A major consequence of ubiquitous digital banking will be a long-term improvement in customer retention, at least for the “primary” bank/checking account. Digital natives will perceive little need to change banks as they move from home to college and then to multiple jobs. Assuming you keep them satisfied and connected to family members, today’s 15-year old might stick with their primary bank or credit union for seven or more decades.

A major consequence of ubiquitous digital banking will be a long-term improvement in customer retention, at least for the “primary” bank/checking account. Digital natives will perceive little need to change banks as they move from home to college and then to multiple jobs. Assuming you keep them satisfied and connected to family members, today’s 15-year old might stick with their primary bank or credit union for seven or more decades.

But you can’t retain a customer who never opens an account.

That’s why I believe FIs should do their best to get an account started for every child in every customer household, probably bundling them into a “family wrap account” which could carry a premium fee (though the individual kids’ accounts should probably come at no additional fee).

And the family account needs to be fully connected and in sync with the parents, guardians, and other current and potential family members. That enables real-time money movement along with expense tracking. And  as children grow into adulthood, the accounts should be able to be easily be converted into their own family account, and the cycle can be repeated with their kids.

as children grow into adulthood, the accounts should be able to be easily be converted into their own family account, and the cycle can be repeated with their kids.

Building it

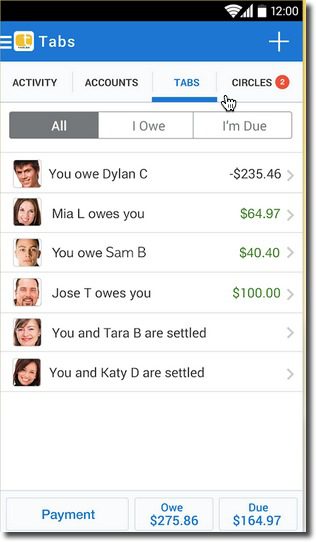

We’ve seen a number of youth-oriented platforms at Finovate, but they have rarely focused on inter-connectivity and communications. Two exceptions are Yodlee’s Tandem app (inset) which debuted at FinovateSpring 2013 and FamZoo, which demoed its new platform the same year. Watch their demos and be inspired (Yodlee, FamZoo).

For more info on the mobile side, see yesterday’s post.