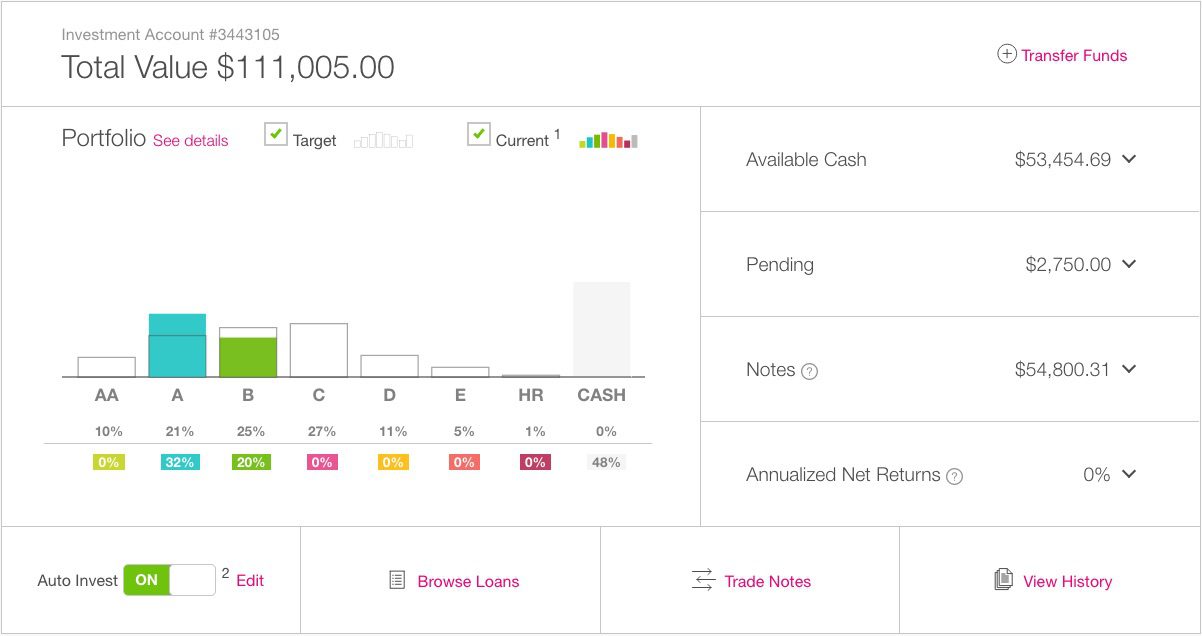

Peer-to-peer (P2P) lending platform Prosper launched a revamped user experience for its retail investors today. The San Francisco-based company’s enhanced investor dashboard offers two new tools:

- Auto-invest: within seconds Prosper applies the user’s saved criteria to invest on their behalf

- Portfolio customization: users select a predefined, target investment mix or create their own custom mix

After testing it out on my own account, I can vouch for the new dashboard’s more intuitive navigation and easier view of portfolio diversification. There’s one thing still missing from the investor experience, however. Prosper still lacks a native mobile app that caters to investors; however, to the company’s credit, its site has been mobile-friendly for some time, and a native mobile app was launched for borrowers last year following its $30 million purchase of BillGuard last September.

This redesign is Prosper’s second move to attract new investors, after the company raised rates by a weighted average of 0.29% last month. The new efforts come at a time when Prosper has struggled to balance interest from investors and borrowers. Earlier this month, after experiencing waning investor interest, the company dropped relationships with LendingTree and Credit Karma, formerly leveraged to attract new borrowers.

Prosper presented at FinovateSpring 2009 as well as the inaugural Finovate in 2007.