In an increasingly mobile world, even small businesses are on the go. Flint Mobile’s technology helps mobile SMBs, such as contractors, accept card payments on their mobile devices. Today, the company is launching App2App Connect, a free, lightweight feature that relies on Flint’s card-scanning technology to offer embedded payments within mobile apps.

In an increasingly mobile world, even small businesses are on the go. Flint Mobile’s technology helps mobile SMBs, such as contractors, accept card payments on their mobile devices. Today, the company is launching App2App Connect, a free, lightweight feature that relies on Flint’s card-scanning technology to offer embedded payments within mobile apps.

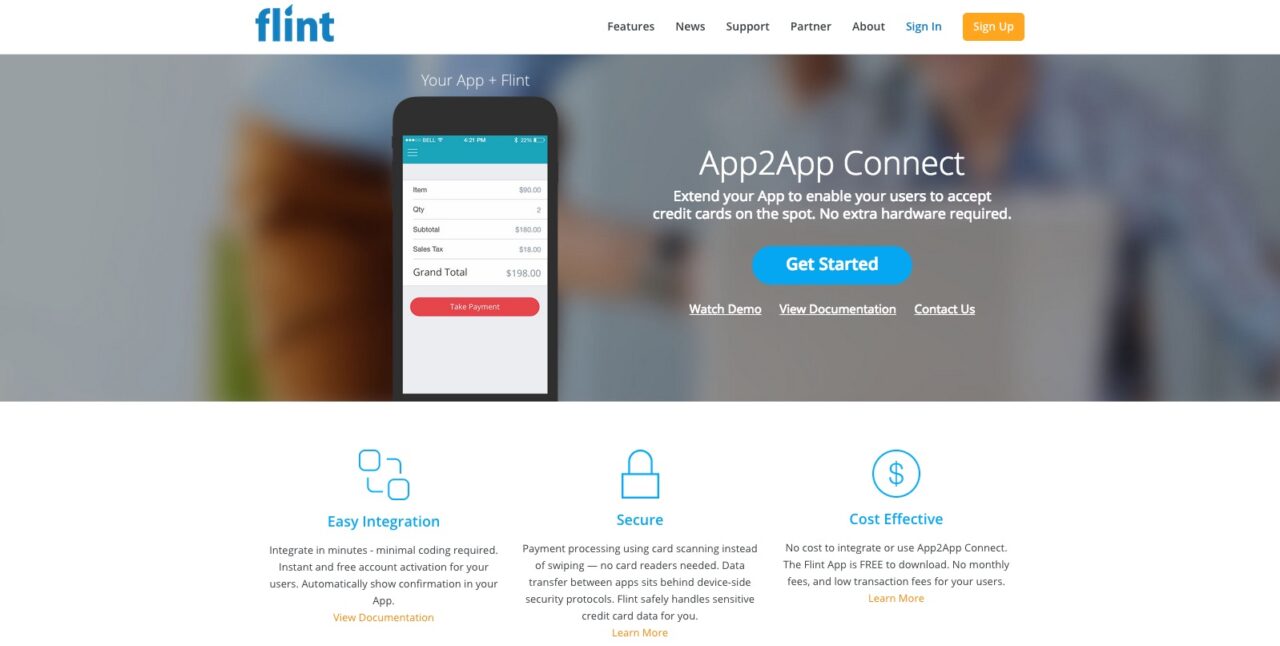

Using App2App Connect, developers add a “Take Payment” button into mobile SaaS apps that offer SMBs solutions such as client scheduling, appointments, or sales. Since Flint takes control of card data entry and management, developers stay PCI compliant and don’t need to deal with the payments process.

Small businesses using a mobile app with the new capability will be able to accept credit card payments on the spot, without additional hardware, instead of invoicing their clients. Here’s how it works:

Also starting today, businesses using Flint’s iOS and Android apps can accept a wider variety of cards. In addition to Visa and MasterCard, the California-based company is launching support for American Express and Discover. For all cards, Flint charges 1.95% for debit card payments and 2.95% for credit card transactions.

Flint launched its first product offering in San Francisco at FinovateSpring 2012.