Clara.