In an increasingly global economy, Valuto’s multicurrency account helps small businesses send and receive payments in five different European currencies. Valuto integrates into systems such as SaaS accounting, ERP and invoicing systems, and other tools businesses already use daily. The multicurrency account leverages Valuto’s P2P currency exchange marketplace offering a foreign-exchange solution at a lower cost than banks.

Valuto believes financial services should be flawless. Since the biggest obstacles for consumers exist in international transfers and foreign exchange, they decided to tackle this market first. “We believe that businesses deserve the convenience of having their banking operations fully automated,” said Matthew Harris, director of strategy and partnerships.

Company facts:

- 110 employees

- €3.2 billion in turnover in 2015 (€9.2 billion since being founded)

- 360,000+ registered users

- Headquartered in Poznan, Poland

- Founded in November 2009

Pictured left-to-right: Founder and CEO Michał Czekalski; Matthew Harris, international business development and partnerships; Lukasz Olek, founder and chief product officer onstage at FinovateEurope 2016.

Pictured left-to-right: Founder and CEO Michał Czekalski; Matthew Harris, international business development and partnerships; Lukasz Olek, founder and chief product officer onstage at FinovateEurope 2016.

In the company’s FinovateEurope 2016 demo, Valuto launched its open API, showing how to integrate a multicurrency account into an SaaS accounting system. Once the open API is integrated into an SMB’s existing platform, they can issue cross-border invoices to make and collect payments in multiple countries and currencies.

At FinovateEurope, we chatted with Matthew Harris, director of strategy and partnerships for Valuto, to get more insight:

At FinovateEurope, we chatted with Matthew Harris, director of strategy and partnerships for Valuto, to get more insight:

Finovate: What problem does Valuto solve?

Harris: Valuto is an innovative solution that bypasses expensive intermediaries such as banks or FX brokers. It is a cost-effective service that facilitates everything from foreign exchange to sending and receiving transfers in local currencies across several European countries. Valuto provides its customers faster settlement times than those offered by the banks due to our network of client-safeguarded bank accounts situated throughout Europe. Finally, which is what we unveiled at Finovate Europe this year, the Valuto open API (makes it) possible to integrate Valuto functionalities into services such as desktop, SaaS accounting, e-invoicing, P2P investment marketplaces and B2B e-commerce sites.

Finovate: Who are your primary customers?

Harris: At the moment our primary customers are SMEs and sole traders. Nevertheless, in recent months we have seen a significant uptake from individuals who have seen value in our service.

Finovate: How does Valuto solve the problem better?

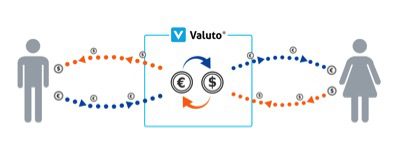

Harris: Valuto users, especially SMEs and sole traders, can enjoy terms and conditions usually reserved for large corporate clients by the banks. When using Valuto, there are no middlemen, meaning Valuto customers can use our currency-exchange marketplace to exchange between one another, thus bypassing expensive spreads charged by the banks.

Moreover, Valuto cuts out the middlemen by offering domestic, localized payouts and pay-ins from our network of bank accounts. This is why Valuto transfers are transparent, predictable and inexpensive.

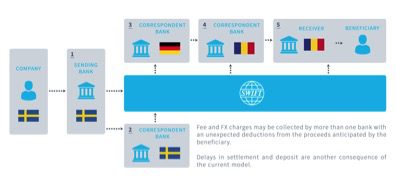

A typical cross-border transfer passes through several correspondent banks, each taking a percentage off the initial payment amount. This is why traditional cross-border transfers are complex, erratic and costly.

With Valuto, transfers are transparent, predictable and inexpensive.

Valuto to Valuto (V2V) is a unique transfer option available to Valuto customers. Everyone who has a Valuto account and sufficient balance can transfer funds to another Valuto customer. The transfer is completely free and will be visible on the recipient’s account within seconds.

Finovate: Tell us about your favorite implementation of your solution.

Harris: My favorite implementation of Valuto would have to be the integration of the Valuto multicurrency payment account into an SaaS accounting solution in order to automate payments, collections and reconciliation. We will go live with our first integration March of this year.

Finovate: What in your background gave you the confidence to tackle this challenge?

Harris: Valuto is a brand new project, and was created by individuals with extensive proven track records of developing innovative financial services and products. Valuto’s co-founders, Michał Czekalski and Łukasz Olek, began their careers by establishing Internetowykantor.pl, one of the largest companies on the online currency-exchange market in Poland. Now they are introducing Valuto as a modern solution for clients across Europe.

Finovate: What are some upcoming initiatives from Valuto that we can look forward to over the next few months?

Harris: In the upcoming months we will launch a new API function designed for P2P investment platforms. It’s a unique feature that will make us stand out from our competition on the market. We’ve seen a lot of fintech solutions aimed at the banks so we wanted to direct our next project to helping fellow fintech providers continue to disrupt the banking sector.

Finovate: Where do you see Valuto a year or two from now?

Harris: We see Valuto as a major player throughout Europe and several other major economies globally. Additionally, our customers can expect numerous new functionalities added to the multicurrency payment account, leading to our goal of creating a modern, connected bank similar to the internet of things. Apart from that, we expect Valuto to be integrated into everything from SaaS accounting platforms to P2P investment marketplaces and more.