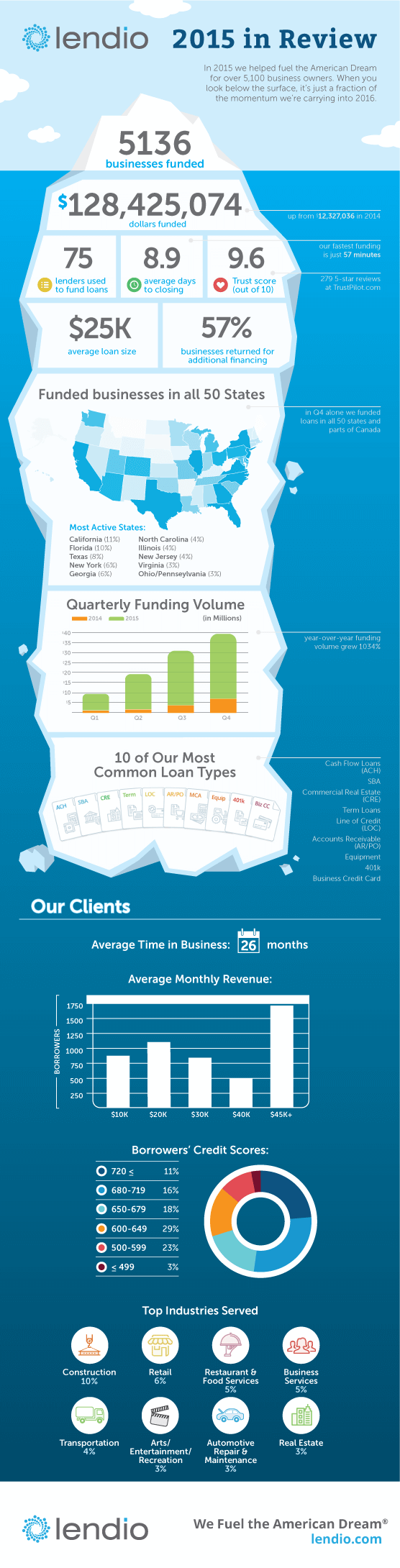

Small business loan marketplace Lendio released a report stating it helped fund more than 5,100 businesses in 2015, up almost 13x from the 400 the company served in 2014, and that’s just the tip of the iceberg.

The Utah-based company experienced record growth across all areas of its business in 2015. Here are the highlights:

- Facilitated $128+ million in financing for small businesses (up more than 10x from $12 million in 2014)

- 100% YOY revenue growth

- 57% of customers returned for additional financing

- Average loan size of $25,000

- Helped fund businesses in all 50 states and part of Canada

Founded in 2005, Lendio prides itself on “fueling the American Dream” by working on behalf of small businesses as a lender-matchmaking service. At FinovateSpring 2011, Lendio showed how it works on behalf of the 75 lenders on its platform, helping them expand their reach to find qualified borrowers. The platform enables lenders to filter borrower applications by preferences such as credit score, time in business, revenue, profits, etc.

Lendio’s infographic offers further insight into its 2015 activity: