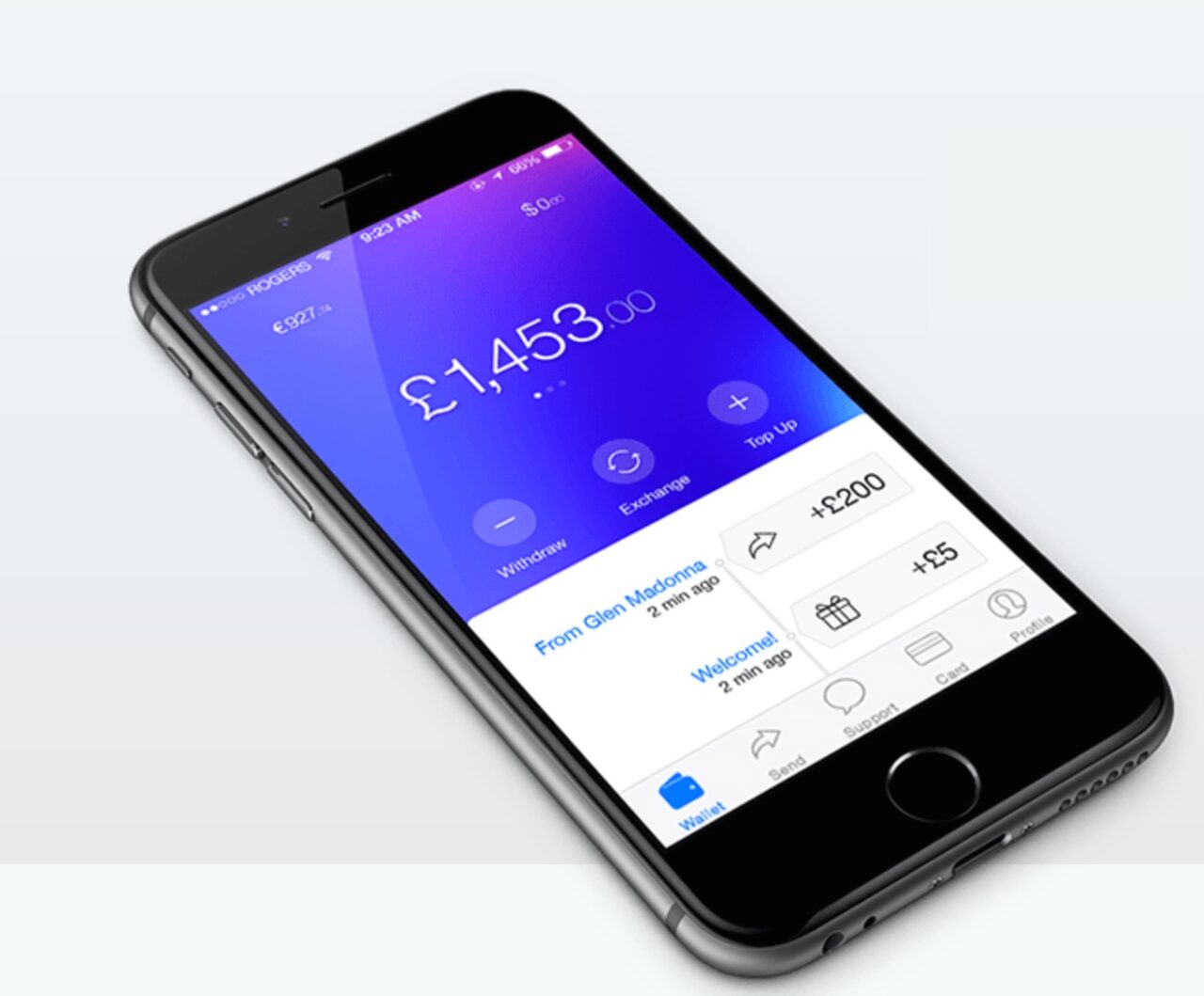

Today, Revolut is publicly launching its money-remittance platform and multicurrency card that lets users spend and exchange money at interbank rates in real-time. The London-based company is also announcing $2.3 million of new funding from a Venture Round led by Balderton Capital, with participation from SeedCamp.

This brings the startup’s total funding to $2.8 million.

Revolut’s multicurrency card and mobile-remittance platform eliminate the middlemen to enable users to exchange money in real time, and at a better rate than they would otherwise receive at a traditional bank. The service is aimed at travelers and remittance customers, who transfer money using the free app, SMS, Whatsapp, and social media channels.

The Revolut card is free, and can be used at any location MasterCard is accepted. When swiped, the card automatically converts into the local currency at the best interbank rate.

On top of all this, no ATM fees are associated with the Revolut card. And in case the card is lost or stolen, the mobile app has a remote card-blocking feature that lets users cancel the card.

While the app is available to users across the globe, the card distribution is limited to Europe (though users can make purchases globally).

What’s next? The Revolut card will soon enable customers to pay at a brick-and-mortar shops using bitcoin.

Revolut debuted its multicurrency card and remittance platform at FinovateEurope 2015 in London. Check out its live demo video.