Looking to provide real value to younger customers, especially the children of your core deposit base? Help them get started in the rental game. I have five family members who have recently rented in the Seattle and Los Angeles metro areas, and it’s a brutal seller’s market for apartments. Landlords are picky and require financial assurances similar to, or even more stringent, than a mortgage (pre-2008 anyway).

For example, as a co-signer on my son’s lease, I was asked to provide two years of tax returns despite the fact that he has a good job lined up (albeit not until after graduating in May) and sufficient current resources to pay the monthly tab. And then there’s the initial cash outlay (in his case, $4,000 in certified checks). All this is quite daunting for new renters or anyone looking to make a move.

Where financial problems exist, banks and credit unions have opportunities. Ideas include:

- Make it easier to save with a goal-based account: First-time renters often don’t realize the financial cost of getting started in an apartment. Offering a systematic savings program to help build the required balance is a win-win. For extra credit, provide a bonus when certain milestones are met and/or allow parents, aunts, uncles and grandparents to contribute as well. Simple, Moven, Mint and most PFM platforms offer goal-based savings; most financial institutions do not.

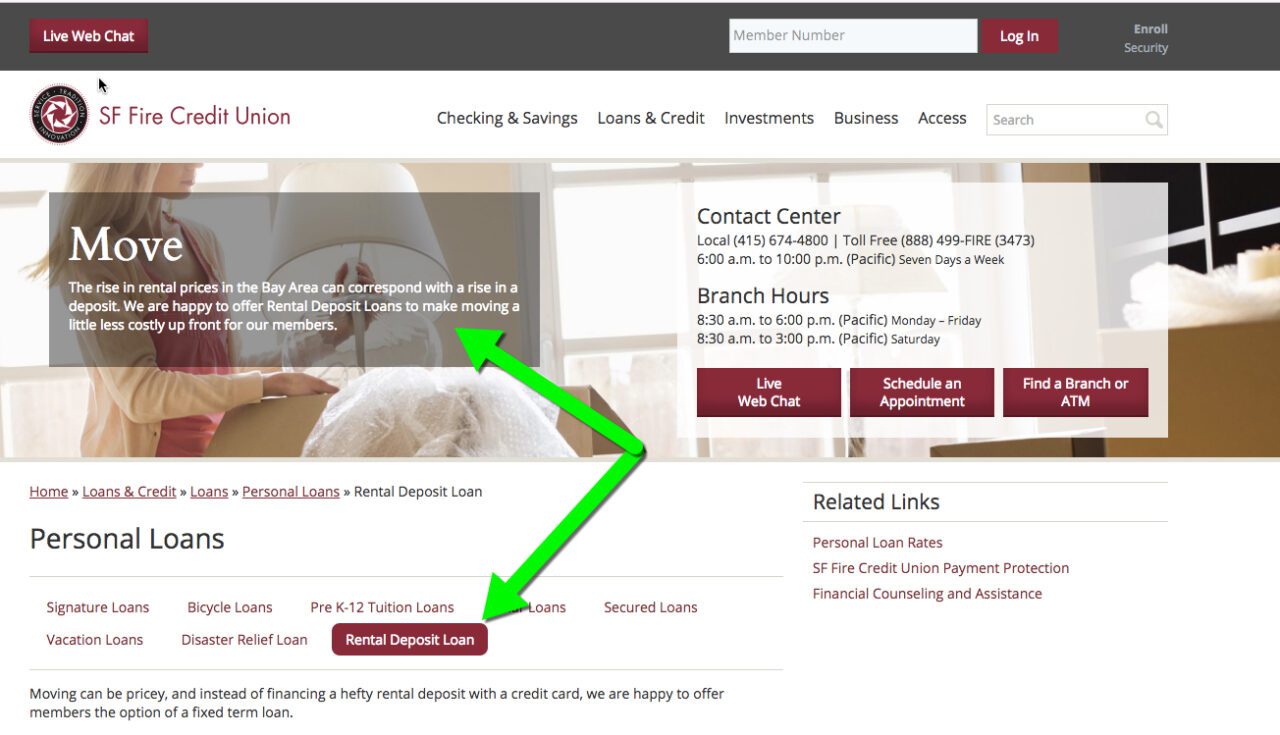

- Provide rental-deposit loans: If savings won’t cover it, offer a modest installment loan with an easy co-sign option. These small loans can also help build a positive credit history. Though rare, a few U.S. credit unions offer small loans specifically to cover rental deposit, first/last months’ rent, utility deposits, and so on, but it’s not typically something you see at banks. See the SF Fire Credit Union page above for an example.

- Help students in their apartment/roommate hunting: Team up with companies helping students and others find a place to live. For example, Rent College Pads, recently raised $1 million.

- Offer renter’s insurance: A low-cost, but valuable bit of peace-of-mind for young renters who can ill-afford to replace stolen or damaged items.

- Encourage more low-cost housing options: In tight rental markets, use your resources to find spare rooms within the community that could house students or others needing housing. A bank or credit union could offer loans to remodel or build new rental spaces.

Bottom line: One of the best ways to cement a long-term relationship is to help someone (or their kids) find a place to live, and provide a means of handling the initial financial burden. I encourage financial institutions, and their fintech partners, to make a home for this strategy in your 2017 gameplans.