Card-not-present (CNP) fraud and chargebacks cost retailers and issuing banks billions of dollars and lost time. To mitigate these losses, Ethoca created a network to help both parties reduce fraud and customer-dispute losses.

At FinovateFall 2015, the company launched Ethoca Alerts, a platform that facilitates real-time communications about fraud and customer disputes. When card issuers confirm fraud with the cardholder, Ethoca sends an alert to the merchant within minutes or hours—instead of days or weeks—through the charge-back process. This allows merchants to stop fulfillment of fraudulent orders, avoid costly chargebacks, increase transaction acceptance and prevent further losses.

Company facts:

- HQ: Toronto, Ontario, Canada

- Founded: 2005

- Network contains:

- 44 global, direct card issuers

- 500+ credit unions

- 7 of top 10 U.S. banks

- 2 of top 5 U.K. banks

- 7 of top 10 U.S. ecommerce brands

- 2,400+ merchants

The process

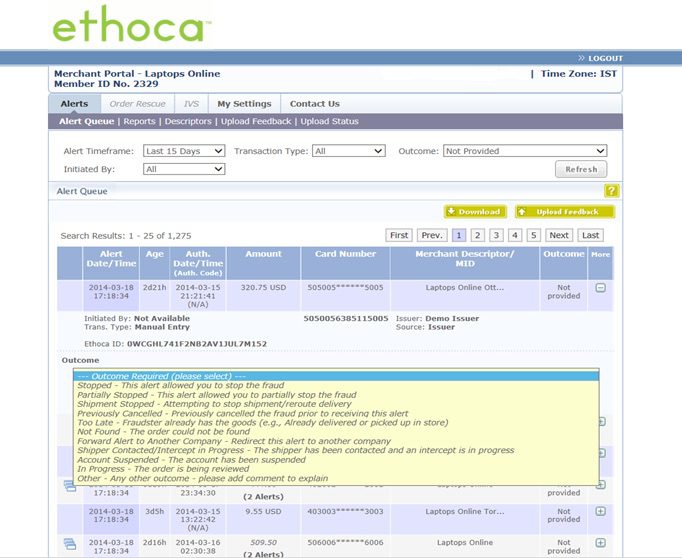

Card issuers have three methods to upload customer-dispute data and to confirm fraud:

- Upload manually (pictured below)

- Send files via Secure File Transfer Protocol (SFTP)

- Send files directly via Ethoca’s API

Ethoca sends fraud alerts to merchants via web portal notifications or through the issuer’s platform (if integrated via an API). After receiving the alert, the merchant issues a refund and stops the shipment, if possible. Next, the merchant reports the outcome to the issuer, who no longer needs to resort to the charge-back process.

The screenshot below shows the merchant portal where the retailer views the transaction details supplied by the card issuer and enters the outcome as seen in the yellow box.

Two major benefits for the issuing bank are worth highlighting:

- Issuers are able to recover write-off losses on low-value transactions which are typically not worth charging back.

- Issuer-liable 3D secure losses, which are usually not recoverable, can be reclaimed since the merchant can reverse fraudulent transactions.

What’s next

Ethoca is seeking to bring the solution across the globe to South America and Africa, as well as expand existing coverage in Asia-Pacific, Europe, and North America. The company currently has a partnership with Accertify, and is working to integrate with more fraud-solution platforms in the future.

Watch Julie Fergerson, SVP of industry solutions, and Steve Durney, SVP, issuer relations, as they debut Ethoca Alerts at FinovateFall 2015: