Financial engagement and digital experiences platform Moven Enterprise has partnered with Japanese financial services company SBI Holdings, which owns Softbank and is partnered with more than 60 financial institutions across Asia.

This is part of a joint venture agreement between the two in which SBI will bring Moven’s technology into Japan under the Moven brand, offering mobile banking tools to domestic and international banks. The agreement also gives SBI Holdings one of six seats on Moven’s board of directors.

Moven has already partnered with numerous financial institutions, including TD Bank and Westpac in New Zealand. Today’s agreement, however, with SBI is Moven’s first foray into Asia.

Launched at FinovateFall 2016, Moven Enterprise takes a software-as-a-service approach by allowing banks and financial services companies to white-label its financial management technology. Moven Enterprise offers tools to help banks engage with their existing customers, acquire new customers, and drive revenue through their mobile channel.

At FinovateAsia 2017, Moven Enterprise demonstrated a new credit offering, chatbot functionality, and an expansion of its wish list feature that leverages behavioral gamification.

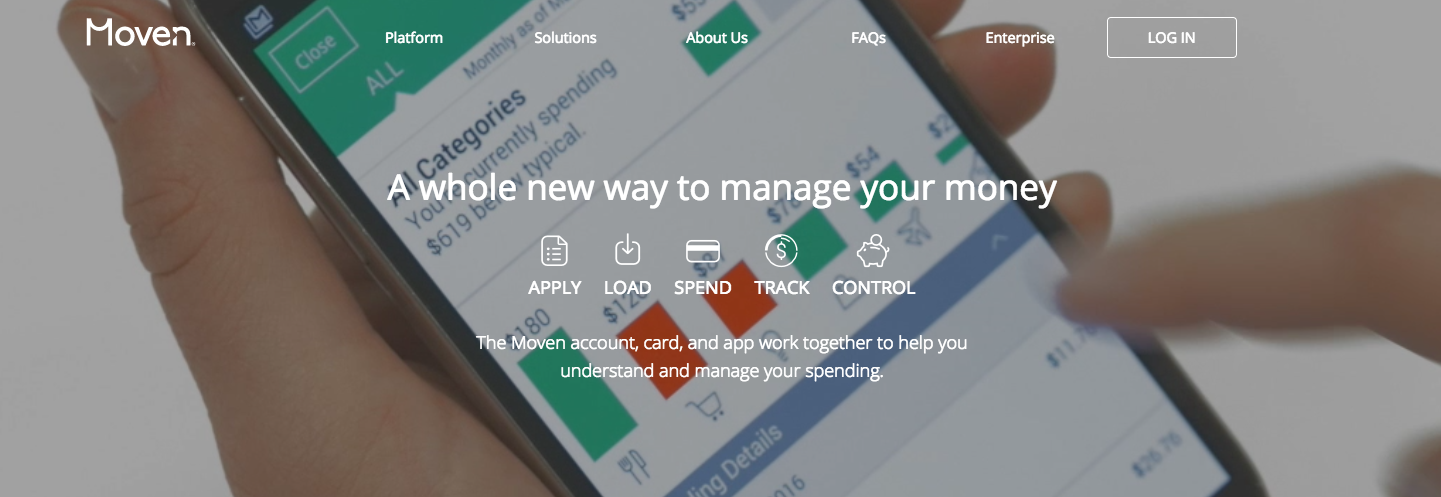

American Banker announced today that Moven’s consumer-facing brand– a challenger bank that launched in 2011– is seeking to acquire a bank, though it has not disclosed which. The company’s founder, Brett King, said the reasoning behind a bank purchase would be to help Moven scale faster and access more services for its customers.

Moven last demoed its consumer-facing platform at FinovateFall 2016 with the launch of a daily digest feature and real-time receipt capabilities. Last June, the company’s enterprise offering, in partnership with Westpac, received the CANSTAR 2017 Innovation Excellence Award.