There’s a big, missing piece with today’s money management (aka PFM) offerings:

Age appropriateness

What I mean is that most FIs offer a one-size-fits-all mobile app and that just won’t cut it going forward. As  development costs drop (see Building it Out, below), it will be easier to cost-justify tightly segmented apps. One of the better examples (from the desktop), is CapitalOne 360’s Teen Money a program it inherited from ING Direct (which launched it exactly four years ago with a $10 million ad campaign).

development costs drop (see Building it Out, below), it will be easier to cost-justify tightly segmented apps. One of the better examples (from the desktop), is CapitalOne 360’s Teen Money a program it inherited from ING Direct (which launched it exactly four years ago with a $10 million ad campaign).

How will this multi-app trend manifest itself? One of the more likely initial phases will be segmenting by life stage. For example, here’s a common example of 10 stages, along with key money-management issues along the way:

- Pre-teen: learning, saving, chore management, light spending

- Teen: learning, saving, college planning, spending

- College: learning, spending, expense sharing with roommates/parents, automobile

- Singles: spending, renting, insurance, expense sharing with roommates, investing/401(k), saving, credit

- Young marrieds: mortgage, insurance, expense sharing with spouse, investing, saving for home

- Family with little ones: insurance, spending controls/budgeting, investing, tuition, home equity

- Family with teens: spending/budgeting, investing, saving for college, sharing expenses with kids, retirement planning

- Empty nest: retirement planning, asset management, investing

- Active retirees: asset management, estate planning

- Homebound seniors: sharing control with kids, health insurance management, estate planning

All of those segments will likely have their own app or at least a way to easily customize a general app in a way that syncs with their needs without the clutter typical of many banking websites (though they are getting much better as building for mobile (responsive design), demands prioritizing features/content.

Building it out

Given the 6, 7 and even 8-figure costs of major mobile initiatives, building 10 apps may seem ridiculously expensive. And it would be if it weren’t for cost savings enabled by third-party and SaaS services fed through APIs, a subject we touched on recently in a post about the coming Golden Age of Fintech APIs.

If you are willing to forgo branding, you could provide age-appropriate apps for virtually no cost. For example, some smaller banks gladly refer their customers to Mint for budgeting/money management help or Credit Karma for credit management. It’s not a bad strategy. Sure, they’ll see targeted financial advertising, but that’s not going to matter if you provide a valuable service.

But we expect most banks and credit unions will eschew custom development and choose a full white-label solution such as MX, Backbase or dozens of others. Or alternatively, go with a hybrid co-brand, such as BancVue’s Kasasa or FamZoo for the teen/pre-teen crowd.

We’ll be looking at these issues and more at our second annual financial services developers event,FinDEVr, in October.

——

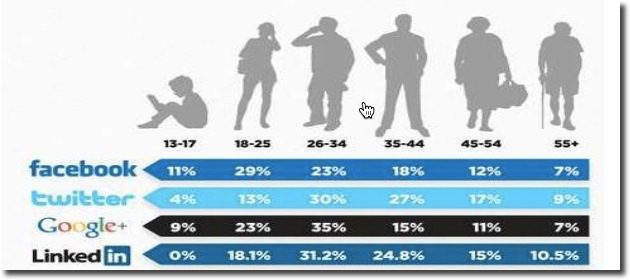

Graphic source: Linkedin