Robo advisory platform Munnypot began the month announcing a new relationship with business process management specialist Capita. Now the U.K.-based FinovateMiddleEast alum is ending the month with news of a major new investment from private equity firm, Livingbridge.

The amount of the investment was not disclosed. Livingbridge typically invests equity of as much as $6.6 million (£5 million). Munnypot said it will use the funds to further develop its robo advisory solution.

“We are delighted with Livingbridge’s investment which will enable us to scale up our business and further develop our offer for consumers,” Munnypot CEO Andrew Fay said.

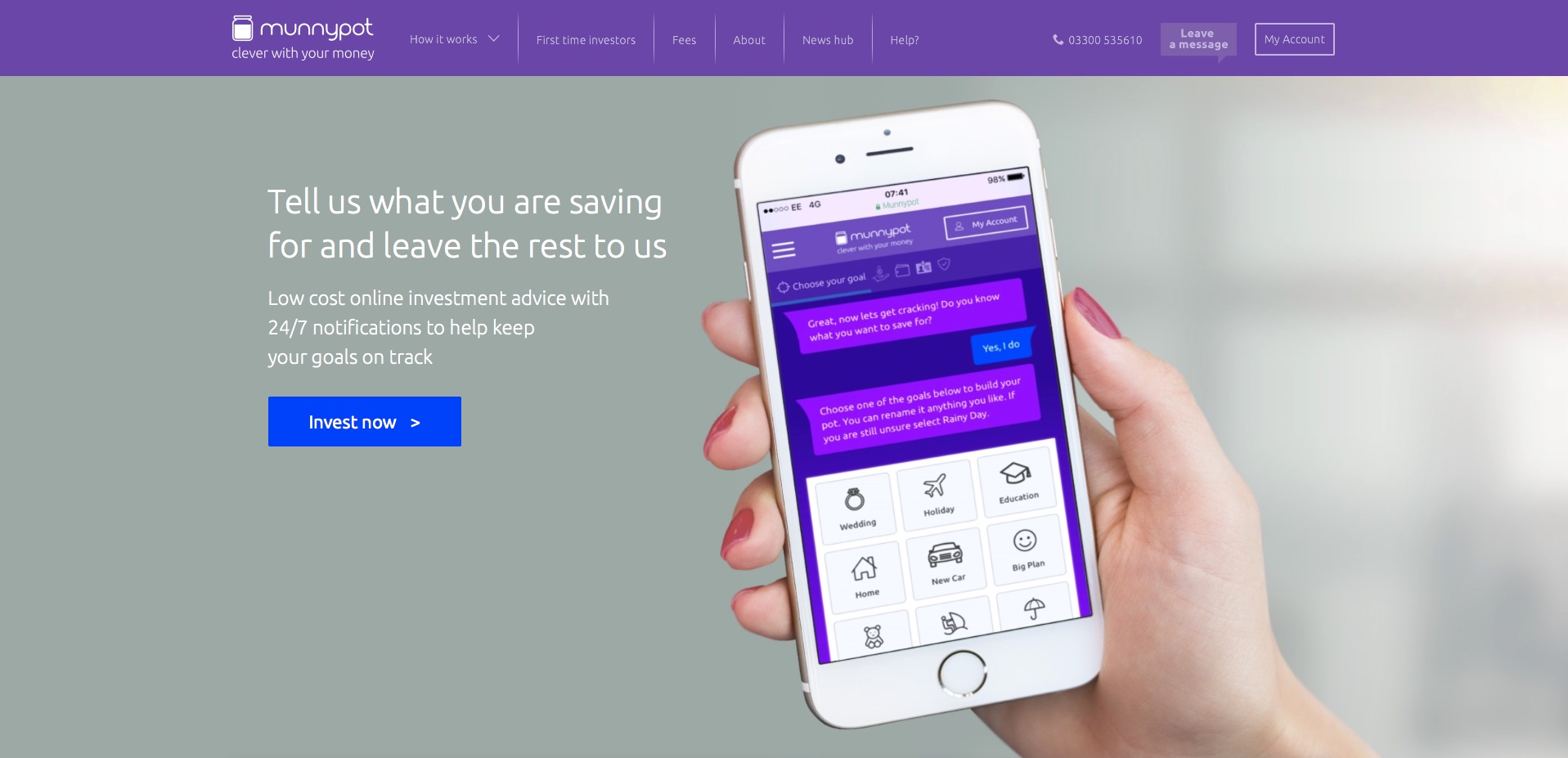

Munnypot CEO demonstrating the company’s robo advisor platform at FinovateMiddleEast 2018.

Munnypot provides automated financial investment services for as little as £25 a month and/or a single £250 investment. The platform leverages chatbot technology to encourage investors to maximize annual ISA allowances, and monitors fund performance against goal-based objectives. If performance is out of line, Munnypot automatically suggests alternatives for the investor to consider.

“We are excited to be supporting Munnypot in the early stages of their development,” Livingbridge investment director Steve Cordiner said. “The robo advisor sector has grown quickly in recent years and Munnypot has a strong proposition; delivering low cost and affordable advice to consumers.”

Munnypot’s funding news comes just weeks after the company announced a strategic “scaling” partnership with Capita, which took a minority stake in the robo advisor. Via this partnership, Munnypot will help Capita develop solutions for wealth management companies. Earlier this year, Munnypot reported that it would power the robo advisor platform for Jyske Bank in Denmark. The deal represented the company’s first European white label partnership.

“We know, first hand, the time and resources required to build a robust online investment advice proposition,” Fay said in a statement accompanying the partnership announcement. “For most firms, partnering is the best and most efficient route to developing an innovative, client-engaging service.”

Founded in 2015 and headquartered in Crawley, U.K., Munnypot demonstrated its goal-based, online investment advice solution at the inaugural FinovateMiddleEast conference earlier this year. Unlike many robo advisors that seek customers from among the mass affluent, Munnypot is designed for those who traditionally have not been able to access financial advice, as well as investors looking for a cost-competitive alternative to other advisory services.