Australia-based P2P lending platform SocietyOne today announced it is partnering with Uber to offer its drivers car loans. This comes at a time of high growth for Uber Australia which has seen its UberX platform grow from 0 to 20,000 drivers in the past 18 months.

Uber, which operates in nine cities across Australia and New Zealand, requires drivers to have a car no older than 10 years. However, some drivers have difficulty obtaining a traditional loan because ride-sharing jobs may be perceived as unstable.

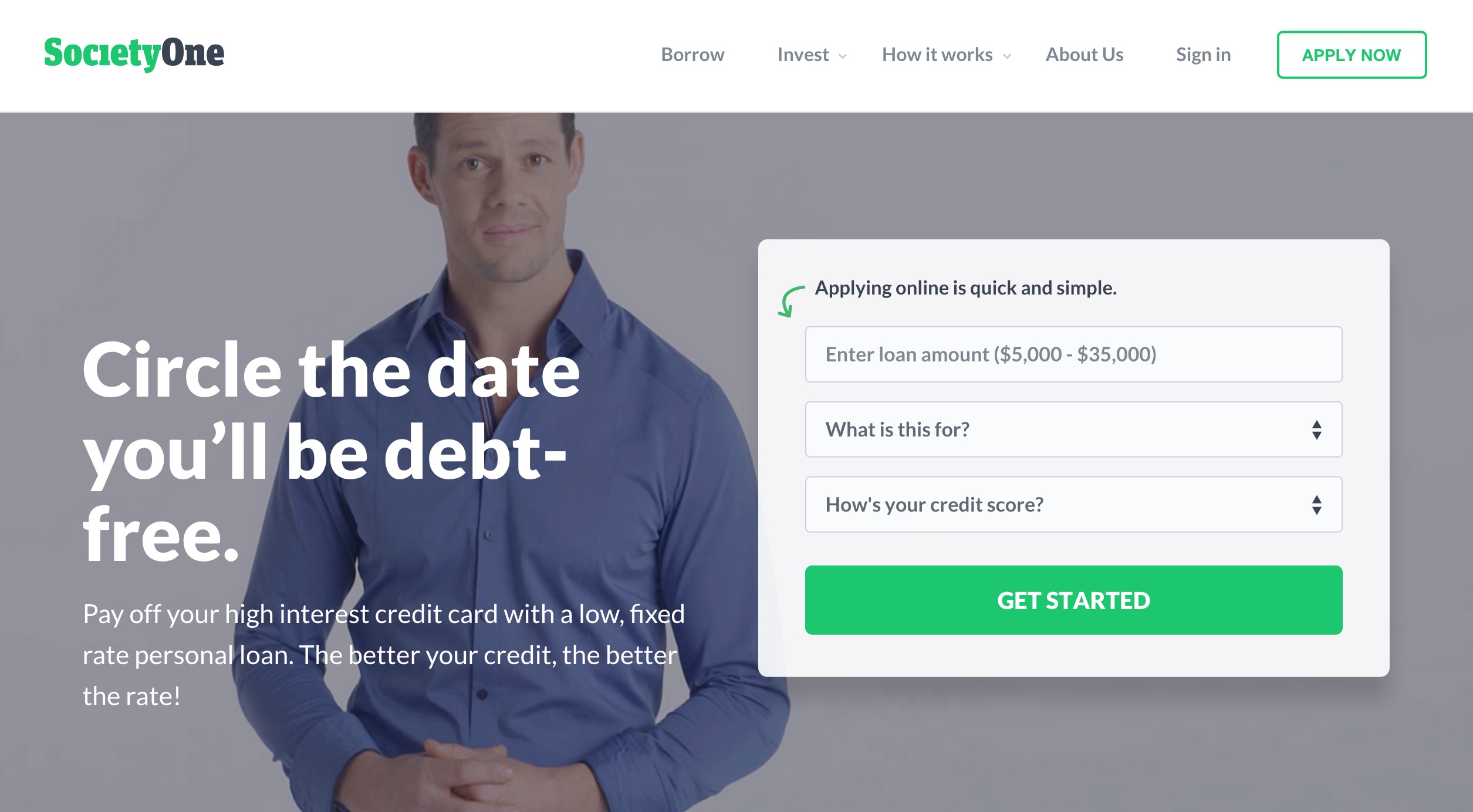

SocietyOne charges drivers an upfront fee of $250 to take out a car loan, which ranges from $5,000 to $35,000 at an interest rate of 6.5% to 12.6% which is competitive with rates from traditional banks.

Launched in 2011, the company now employs 75 in Australia and New Zealand and has extended $60 million in personal loans this year. It is experiencing 10% growth in loan originations month-over-month.

SocietyOne debuted its ClearMatch technology at FinovateAsia 2012 in Singapore.