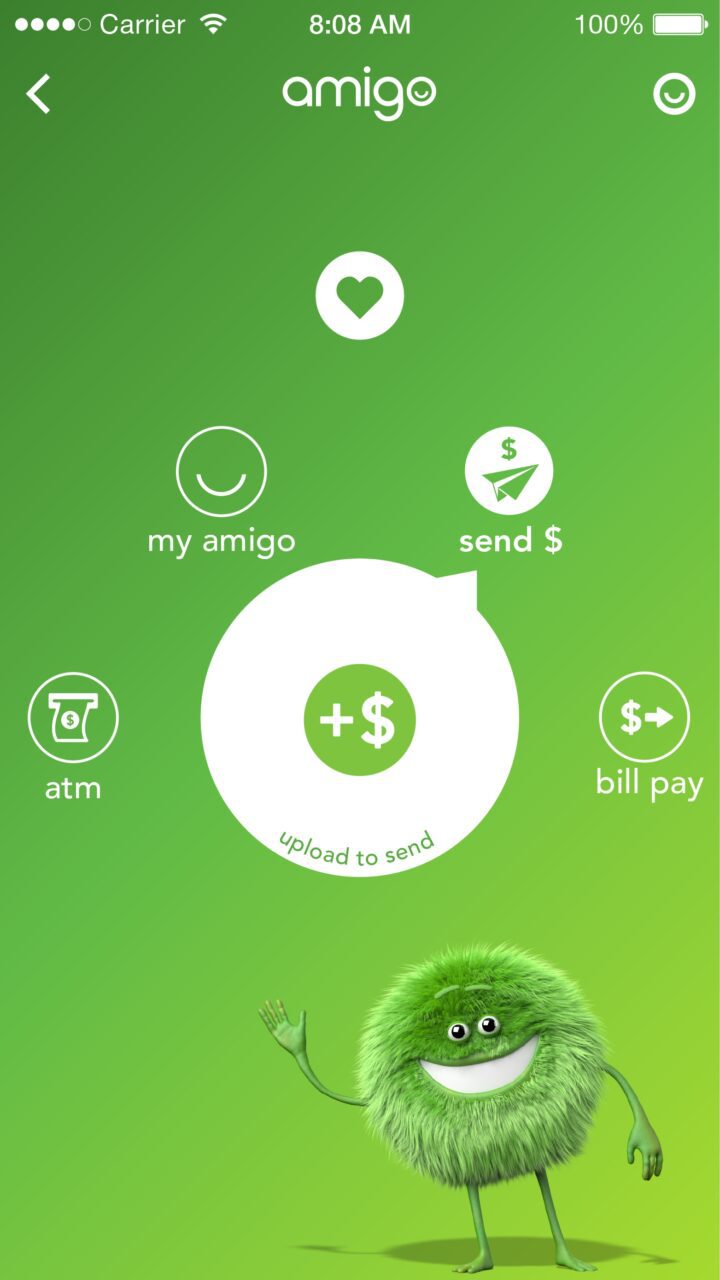

Money Amigo’s mobile banking platform delivers traditional banking products in a nontraditional way. Its clean interface targets underserved markets by delivering simple-to-use services with a transparent fee structure.

mobile banking platform delivers traditional banking products in a nontraditional way. Its clean interface targets underserved markets by delivering simple-to-use services with a transparent fee structure.

Company facts:

- $300,000 raised

- 7 employees

- Headquartered in Las Vegas, Nevada

Money Amigo, which is primarily targeted toward Hispanics and students, prides itself on bringing financial services to previously ignored market segments. Its core feature is international remittances.

Cross-border remittances are expensive and time-consuming. To keep the cost low and the transfer-speed high, Money Amigo moves money using the blockchain. Because digital currencies intimidate most users, the startup insulates all players from cryptocurrency elements. The currency-transfer process runs completely and securely in the background: The sender, recipient, and back-end operational players interact only with Money Amigo’s simple user interface, unaware they are using digital currency.

When I asked the Money Amigo team for specifics on how the startup is using the blockchain, they would admit only to doing some “very very cool things” that they “just can’t talk about right now.”

What’s next for Money Amigo? With so many players interested, the team tells me that Money Amigo is considering selling its remittance solution as a separate white-label option.

This post would not be complete without mentioning Mr. Amigo. The furry green mascot is a crucial part of the user experience. The friendly guy greets users at multiple points to walk them through the user experience. Financial services can be quite complex, and Mr. Amigo helps make managing money more approachable.