Courtesy of a Series E round led by IGM Financial, digital wealth management giant Personal Capital picked up an investment of $50 million now, with another $25 million coming in 2017. The new capital takes the company’s valuation to $500 million.

Calling IGM Financial “the ideal investor,” Personal Capital CEO Bill Harris said his company would benefit from IGM Financial’s “expertise in financial advice and asset management.” Harris added that the partnership with IGM Financial would help his company meet the growing demand for Personal Capital’s digital wealth-management services.

Pictured (left to right): Personal Capital’s Jim Del Favero, chief product officer, and CFO Bill Harris demonstrated their platform’s One Click Investment Proposals at FinovateSpring 2014.

In the same statement, IGM President and CEO Jeff Carney praised Personal Capital’s veteran management. “We believe the financial advisory landscape will be enhanced by the type of service that Personal Capital provides,” Carney said. “We’re delighted to be backing the leader in digital wealth management.”

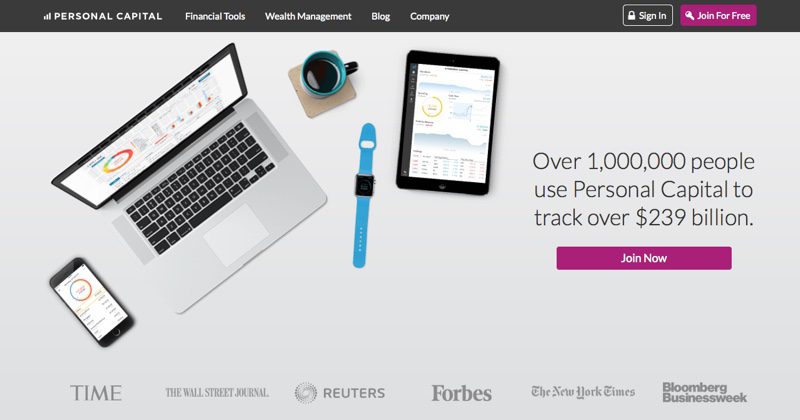

Personal Capital uses a hybrid approach of online technical tools and personalized advice to give average investors the same kind of service historically enjoyed by the high-net-worth clients. “Our approach allows people not only to manage their entire financial life through the mobile devices they carry in their pockets, but also to receive a level of personalized advice previously available only to the ultra-wealthy,” Harris explained. Personal Capital manages $2.4 billion in investments for more than a million investors.

In addition to management, Personal Capital offers investors free resources to help them manage their investments better. These solutions include a dashboard that lets investors see all their investment accounts in one place, as well as a Fee Analyzer and Investment Checkup. For fund management, Personal Capital charges a flat fee based on the percentage of assets managed, starting at 0.89% for the first million.

Founded in 2009 and headquartered in Redwood City, California, Personal Capital demonstrated its technology at FinovateSpring 2014 and presented at FinDEVr San Francisco 2015. The company surpassed $2 billion in assets under management in March, and lowered its investment minimum from $100,000 to $25,000 back in November.