Consumer interest in digital currency is at an all-time high. Much of this is thanks to Bitcoin which, as of this morning, is valued at over $11,800. So this week is the perfect time for global banking company Revolut to launch cryptocurrency trading on its platform.

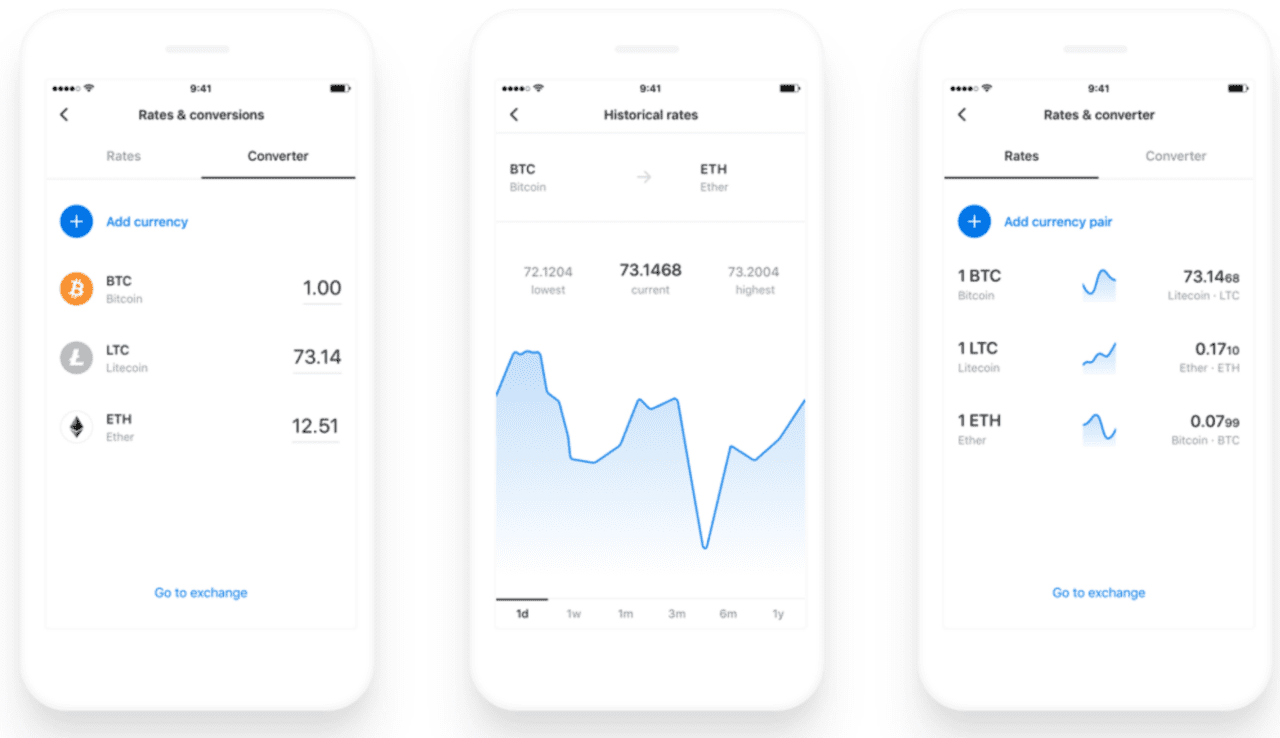

Starting Thursday, Revolut account holders will be able to buy, sell, and hold Bitcoin, Litecoin, and Ether. The mobile banking company, which also supports 25 fiat currencies, aims to “erase the divide between old and new money,” according to TechCrunch. The article notes that during Revolut’s one week beta test, 10,000 users traded $1 million in cryptocurrencies.

In line with its transparent pricing strategy that allows users to send more than $5,900 per month in 16 currencies with no fee, U.K.-based Revolut will offer low rates on cryptocurrency trading. The company will charge a flat fee of 1.5% and, thanks to its global currency platform, does not charge additional foreign exchange fees for purchases made with most fiat currencies.

Revolut debuted at FinovateEurope 2015 in London. The company’s CEO and founder Nikolay Storonsky began working on the idea after his bank charged him $2,000 in fees after spending $12,000 while traveling abroad. “That is why we built Revolut,” Storonsky said during the demo. “It allows you to exchange, send, and spend your money, completely avoiding all your banking fees without actually using a bank.”

Founded in 2013, the company has experienced sharp growth recently. Over the past two years, Revolut has processed 42 million transactions for 1 million users in Europe, tallying up $160 million in savings on foreign transaction fees. According to TechCrunch, Revolut is “doubling the rate of new customer sign-ups versus three months ago.”

Revolut has been busy lately. Here’s a quick timeline overview of the company’s progress over the past three months:

- November 2017

- October 2017:

- September 2017