Colorado-based service commerce solution PaySimple just closed its second round of funding since its founding in 2006. The $115 million round amounts to 7X more than the first round the company closed in 2011. PaySimple’s funding now totals $131 million.

The company anticipates the investment from Providence Strategic Growth will fuel efforts to market services online, automate payment acceptance, and deliver the solution to its customers. Mark Hastings, managing director and head of Providence Strategic Growth, will join PaySimple’s board of directors.

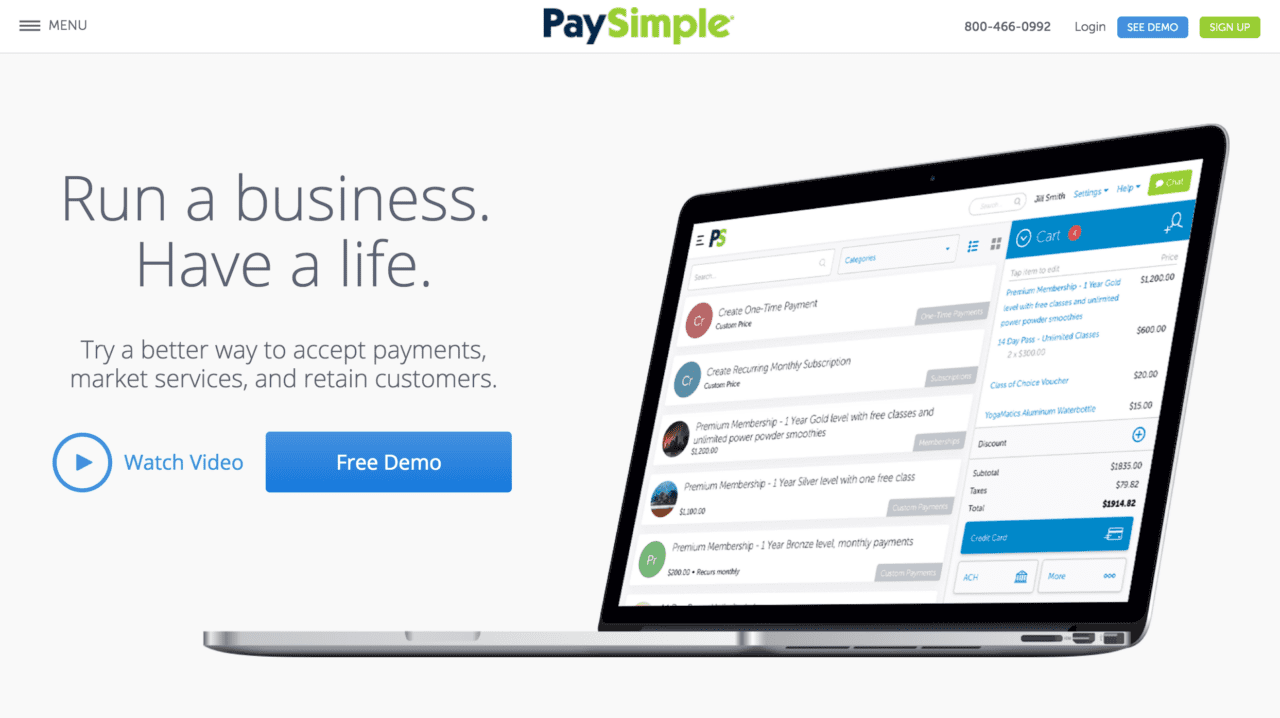

At FinovateFall 2012, PaySimple CEO Eric Remer (pictured right) demonstrated how the company uses early payment incentives to help small businesses get paid faster. Earlier this month, PaySimple began focusing on helping service-based businesses improve the customer experience by offering tools such as online appointment scheduling, payment and registration forms, and an online store, as well as a variety of ways to collect payment, such as in-person, online, over the phone, via invoice, and by recurring billing. Remer said, “The service-business model is centered around customers.” He added, “Business owners have to build trust and create lasting and ongoing relationships with people. Our service-commerce platform connects business owners and their staff to the people they do business with, instead of just the transactions or products sold.”

The company serves 17,000 clients in a range of industries, from fitness to professional services. In May, PaySimple partnered with small business loan marketplace Fundera to offer its clients a new way to procure working capital via the Fundera-empowered Loan Center.