Retirement and college savings robo-advisor, FutureAdvisor, announced its first major bank partner today.

The San Francisco-based company has partnered with BBVA Compass which will use FutureAdvisor to power a digital investment service for its clients.

The announcement comes five months after investment manager BlackRock acquired FutureAdvisor for an undisclosed amount, prompting the robo-advisor to change its customer-acquisition strategy from direct-to-consumer to business-to-business.

BBVA hopes the partnership will help it engage with millennial customers who aren’t currently using its investment services and are seeking a digital experience. As BBVA Compass Chairman and CEO Manolo Sánchez says, “The ultimate goal here is to help our clients take greater control of their finances so they can build bright futures.”

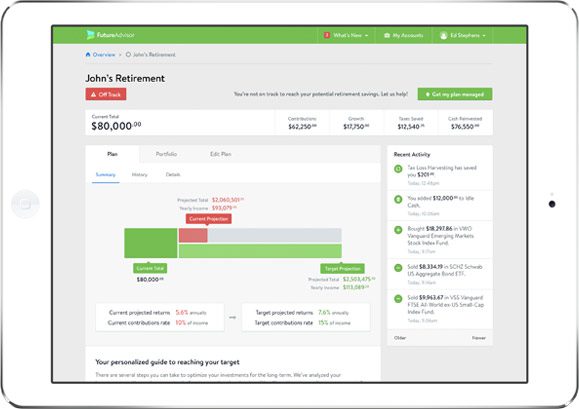

BBVA clients, who will gain access to FutureAdvisor’s services later this year, can either link their external investment accounts and receive a customized investment plan, or they can opt for a managed portfolio in which assets are held through the bank’s broker-dealer affiliate, BBVA Compass Investment Solutions.

FutureAdvisor is not the first Finovate alum with which BBVA has formed ties. The bank, which has 672 branches across the U.S., acquired Simple in 2014, and partnered with Dwolla in the spring of 2015 to leverage the startup’s FiSync for real-time transfers.

Since launching its service in 2013, FutureAdvisor has managed more than $700 million in client investments. The company received the World Economic Forum’s Technology Pioneer award in 2015, and Euromoney’s Best American Wealth Management Innovator award in 2014.

FutureAdvisor CEO Bo Lu debuted its premium offering at FinovateFall 2013 in New York.