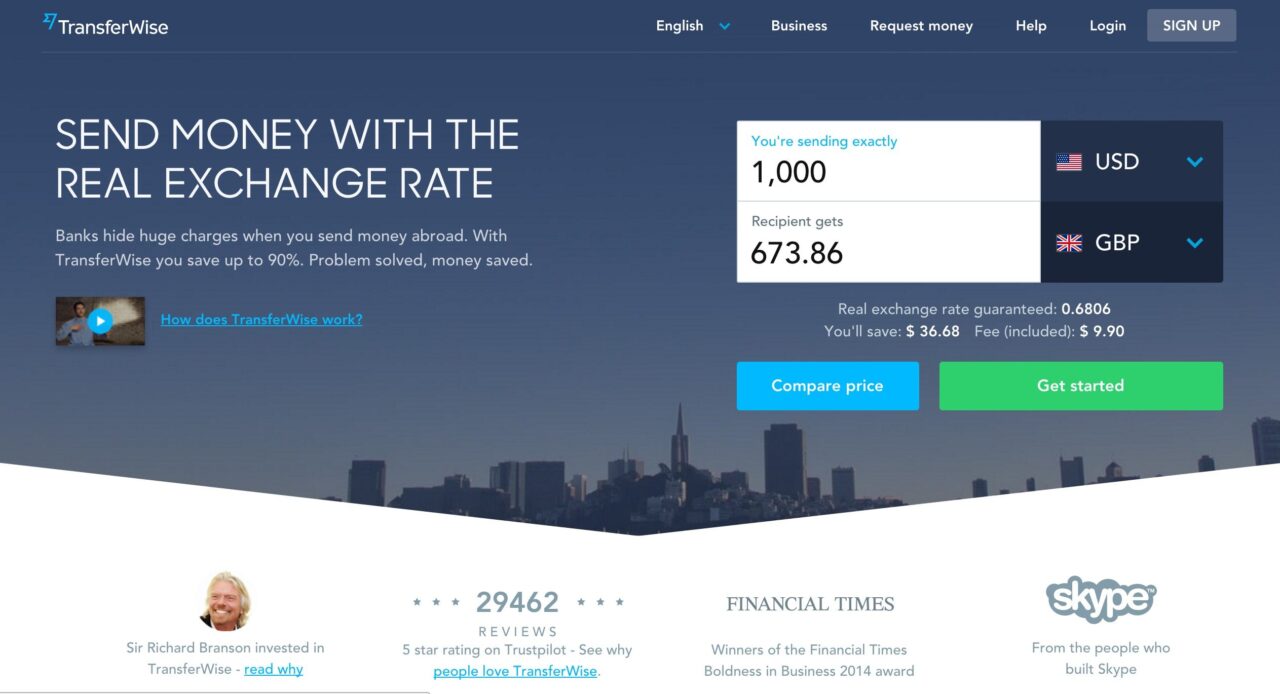

Foreign Exchange platform TransferWise, which announced geographic expansions last month, today reports an expansion of a different nature. The London-based company pulled in $26 million, bringing its total funding to $117 million and burgeoning its valuation to $1.1 billion (according to TechCrunch), thereby making it a fintech unicorn.

The round, which the company plans to use to fuel future growth, was led by Baillie Gifford. Existing investors, which include Andreessen Horowitz and Sir Richard Branson, also participated.

At FinovateEurope 2013, TransferWise co-founders Taavet Hinrikus and Kristo Kaarmann stood up in front of an audience of bankers with a decidedly non-bank-friendly message. There, the company announced its mission to reduce foreign exchange fees by circumventing financial institutions. Today, the company transfers $750 million each month on its platform.

TransferWise employs a workforce of more than 600 across its offices in United Kingdom, Europe, and the United States, where a separate money-transfer license is required for all 50 states. The company recently received heat after one of its U.S. banking partners was scrutinized by regulators for “unsafe and unsound banking practices,” though co-founder Hinrikus states that he is confident TransferWise is in compliance.