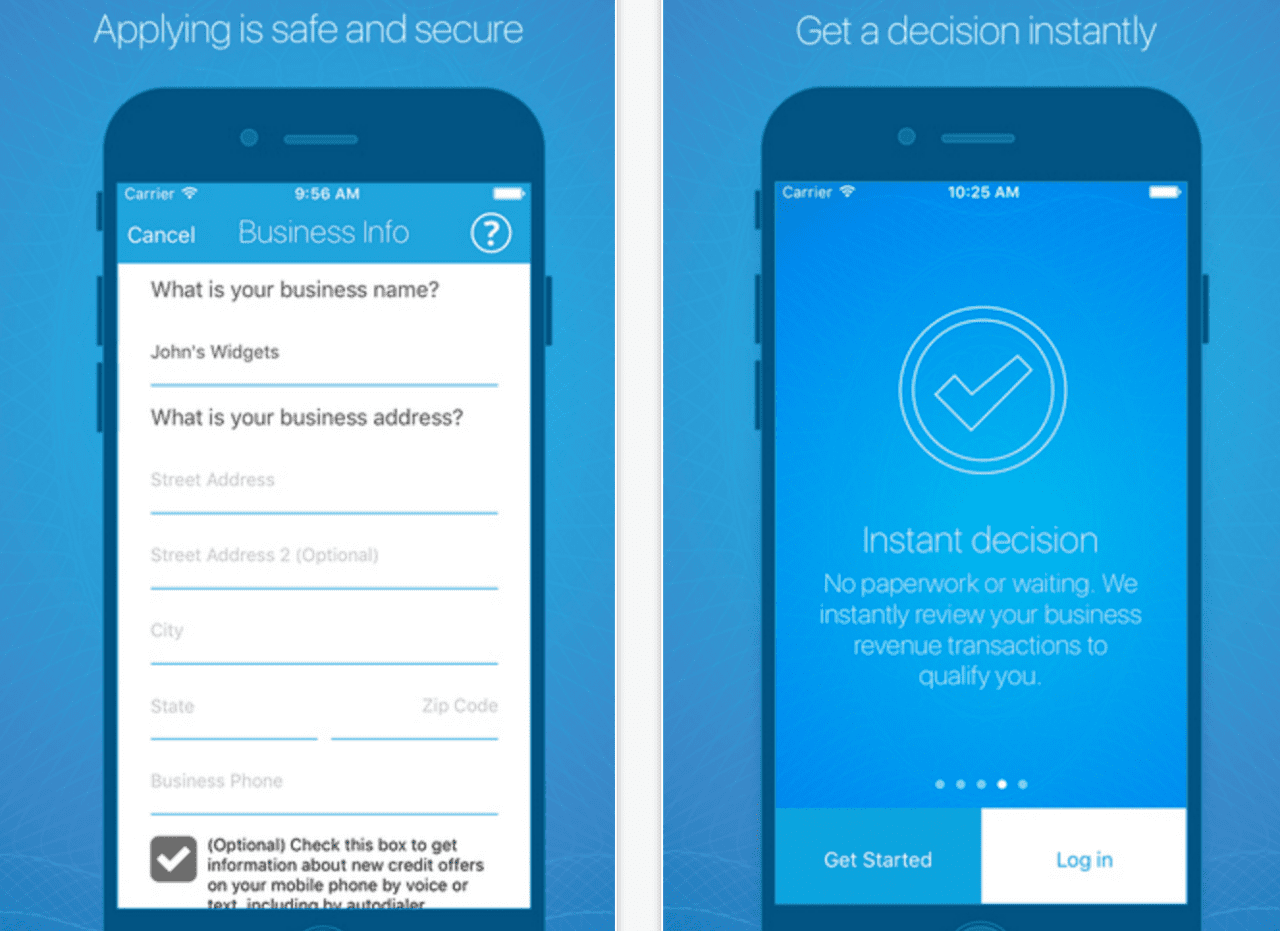

Alternative financing provider Kabbage unveiled a major mobile update this week. The Atlanta-based company revamped its iOS app to allow small businesses to apply for funding on their mobile devices.

Kabbage launched a native app in 2013 to help customers manage and track their financing. The company has since grown to serve 80,000 small businesses.

Underlying the mobile application process are tools such as driver’s license recognition, bank account verification, and TouchID authentication. After users become qualified, they can continue to manage, track and access funds from within the app.

Kabbage said it hopes the new release will “fundamentally transform the borrowing experience.” The company now drives $7 million per month in loan originations from mobile devices. The app will be available on Android later this summer.

At FinovateSpring 2015, Kabbage unveiled the Kabbage Card, a payment card that lets small business owners carry a financing tool in their wallet to pay for supplies needed to keep their business running. The company’s CTO Andy Badstubner presented at FinDEVr San Francisco 2015 on how to integrate into the Kabbage platform.

Last month, the Kabbage partnered with Scotiabank which will co-brand small-business loans in Mexico and Canada. Scotiabank joins Santander and ING, both of whom already selected Kabbage to power their online business loans.