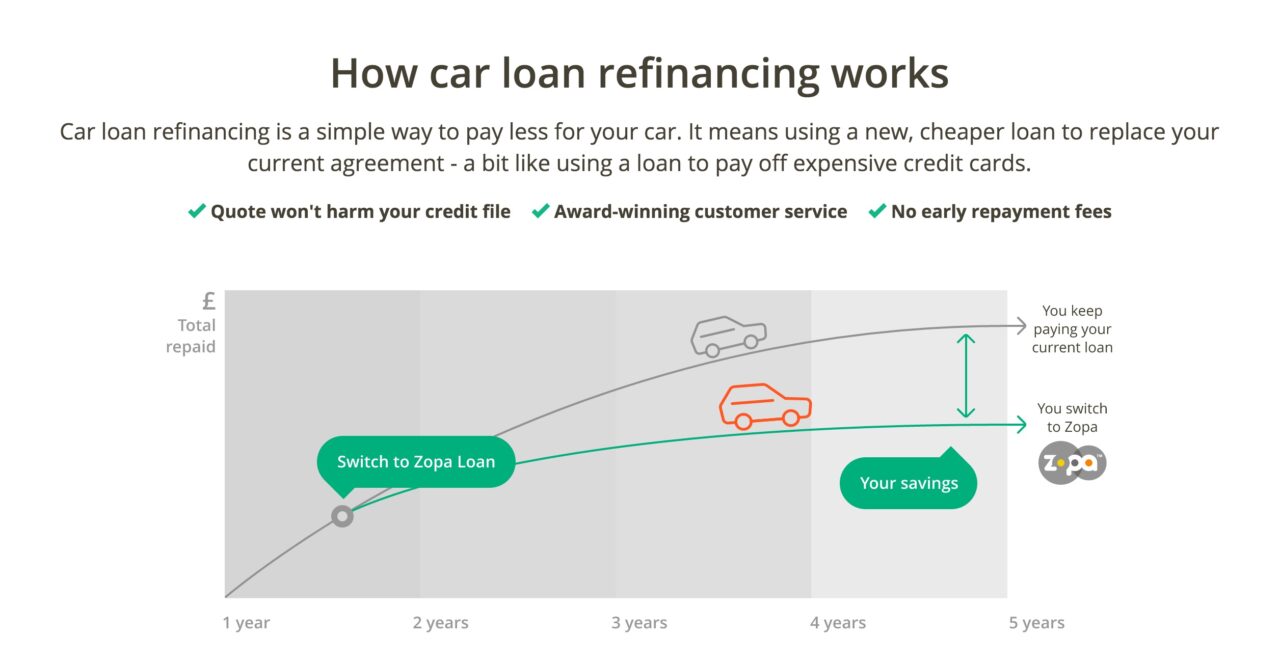

U.K.-based P2P lender Zopa has expanded its loan offerings to tap into the used-car financing market worth an estimated £12 billion in annual loan originations in the United Kingdom. The company’s new auto loan refinancing product, Zopa CarReFi, enables U.K. consumers to pay off expensive car-financing deals with a loan that’s a better value and has a more flexible agreement.

The direct-to-consumer offering maintains transparency by offering a free, instant, personalized savings quote. The platform, which was built in-house, uses Zopa’s API to tap into the company’s credit-risk algorithms and combines the data with vehicle information to help users decide if it’s worth refinancing. Similar to traditional auto lending, the ownership of the vehicle remains with Zopa’s lenders until the consumer makes the final payment.

Zopa CEO Jaidev Janardana talked about the motive behind the launch: “Buying a car is by far the most common reason for a customer to take a personal loan from Zopa, so we are proud to now also offer a product that can help customers that already have a car on a finance agreement. With an outstanding team and a deep understanding of technology, it is possible to combine longstanding history and credit excellence with lean, design-led innovation.”

The move comes at a time when P2P lenders in the U.S. are facing a lot of heat. Check out Jim Bruene’s take on the recent news in his piece, Lending Club’s Stock Price is Not a Leading Indicator for Fintech.

Since its launch in 2005, Zopa has matched borrowers with £1.5 billion in P2P-funded loans. The company, which demoed at FinovateSpring 2008, was recently voted MoneySuperMarket’s Best Personal Loans Provider of 2016.