We’re living in an era where major banks and financial services companies have their own in-house innovation labs. Major players who are generally thought of as too clunky to operate hip, fast-moving, tech-adopting divisions are getting in on the game. The list of financial services companies who have launched labs in the past ten years is a long one.

Banks such as Capital One, Citi, Visa, Chase, BBVA, DBS Bank, Fidelity, JP Morgan Chase, Deutsche Bank, FIS, and Lloyds have all launched their own fintech labs. Some banks, such as USAA, even have member labs, where the bank’s customers can opt to test out new services before they’re released, and offer feedback.

Even non-banks are starting labs of their own. At FinovateSpring last year, NCR showcased a lab-grown technology that leverages virtual reality to offer ATM servicing help. And earlier this year, business commerce platform Tradeshift launched an innovation lab to leverage new enabling technologies. The result of these labs are often beneficial and have led to multiple, successful product launches. In fact, Many products pitched from the Finovate stage started out as projects from a lab.

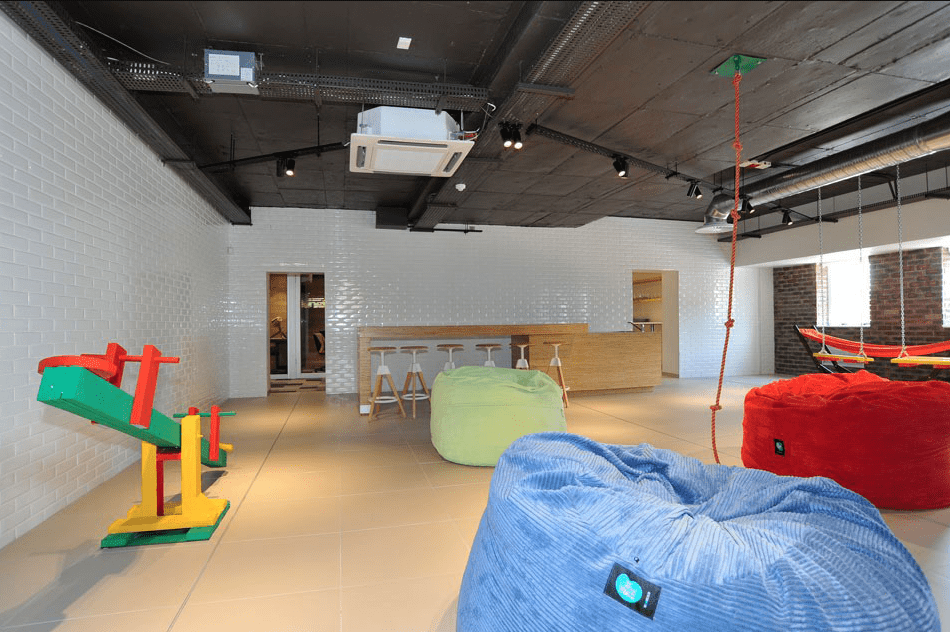

The photo above shows off Standard Bank’s innovation lab, from the Financial Brand’s article titled Peek Inside 7 of The Banking World’s Coolest Innovation Labs. As the article suggests, it’s cool. But do you really need a place that looks like a daycare to create and launch new services for your members? Smaller FIs may argue that they can’t– they are already strained for resources and aren’t able to move fast enough to bring a product to market before technology changes. So how can small banks compete?

Room to fail

Create room in your culture to fail. If all of a bank’s or a fintech’s employees are afraid to fail, none will be willing to take on the risk of suggesting or trying new things. When you remove the fear of failure and replace it with an incentive to test new ideas, you’ll be surprised how the culture shifts.

Start small

Fintech innovation doesn’t necessarily mean creating the next mind-reading IoT device that automatically optimizes your investments and doubles as a mobile wallet. Instead of being intimidated by fintech vaporware, think about a spreadsheet or a process that your team dreads. What move can you take to change that process? Maybe you can make it more efficient adding productivity-enhancing technologies to automate or digitize more tedious, time-consuming parts of the process. Or perhaps some portions of the process are no longer necessary, and the simplification is the innovation. Sometimes, starting small is starting tiny.

Use your size as an advantage

The advantage of creating change in a small credit union or community financial institution is the small size, which translates to small scale. When you want to implement a fintech initiative as a smaller FI, you can get your entire organization on board. Big banks can’t do that. If 100% of a bank or credit union is excited about the change and willing to push the new initiative, things can happen a lot faster.